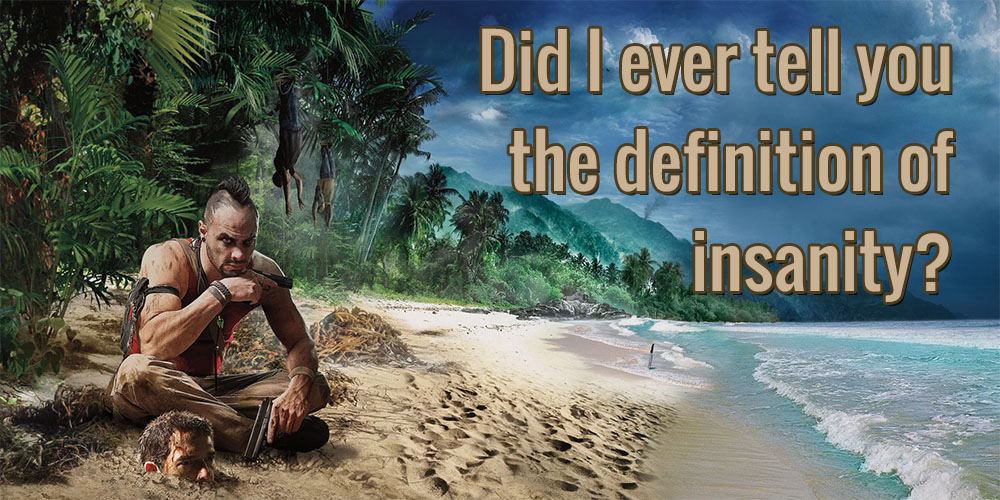

Recently I replayed Far Cry 3, a first-person shooter set on a tropical and paradise-like island that’s riddled with deadly animals and modern-day pirates. The story is mostly carried by the game’s main antagonist, Vaas Montenegro. As the drugged-up leader of the pirates, he often shares his words of wisdom with the player. And it’s one of his sayings that got me thinking.

(Potential spoilers below, so if you still want to play Far Cry 3 you better sit this post out.)

During one of the key scenes of the game, Vaas asks the player if he knows what insanity is:

Did I ever tell you what the definition of insanity is? Insanity is doing the exact… same fucking thing… over and over again, expecting… shit to change.

Even though Vaas’ words hold a certain truth, it’s easy to misconstrue them. One of my friends, for example, uses the saying as a way to evade doing things he rather wouldn’t do. While it’s true that you shouldn’t become a present-day Sisyphus, there’s no reason to apply the logic explained by Vaas in the service of avoidance.

And it’s not just my friend that does this. Since joining the financial independence community about a year and a half ago, first by lurking anonymously and later on by taking up a more active role through this blog, I’ve noticed many people grabbing on to the insanity saying as a way to rationalise their behaviour.

More specifically, I’ve read the explanations and justifications below as to why financial independence is not for them or how they try to tackle their financial woes:

- “I tried saving 10% of my paycheck, but after failing three months in a row I gave up.”

- “The stock market whiped out all my May savings, so why bother?”

- “I’ve opened up another credit line to consolidate my credit cards, so now I’m sure to get out of debt.”

What’s most striking about these rationalisations is that people actually seem to believe that they are doing things differently from before and should thus be rewarded with a different and better outcome. I call it The Complain Game.

Trying to save 10% isn’t actually changing how you go about your business, just like feeling defeated by an outside force like the stock market doesn’t fall within the definition of insanity. And could someone explain to me how consolidating your debt isn’t exactly the same as not combining multiple credit lines? In the end you’re still up to your eyeballs in debt!

The missing link in the examples above is perseverance.

Perseverance, being persistent in doing something despite difficulties or a possible delay in achieving success, should never be confused with futile repetition. That’s especially the case when you set a clear objective and conjure up a plan to work toward that goal, which is what financial independence is all about.

Although I’ve been doing great at saving a large portion of my salaried income, I admit that it’s not easy for everyone to do so. However, when you can’t even move the needle in the right direction after three months, there’s a high chance you haven’t actually changed your spending pattern at all, but merely continue doing the same thing over and over in the hopes of saving more.

At that point, you’re basically still like the cavemen in Plato’s Allegory: day-in day-out they gawk at reality’s reflections on the cave’s walls instead of doing something drastically different to define their own reality.

However, it’s difficult change your mindset, but if you want to become financially free you have to persevere in saving as much as possible and investing that money for the long-run. Persistency and consistency are the only factors with an impact on your financial freedom that are fully and reliably within your own control.

So get out of your comfort zone and try something unlike anything you’ve done before to make your own financial independence happen! Don’t be afraid to feel like a fish out of water, you can determine your own life to focus on what makes you happy. I’m sure you’ll make truly beautiful things happen when you persevere and keep at it.

Besides, what’s worse than getting up every morning to go to work, so you can provide yourself with enough money to pay for a relaxing downtime as to recharge your batteries, just to go back to the office again? To me, that’s the definition of insanity: mindlessly going to work without your situation ever changing for the better.

I’d rather build my own Win for Life and make time my own again. How about you?

Completely agree. Perseverance/determination is the biggest factor in succeeding in any endeavor, but especially those that don’t come natural to you. Some people tend to be spenders, others are savers. Luckily I’m in the saver category so I didn’t have to drastically alter my lifestyle to be able to move towards FI. But that doesn’t mean it can’t be done. There’s countless stories of people that were big overspenders and got way into debt but then turned their lives around and are in much better, if not amazing, financial shape. Or the many stories you hear about the dramatic weight loss stories. While diet is the most important factor there, then exercise, what truly makes the difference is your will power.

You have to truly commit yourself to any change in order for it to stick. And a set back is just that, a set back. That doesn’t mean you can’t do something.

“I have not failed. I’ve just found 10,000 ways that won’t work” – Thomas Edison

JC,

Glad to hear you’re in the natural saver category! I can imagine it being difficult to become financially independent when you have to make big lifestyle changes, but thankfully that doesn’t apply to us.

The debt to riches story always amaze and surprise me (in a positive way) – really enjoy reading them for some reason. I think it’s a combination of perseverance and often a positive feeling those kind of stories elicit.

Love the Thomas Edison quote! Really good way to go through life.

Cheers,

NMW

Yup, doing something that’s ACTUALLY different, and sticking at it without being a wussy pants after 3 months is necessary.

Thank you for setting us a good example!

M,

Giving up after three months, especially when you try to become financially independent, is such a shame. How can you expect drastic improvements or gains with just three months under your belt? It saddens me when people give up because of that reason.

Thanks!

NMW

Nice post, NMW.

It is something that is so important to successfully build your way to financial independence. However, it is actually rarely commented on directly. Perhaps this is because those who are making progress towards that goal (and, say, blogging on it) have already internalised that perseverance they forget how hard it can be to build that stoicism in the first place.

Hopefully it will inspire plenty more people!

Dividend Drive,

You make a keen observation in that it’s a topic not often discussed by most bloggers, probably because they take it for granted like you said. However, I think that many people simply lack the willpower to succesfully see through a long-term endeavour and that is exactly one of the reasons why financial independence seems impossible to them.

Cheers,

NMW

Nice sunday afternoon read. It does indeed take an effort to move the needle. It was not easy for me many years ago, but it pays off now.

By the definition of insanity, I must be insane. I do the same each month ( live beow our means and invest the rest) and I expect a different outcome: financial incependence. It might not be there this year or next year, but one year, it will!!

ATL,

All beginnings are difficult, but if we stick to our plan and goals difficult chores become easier over time. Financial independence doesn’t differ much as you seem to have experienced yourself. Saving and investing now comes easy enough to you!

Ha, I thought the same thing: how insane are most of us for saving as much as possible each and every single month!?

Cheers,

NMW

Hi NMW,

A great article – I’m definitely with you on the perseverance. As JC noted above, the implication behind trying again is that you’ve learned something from the first failure and have improved for the next time around.

The other aspect that’s important is being realistic and knowing yourself. For some, especially on lower incomes, saving 10% of income might be impossible or require too much frugality. Their goal might be better served in the shorter term at trying to increase their current income instead.

Best wishes,

-DL

Trevor,

Thanks, buddy! Appreciate the kind comment as always.

Insighftul addition to the discussion! Of course being realistic is important when you try to achieve something – otherwise you’re just pursueing a fool’s errand. There’s not chance I’ll ever be able to win the Tour de France, so no use in trying.

I’ve often thought about financial independence on a lower income… It’s easy for me to say you should save above 50% of your income when I’m already earning the average worker’s income my first year out of University, but when you earn half what I make it becomes another story entirely. Focussing on increasing income could then be a viable option, like you said. It just goes to show that picking the right goals is just as important as trying to achieve them.

Cheers,

NMW

Hey NMW,

It always amazes me how people have such a severe lack of financial education. The bit about the stock market wiping their savings in a single month is almost comical. I mean, come on! Why don’t those people then mention how their savings bounced back even higher over the next few weeks?!

I identify with the scenario you describe, where one saves money just to be able to spend it all on holiday and feel alive and free… just to do it all over again. I was in that situation not so long ago, and I HATED it. Thankfully I had my eyes opened and have found a much better way.

Far Cry 3 is such an awesome game! Vas was genuinely scary – such a great villain! I got a bit obsessed with claiming all the outposts, so much fun!

Great article man, as always.

DL

DL,

The lack of financial education is astounding – I’m often surprised by how little I still know in some subject areas. I feel it’s a big gap in our educational system.

To answer your question: those people can’t mention their savings bounced back up because they pulled out the minute they were in the red! 😉

Far Cry 3 is a great game, especially after the miserable experience that Far Cry 2 was. Vaas really carried the story and I loved the over-the-top and crazy missions. Have you played the Blood Dragon stand-alone expansion? It’s even better because it doesn’t take itself seriously and employs a ton of 80s clichés.

Thanks!

Best wishes,

NMW

NMW,

I agree, I hear this a lot and it has definitely become more noticeable since like you I started lurking then writing. Mr. Money Mustache calls them “complainy pants” I believe, and it is similar to people playing the complain game. If you want change you need to reach for it, or make it happen. Anything else and nothing will change.

Keep enjoying the good summer,

Gremlin

Gremlin,

Indeed, there’s a really fine line between simply being a quitter and a complainy pants. Even when you have everything going for you, you’ll still need the willpower to see things through… But it’s easier to complain about outside factors than man up and get to the task at hand, I guess.

Cheers,

NMW

NMW,

Good stuff. Most ordinary folks become extraordinary not from being some sort of superhuman, but from doing something “okay” but for very long periods of time. This is, of course, evident in dividend investing. But, we also see this in many places. I ran 30 miles (http://www.retire29.com/early-retirement-lessons-from-a-30-mile-run/) last month. I’m not some gifted Kenyan, I just stepped out and kept going for a while. Nolan Ryan (I know you’re Belgian, but you probably have heard of him) is said to not even be that great of pitcher. However, he amassed over 5,000 strikeouts because he was a decent pitcher, who happened to stay healthy for like three decades.

Like they say in “Shawshank Redemption”. “Pressure, and time. That’s all a man needs, really.”

Eric,

Holy hell, pal, 30 miles! That’s insane, even by my standards – well done! 🙂

Sticking to something for very long periods of time is indeed the silver bullet to achieving greatness. In finance that force is evident from compounding interest, but in other areas of life we can see similar patterns. Sports also show an exponential performance curve when you train on a regular basis, which easily explains your 30 mile run.

Best wishes,

NMW

Completely unrelated, Steam notified me that KOTOR II was released for Mac the other day and I instantly spent $8.75 buying the game. I was obsessed with KOTOR I back in the day and never got around to playing II since I switched over to a Mac.

Now, combined with my obsession with playing Civ 5 and marathon training, I don’t even know how I’ll find time to write posts for the foreseeable future 😛

Steve,

Ha, both KOTOR games are pretty great! I recently tried playing KOTOR again, but even with a ton of mods it felt outdated. Some games do lose their lackluster after a while, such a pitty.

Are you taking on a million things at once again? You’re one of the busiest people I know, not to mention your wide range of interests!

Also, did you make the jump to Beyond Earth yet or do you also enjoy Civ5 more?

Cheers,

NMW

And people said video games can’t teach you anything?

Totally agree, keep doing the same thing over and over again for years and years is absolutely insane. I see the same with people going to their health provider…. some people have been going to the same chiropractor for years and saw no results. But when you suggest them trying something else they are like “but I’ve seen my chiropractor for years….” Right, I know, but you’re still suffering some sort of pain, so shouldn’t you try something else?

Tawcan,

Video games taught me a lot, ha! It’s not because Mario jumping over blocks doesn’t teach you anything (apart from good motor skills) that games don’t often provide teaching experiences.

Your story exemplifies what I’m trying to say here, unbelievable…

Cheers,

NMW

NMW,

As a part-time philosopher, I love the references to Plato and Sisyphus. I also feel this quote which is often attributed to Einstein gets used in the wrong ways; sometimes it actually makes sense to repeat the same steps in a similar fashion.

The debt consolidation example is the one I most hate. If you speak to someone who is thinking about consolidating their debts, they seem to think this is somehow the “answer”. “Once my interest rates are lower, it will be easy to get back to zero”, they say. The truth, of course, is that until they change the spending habits that got them into their situation in the first place, consolidation won’t make much difference at all.

Thanks for the read,

– Ryan from GRB

Ryan,

Glad to hear you enjoy the references to the Greek myths and philosophy – at least it’s not wasted on all readers then! 😉

Of course getting out of debt is much easier when you enjoy a low interest rate, but that by itself is not going to cut it. If you’re not willing to change your spending habbits and put in the work yourself, you’ll just amass more debt at a slower rate rather than actually pay it off.

Best wishes,

NMW

I agree as well. I haven’t had any cash to invest all year but that hasn’t stopped me from trying to find ways to save more money or earn more. My end goal hasn’t changed!|

DFG

DFG,

I admire your positivism and enthusiasm! Many people would have given up a long time ago, but you actively try to seek new ways and solutions to make your dreams happen.

Keep it up!

Best of luck,

NMW

Great post NMW and as usual, love it when you link your writing with video games!

I guess us FI-wannabes are in the insane camp, saving/investing, being frugal, rinse and repeat every day, every month.

The difference compared to the ‘other’ insane lot is that, are we complaining? No, we blog about doing the same thing because we all have a goal in mind and achieving that goal will make a difference! 🙂

Weenie,

Glad you like the post! I appreciate the kind words.

To other folks we could very well look like insane loonies, but we both know that we’re going for a completely different outcome from where they think we’ll end up.

Cheers,

NMW