Dividend income, it’s amazing! Seriously, as I progress further and further in my financial independence journey I become increasinly convinced that dividend income is what keeps me on course. Monthly savings differ and stock prices love irrational ups and downs, but dividends from established businesses are something you can count on – month after month. They’ve kept my eye on the ball in the past two years.

Everyone that plays or watches sports knows that keeping your eye on the ball is more important than taking into account what the other players are doing. It’s how you win the game, be that football, basketball, tennis or any other ball sports. And winning the financial independence game is what it’s all about.

Why do I like the boring and recurring nature of dividend income? Well, there’s two very good reasons.

First, every time a dividend payment hits my account I’m filled with joy that I made money without having to lift a finger. While I was sleeping, going out with friends, cycling – although not last month due to my accident, and generally enjoying life businesses all around the world worked their asses off to forward me a piece of their profits. It’s a great recurring stimulus.

Second, I can take advantage of the double compounding effect. On the one hand I get to see how these dividends increase year after year, semi-automatically almost, while on the other hand I get to put fresh income immediately to work in the stock market again. As a result, I propell my passive income forward faster and faster as I progress.

Once that passive income surpasses my monthly expenses I’m effectively financially free and I could potentially retire early. So let’s see where I landed in June with regards to free-of-work income!

Dividends received

At the beginning of the year I told you guys that I was aiming for €1,500 in dividends for 2016. Since that time I’ve come to realise that I might have aimed for the stars instead of the moon, but I’m still happy to report that I passed the €1,500 forward dividend income mark. Still on track, but not really.

However, that’s just a minor complaint when you consider that I only started a little under two years ago and had three amazing months back to back already in 2016. On top of that I managed to seriously up my game this month compared to June last year even though almost the same nine companies distributed a dividend – re-investment at its finest. If I keep this up I should seriously push my financial independence date forward yet again.

All dividends below are listed in Euros, and are after foreign withholding taxes and a 27% income tax levied by the Belgian federal government.

| Date | Ticker | Company | Dividend |

|---|---|---|---|

| 01/06 | AFL | Aflac Inc. | 2.00 |

| 01/06 | ULVR | Unilever plc | 21.21 |

| 07/06 | JNJ | Johnson & Johnson | 8.54 |

| 10/06 | IBM | IBM Corp. | 4.48 |

| 17/06 | BP | BP plc | 5.72 |

| 20/06 | MCD | McDonald's Corp | 6.68 |

| 22/06 | QCOM | Qualcomm Inc. | 10.27 |

| 23/06 | FP | Total SA | 16.69 |

| 29/06 | RDSB | Royal Dutch Shell | 31.14 |

| Total | 106.73 |

In total nine companies’ dividends landed in my brokerage account, most of them being quarterly regulars, with French oil tycoon Total (EPA:FP) being the odd one out because its payment date seems to jump all over the place. Its sector brethren BP (LON:BP) and Royal Dutch Shell (AMS:RDSB) help push income from oil operations to almost 50% of this month’s income.

My recent addition to US chip maker – I first wrote chimp maker, ha! – Qualcomm (NYSE:QCOM) is also paying off already, with the current payment being over four times as much as before. And with the company’s recent strong performance and earnings I can expect that payment to grow even more in the next years.

I’m really pleased with another three figure month in the books – that’s four months in a row now that I made over €100. June’s total number comes in at €106.73, which is almost enough to cover all groceries during the same period. I guess I’ll never be hungry again? Great!

Growth

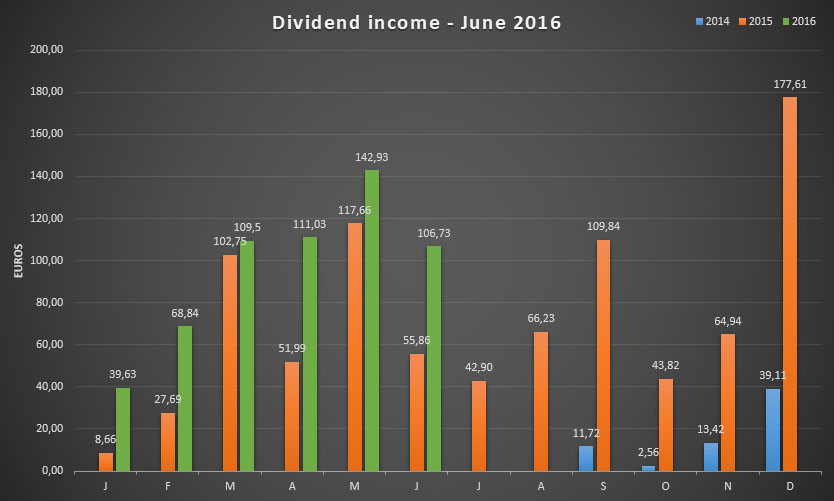

As most of you know my net worth soared to new heights the past couple of weeks, barraging past any previous upper limit like nothing before. And I’m glad to say that the same thing is happening with my passive income. Compared to last year, June’s income grew by a staggering 91.07%. That’s not as much as the numbers we saw in January and February, but still very solid considering its my overall strongest quarter.

Most of that increase is the result of fresh money being shoveled into stocks, but a small portion comes from organic growth like is the case with Aflac (NYSE:AFL), Johnson and Johnson (NYSE:JNJ) and IBM (NYSE:IBM). These companies work around the clock to up my passive income. You can see their and my efforts reflected in the chart below.

At the moment I’m hovering around 48 Euros of income on average every month for the entire year. Just half a year has passed by and I’m already nearing last year’s number, amazing!

Of course I won’t stop there. Over the coming months I’ll try to save as much as possible and continue to invest those savings into high-quality businesses that will fuel my free-of-work income ever higher.

Going forward

Now that we’re six months into 2016 it’s fair to say that it’s been a good year so far. At the moment I’ve made a grand total of €579 in dividend income, which is almost enough to live on for one month with just the bare essentials. With six more months to go it seems unlikely that I’ll make my €1,500 target for this year, but no matter. Winning the lottery takes time, or so I’m told.

So I’ll just do the rational thing – even though some might consider it insane because it’s very repetitive: saving as much as possible and investing those savings for the future. Money has the awesome property to turn into more money if you put it to good use, so you can bet on it that I aim to do just that.

Of course, the grass always looks greener on the other side of the fence, but it’s no use to complain about that. Others might be doing better, but who cares? Remember, keep your eye on the ball and not the other players!

How was your month in terms of dividends? Have you recovered from the dividend bonanza of the past couple of months?

Nice streak! You’re on a roll. 4th Time over 100 Euro’s. And if you are over 1500 forward income already, than that looks promising for next year to.

Keep it up!

P2F,

With six more months to save and invest I’m sure to grow that forward income even more. As a result, next year should see large gains once more. Now, if the stock market would come down I might grow my future income even faster.

Thanks for your support!

Cheers,

NMW

Yes the overall market is a problem. I just started last year and to be honest, I don’t really know a lot of companies that feel good to invest in at current valuations.

Impressive results, NMW! I share your joy when the payments hit my account.

Thanks, Dogge!

Fresh income hitting my accounts really lifts my mood during the day – kinda weird, but who cares as long as it works.

Best wishes,

NMW

Very nice month again NMW! Great to pass the limit of 3 digits in income :).

I think i caught around €70 this month, and increased my position in Ageas with 55 shares to 100 in total. Next year this will nicely payoff.

Greets

WDYR,

Awesome feeling, right? And you’re already at €70, great job! Congrats on your AGS purchase – that’s a lot of new income you’ll get next year.

I have added to my Ageas position again when it dipped below the €30 mark. Really don’t get why it’s being priced so low by the market at the moment, but I won’t complain. Hopefully prices stay low enough so I can add more in the future because my position is starting to become rather large at the moment.

Cheers,

NMW

Hi Nmw,

it seems you are doing great. it seems we have quitte a few companies in common.

Kisses,

Mrs. Moneypenny

Mrs. M.,

June was another great month indeed! Let’s hope I can continue this track record for the coming months.

Glad to hear we share a couple of companies – you know what they say about great minds!

Cheers,

NMW

Hey Nomorewaffles, thank you for this quick update. Although i got some dividend stocks, i mainly focus on tech stocks like Alphabet and Amazon, they made a good jump in the last three days. Remember: You gotta pay tax on dividends…

Paul,

Alphabet and Amazon have been on fire lately indeed, congrats! Tech stocks in general have a larger upside, but also involve a lot more risk than many of the dividend growth stocks that are in my portfolio. If Google ever reaches a point where it’s operations stabilise and management decides to pay a dividend, I’ll be all over it.

Cheers,

NMW

Well done! It’s my always-questioning-everything-nature, but I was wondering how you feel about the ethics of investing in companies like BP and Total ? It’s an honest question. I would love to be financially independent myself and try to make good financial decisions in that direction, but on the other hand I don’t want to invest in companies involved in arms trade, oil extraction etc. So I end up with Triodos and the likes, which obviously limits my profits 😀

Hey Inge, you ask a valid question. In return, here is another question: do you use products that are oil based (drive a car, ride the bus, take a plane for holiday, have plastic at home – it is oil based after all) I gave it thought as well. As I use the products and do not plan to stop, I might as well invest in it.

I try on the other hand to limit my impact (commute is bike train again), we recycle as much as possible, avoid plastic bags, buy bio food,…

Hi. Obviously I do use oil-based products as it’s almost impossible to live a modern life without them. I do however not own a car, use public transport in most of the cases (buses and metro nowadays can run on clean technologies by the way), etc. I can see lots of people are making these kind of efforts, but am just wondering what’s the use of it all if at the same time we continue investing (and thus funding and ‘supporting’ in some kind) unsustainable industries. Where you put your money (especially if you have a lot of it) may make a lot more difference than whether or not you recycle every plastic bottle…

Inge,

I commend you for your efforts on reducing your environmental foot print – it’s something I try to do too. Small efforts turn into a major force if kept up long enough, never forget that!

For a major impact and industry change I think we need a global initiative from the developed countries (at least) and potentially even the majority of emerging countries. This has to be government-driven because there will always be people that are willing to invest in oil companies otherwise. Look up the “free rider problem” if you’re interested in why I think so: https://en.wikipedia.org/wiki/Free_rider_problem

Best wishes,

NMW

ATL,

I’m of a similar thought, but feel something for Inge’s ethical conundrum as well. I’m still not 100% sure if oil companies should be a part of my portfolio, but for the time being I’ll leave them there. Besides, I don’t see a future where all of them survive, so they better hurry up switching to sustainable energy delivery to stay relevant.

Cheers,

NMW

There is a lot to think about the ethics of investing. To me, it all starts indeed with the actions we take (drive less car, buy ethical clothes,eat local food,…). As I know very few companies that have zero environmental impact (goods need to be produced and shipped) , I keep that out of the equation for now.

A thought I have with the oil companies is the sustainability of the dividend. For now, I stick to my RDSA stock.

Inge,

Good question! We’ve had a similar discussion under the stock analysis of British American Tobacco, which sparked discussions on other people’s blogs too. You can find the analysis here: http://www.nomorewaffles.com/2014/08/british-american-tobacco-bats-stock-analysis-fairly-valued-dividend-powerhouse/

I’m probably somewhere in the middle when it comes to Triodos and an all-out profits approach. I do think optimising your investment returns is important, but not at all costs. That’s why you won’t see me purchase arms or cigarette manufacturers, for example.

Oil has always been a bit of a big question mark for me. Even though I know its environmental impact isn’t any good, I don’t think its unethical to invest in it. I follow Amber Tree’s school of thought: I’d better get my own foot print down (no car, energy efficient heating, etc.) and leave the big social and environmental regulatory impact to government. Modern life simply isn’t possible without oil even though sustainable alternatives are starting to pop up left and right.

On top of that, when I invest in energy companies I also look at the efforts they make towards a sustainable future. Even though a big part of those statements is window dressing, I believe most oil majors try to practice what they preach – European companies more so than American ones. Take Shell, for example: horrible track record when it comes to environmental damage, but they’re slowly shifting away from that towards natural gas and now even wind energy projects in the North Sea.

Cheers,

NMW

Hi NMW,

your updates are always a real injection of motivation to me!

For me as a German investor, july is not among the best months.

However, my internatonalization efforts begin to pay off: I received 9,34 from Coca Cola, and 25,12 from GSK. On top of that, I received 27,56 from the IShares Euro Banks fund, which I purchased right after the brexit-referendum in the expectation it won’t be too bad after all – by now, a successful investment.

Best

Wagner

Wagner,

Thanks, really glad to hear that! It’s one of the main reasons why I write these posts.

Home bias as a European investor does make it so that the second half of the year is much lower in terms of dividend income indeed, but I can see that your first international purchases are starting to pay off already. Wish my position in GSK and KO was as large as yours!

Keep it up,

NMW

Hey Waffles,

June wasn’t to good but there was a reason (see my post for that month). Anyways hope to get back up to regular dividend payments in Q4.

Cheers,

DFG

Hi,

good luck with the dividend building and reinvestment.

A problem for me is sticky months where I get less dividend payments, June is particularly bad.

I have been lucky enough to have reached £1,216 dividend payments the first half of this year jan- june.

(last year £1,887 over the 12 months)

If you are in the UK you can earn £5,000 dividends tax free and put £15,000 a year into an ISA which avoids tax on dividends.

Gary

NMW,

Good to see you having a great month. Great to see the growth continue!

-Gremlin

Nice growth NMW. July was also my fourth month in a row of triple-digit dividend income.

Regards,

DaC

Ah, more free money. Nice month Mr. NMW.

Missing some of your updates. When is the next dividend income going to be posted?

How do you reinvest your dividends? How do you make all your stock purchases?

What feels do you pay for each time you want to buy more stocks / reinvest your dividends?

If you are using dividend reinvestment plan, do you still have to pay tax on the profit from the dividends in Belgium?

https://en.wikipedia.org/wiki/Dividend_reinvestment_plan

Hi,

Soon I also want to start investing from Be. What brokerage do u use ? Do u know anything about ‘interactive brokers’ ? They seem pretty cheap and safe.

Waiting on your next interesting post ! Nice Blog !

Where are you NMW? Loved following your blog – you were one of my inspirations!

Hi,

I hope you are ok and healthy !

I am missing your posts…

best regards,

Thomas

How are you NMW? I miss the updates! Your articles were really motivating!

🙂 Hope all is well. Keep the good work… waiting for an update! Cheers.

Hi there Mr NMW! Please post an update, even just to let us know you are still there! Thanks 🙂

Hi NMW,

Long time since we’ve heard from you. Hope all is well and you’re progressing towards your DGI goals.

Looking forward to hear from you soon!

Rgds – mark

Hi NMW

Happy New Year in 2017 ! Someone at a VFB conference mentioned your blog.

Glad to see your progress. Keep on grinding higher. Look forward to read your 2017 goals

Our goal is to launch our blog in Q1 2017. Take a peek at our goals

Look forward to read more from another Belgian guy

Dividend Cake