Below you can find all of my dividend income since my first payment back in September 2014. Because I started blogging before I went on my dividend journey you can find every single Euro I’ve ever received following the dividend growth strategy below.

Please note that the amounts below are denominated in Euros and are after any applicable foreign withholding taxes and a 30% Belgian income tax.

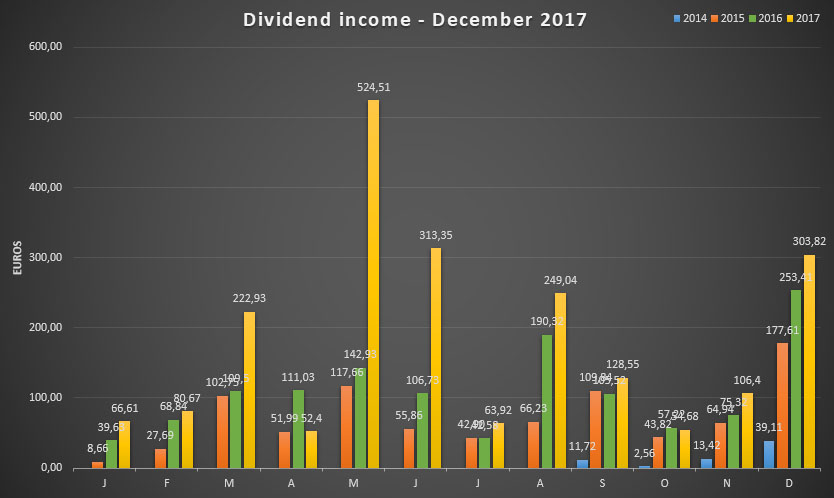

2017

| Month | Amount | YoY Growth |

|---|---|---|

| January 2017 | 66.61 | +68.08% |

| February 2017 | 80.67 | +17.18% |

| March 2017 | 222.93 | +103.59% |

| April 2017 | 52.4 | -52.81% |

| May 2017 | 524.51 | +266.97% |

| June 2017 | 313.35 | +193.59% |

| July 2017 | 63.92 | +50.12% |

| August 2017 | 249.04 | +30.85% |

| September 2017 | 128.55 | +21.83% |

| October 2017 | 54.68 | -4.44% |

| November 2017 | 106.4 | +41.26% |

| December 2017 | 303.82 | +19.89% |

| Total | 2,166.88 | +66.30% |

2016

| Month | Amount | YoY Growth |

|---|---|---|

| January 2016 | 39.63 | +357.62% |

| February 2016 | 68.84 | +148.61% |

| March 2016 | 109.50 | +6.57% |

| April 2016 | 111.03 | +113.56% |

| May 2016 | 142.93 | +21.47% |

| June 2016 | 106.73 | +91.07% |

| July 2016 | 42.58 | -0.75% |

| August 2016 | 190.32 | +187.36% |

| September 2016 | 105.25 | -4.18% |

| October 2016 | 57.22 | +30.58% |

| November 2016 | 75.32 | +15.98% |

| December 2016 | 253.41 | +42.68% |

| Total | 1,302.76 | +49.75% |

2015

| Month | Amount | YoY Growth |

|---|---|---|

| January 2015 | 8.66 | N/A |

| February 2015 | 27.69 | N/A |

| March 2015 | 102.75 | N/A |

| April 2015 | 51.99 | N/A |

| May 2015 | 117.66 | N/A |

| June 2015 | 55.86 | N/A |

| July 2015 | 42.90 | N/A |

| August 2015 | 66.23 | N/A |

| September 2015 | 109.84 | +837.20% |

| October 2015 | 43.82 | +1611.72% |

| November 2015 | 64.94 | +383.90% |

| December 2015 | 177.61 | +354.13% |

| Total | 869.95 | +1202.13% |

2014

| Month | Amount | YoY Growth |

|---|---|---|

| September 2014 | 11.72 | N/A |

| October 2014 | 2.56 | N/A |

| November 2014 | 13.42 | N/A |

| December 2014 | 39.11 | N/A |

| Total | 66.81 | N/A |

NICE!

Great job! I’m from Spain and also investing towards financial independence.

Thanks a lot for the Euro Dividend All-Stars. I was just looking for that.

Can I share the list on my blog with credit to you?

Dividendos,

Of course! As long as you make sure to link back you can use the information anyway you see fit. 🙂

Best wishes,

NMW

Hi, just wonder, where can i buy share that give me dividend, i’ve done some research online, but no one really mention dividend

s27y,

I’m not really sure what you’re asking, but if you’re looking for companies that pay dividends on a sustainable basis, you could take a look at David Fish’ USA dividend aristocrats, Tyler Witten’s UK dividend champions or my own Euro Dividend All-Stars.

You can buy them on their respective stock markets through a broker or your bank.

Best of luck,

NMW

do you have any online broker recommendation? I only know DeGeiro…

s27y,

I have experience with Binck Bank and Bolero in Belgium. I recommend both. If you wish to use Binck hit me up through the contact form since we could both receive referral credit.

DeGiro is popular too because it’s cheap, but comes with some drawbacks. I don’t like that they’re allowed to swap your shares with other financial institutions, for example.

Cheers,

NMW

Hi NMW

I want to open an account in Binck Bank. Let’s get those 100 EUR of referral credit for transaction costs.

They need your full name and date of birth.

I’ve sent you already two messages through contact section. Not sure if you have seen them?

Could you please contact me by email to arrange this?

Boban,

I’ve just replied to your e-mail!

Cheers,

NMW

Hi there, how much capital did you put towards the shares? to get those dividends?

Hi NMW,

Perhaps we both can take advantage of a good referral system too? I’ll be looking around myself but I guess you already are with a decent broker so perhaps we can both profit from that?

Unless things have changed and you can refer me to a better one?

cheers

Mr2

Great progress!

Any reason you are not using accumulated index funds (IWDA?) where you would not need to pay any % dividend tax? Capital gains tax is 0% in Belgium so why not take money 1x per year or not at all until the time you need it?

That 30% dividend tax is hurting your growth rate and potential. Not paying the taxes today or ever would increase your compounded rate immensely.