The second quarter of 2016 is officially over and that can mean only one thing – it’s time for a quarterly net worth update! When I first started blogging I published all net worth changes on a monthly basis, but not too long ago I switched to a three-monthly update.

The main reason behind this change stems from the fact that I’m not trying to build as much wealth as possible, but rather try to achieve a steady and growing stream of passive income. Indeed, through regular free-of-work payments into my bank accounts I should reach financial independence some day. However, making awesome progress with dividends only and taking huge capital losses isn’t something I’m interested in – hence the quarterly net worth reviews.

Still, that doesn’t answer my choice for quarterly over monthly updates. When you’re exposed to the mood swings of the stock market you’ll see your portfolio vary wildly from day to day, which is rather tough psychologically – who likes losing €2,000 on paper, right? By reviewing my portfolio on a less frequent basis I take away the daily swings and thus the perception that my investments are volatile.

So, who is excited to see the effect of the Brexit vote in the UK on my portfolio and net worth?!

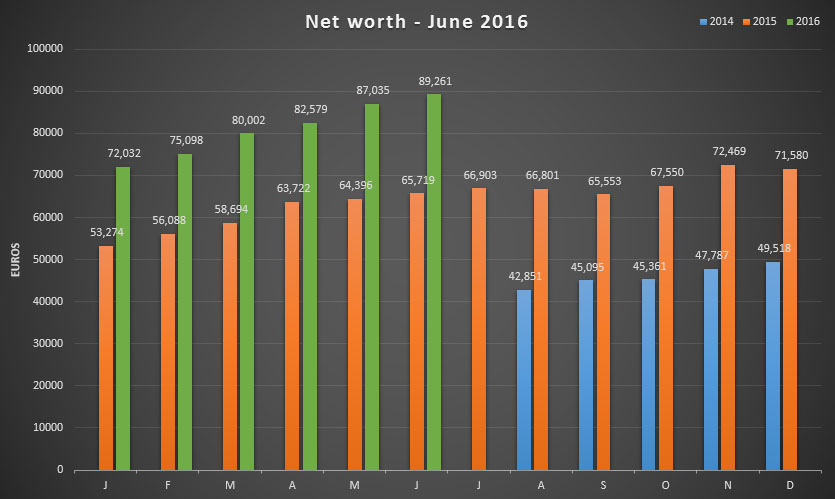

Oh, whoops! For all the hysteria in the financial section of news outlets there’s not much impact after all. Compared to the end of March my portfolio soared by 9,259 Euros, which is even better than last quarter – talk about a snowball starting to form. Of course, most of the increase comes from my excellent savings rate, but the uptrending stock market definitely put in some work too.

As the title of this post already revealed, the total gain during Q2 comes out at 11.57%, or just a tad higher than Q1. Moreover, I’m almost at the €90,000 threshold and closing in on the six figure mark. If I keep my insanely good savings habit up for the rest of the year there’s a high chance that I’ll make it to 100,000 Euros.

What exactly does it mean to have this much money stashed away in my financial independence piggy bank? Well, considering I make about €12 an hour after taxes, you could say I saved up 770 hours or over 100 days of work-free capital. And the best part? That money is now working hard all by itself to build my wealth even faster.

Dividend growth stocks

Since I’m a dividend growth investor first and foremost it should come as no surprise that dividend stocks make up the bulk of my portfolio. They lead the way in building my passive income to afford a future financially independent lifestyle. At the moment, however, I’m still re-investing my dividends to fuel the compounding effect of my stocks. On top of that I pour my monthly savings into new positions whenever I see an opportunity in the market. in Q2 I did so six times.

First, I increased my position in Qualcomm (NYSE:QCOM) from 9 to 36 shares. The US-based chip-maker seemed undervalued at the time, especially when you consider the company’s free cash flow and future prospects. Of course, the 10% dividend increase didn’t hurt either.

Second on the list was UK utility National Grid (LON:NG), a staple in many British investors’ portfolios because of the well-regulated environment the company operates in, the steady business prospects, and relatively high and safe yield. During a small moment of weakness in the stock’s price I decided to double my position to 200 shares.

Not too long after I bought into another British company, namely Vodafone (LON:VOD). Even though Vodafone has been struggling the past couple of years on the European mainland I believe the telecoms provider is showing the first signs of a recovery in earnings. That’s why I decided to triple my position to 600 shares.

Fourth and by far my biggest purchase during the past couple of weeks is Belgian mono-holding Solvac NV (EBR:SOLV). Fellow blogger Ambertreeleaves pointed out to me that it was far more beneficial to purchase Solvac than its underlying company Solvay (EBR:SOLB), which I had been following for a while now, simply because the holding trades at a discount compared to the business. Consequently I initiated a position of 25 shares of the internationally diversified chemicals group to start off with.

My fifth purchase happened right after I saw most banking and insurance stocks plunged over a couple of days, mainly because of Brexit rumours and higher than average weather damage in mainland Europe. As a result, I purchased another 7 shares of re-insurer Munich RE (ETR:MUV2) right near the bottom. Even though the business is under some stress right now, mainly due to the low-interest rate environment, I don’t see trouble in the long-term.

Another insurance business that saw its stock price tumble excessively over the past couple of weeks is Belgium-based Ageas NV (EBR:AGS). As the sixth purchase of the past quarter I bought into the stock twice, once before the Brexit and once right afterwards for what I consider a very compelling starting position of 70 shares.

You can find the gains in absolute and relative numbers for each company in the table below. The cost basis for each position includes the price of the shares, a 0.27% stock market tax and brokerage fees.

| Ticker | Company | Shares | Cost basis | Mkt. value | Gain |

|---|---|---|---|---|---|

| ABI | AB Inbev | 22 | 2,385.18 | 2,587.20 | +8.47% |

| AFL | Aflac Inc. | 9 | 419.41 | 584.90 | +39.46% |

| AGS | Ageas NV | 70 | 2,247.55 | 2,169.30 | -3.48% |

| T | AT&T | 80 | 2,352.46 | 3,113.28 | +32.34% |

| BLT | BHP Billiton plc | 110 | 1,908.56 | 1,231.62 | -35.47% |

| BP | BP plc | 92 | 507.24 | 479.76 | -5.42% |

| CAT | Caterpillar Inc. | 25 | 1,465.40 | 1,706.91 | +16.48% |

| DE | Deere & Company | 7 | 452.61 | 510.91 | +12.88% |

| DGE | Diageo plc | 75 | 1885.55 | 1,1,847.01 | -2.04% |

| ENG | Enagas SA | 50 | 1,258.60 | 1,365.50 | +8.49% |

| GE | General Electric | 22 | 450.70 | 623.74 | +38.39% |

| GSK | GlaxoSmithKline | 80 | 1,470.38 | 1,528.46 | +3.95% |

| HOME | Home Invest Belgium | 30 | 2,682.00 | 3,000.00 | +11.86% |

| INDV | Indivior plc | 10 | 3.89 | 30.14 | +674.70% |

| IBM | IBM Corp. | 6 | 736.76 | 820.18 | +11.32% |

| JNJ | Johnson & Johnson | 20 | 1,769.41 | 2,184.92 | +23.48% |

| KIN | Kinepolis Group | 40 | 1,399.25 | 1,604.40 | +14.66% |

| MCD | McDonald's Corp | 14 | 1,003.47 | 1,517.34 | +51.21% |

| MUV2 | Munich RE | 21 | 3,657.15 | 3,155.25 | -13.72% |

| NG | National Grid plc | 200 | 2,637.67 | 2,621.03 | -0.63% |

| NOVN | Novartis AG | 30 | 2,295.71 | 2,219.13 | -3.34% |

| PG | Procter & Gamble | 23 | 1,594.66 | 1,753.89 | +9.98% |

| QCOM | Qualcomm Inc. | 36 | 1,733.79 | 1,736.87 | +0.18% |

| RB | Reckitt Benckiser plc | 10 | 630.34 | 875.98 | +38.97% |

| ROG | Roche Holding AG | 5 | 1,233.71 | 1,181.78 | -4.21% |

| RDSB | Royal Dutch Shell | 110 | 2,956.64 | 2,743.40 | -7.21% |

| SAN | Sanofi SA | 15 | 1,077.36 | 1,123.80 | +4.31% |

| SOLV | Solvac NV | 25 | 2,313.46 | 2,337.25 | +1.03% |

| S32 | South 32 Ltd. | 48 | 20.04 | 49.89 | +148.95% |

| KO | The Coca Cola Company | 17 | 540.05 | 694.03 | +28.51% |

| FP | Total SA | 45 | 2,045.95 | 1,952.10 | -4.59% |

| ULVR | Unilever plc | 90 | 3,170.00 | 3,839.28 | +21.11% |

| VZ | Verizon Communications Inc. | 20 | 785.07 | 1,005.82 | +28.12% |

| VOD | Vodafone plc | 600 | 1,781.49 | 1,618.49 | -9.15% |

| Total | 52,871.49 | 55,813.55 | +5.56% |

Exchange-traded funds

I’ve said it before and I’ll say it again, the ETFs below have been doing exactly what they were designed to do. By tracking the MSCI World, emerging markets and Europe indices rigorously, these exchange-traded funds have experienced respectable growth in the past few months, especially the MSCI World ETF. If you’re a new investor looking for a long-term set-it and forget-it approach, I can’t recommend index funds enough.

| Ticker | ETF | Cost basis | Mkt. value | Gain |

|---|---|---|---|---|

| IWDA | iShares Core MSCI World | 6,217.44 | 7,273.56 | +16.98% |

| IEMA | iShares MSCI Emerging Markets | 1,214.59 | 1,238.22 | +1.95% |

| IMAE | iShares MSCI Europe | 3,561.94 | 3,582.48 | +0.58% |

| Total | 10,993.97 | 12,094.26 | +10.01% |

Other

The last part of my portfolio constist of a tax-efficient pension fund and good ol’ boring savings accounts. As you can see my emergency fund is relatively empty, but that’s just because I used some of the cash in there to fuel this quarter’s stock purchases. Over the coming months I’ll slowly replenish it. On top of that my pension fund continues to receive automtic payments to hit the €950 upper limit for 2016.

| Name | Cost basis | Current value | Gain |

|---|---|---|---|

| Pension fund | 2,329.98 | 2,353.68 | +1.02% and 30% tax break |

| Savings account | N/A | 18,000.00 | N/A |

| Emergency fund | N/A | 1,000.00 | N/A |

| Total | 21,353.68 |

Going forward

Another great net worth update in the books – that’s what I like to see! As a result, I’m still convinced that living below your means, saving as much as possible and investing those savings in high quality dividend growth stocks remains a good way to reach financial independence or early retirement. That’s why I plan to give it my all in the second half of 2016.

I sincerely hope you all had a good Q2 too, but judging by the first reports on the blogs I follow every single one of you seems to be crushing it. Your success shows me financial independence can be done and it motivates me to no end to keep pushing the boundaries month after month.

Thank you for reading and for your support.

PS: I’ve been absent because of a bad cycling crash where I had difficulty typing with my left hand. Over the coming weeks things should start to pick up again.

Nice one! Take care of that hand and thanks for the update, always excellent to read

Thanks, Fabio!

I hope you enjoyed ploughing through the numbers.

My hand is much better and I went for a ride a couple of days ago for the first time – felt really great.

Cheers,

NMW

Hey NMW

Great to see you getting closer and closer to that 100k milestone, keep up the great work. Brexit will cause more changes, only time will tell but with a diversified portfolio, you will just ride all the rollercoaster movements!

Sorry to hear about your accident and hope you recover soon and are not in too much pain.

Weenie,

Inching closer to the 100k milestone indeed – mostly thanks to the Brexit affairs in the past couple of weeks. We’ll see what the impact is going to be, but in the long-run it’ll be just a small blip on the radar probably.

I’m doing much better and fully mobile again, thank you!

Hope all is well over there!

Cheers,

NMW

Freaking impressive, awesome or any other positive remarks you can think about. Just sweet to read!

Mr. MB,

I was really happy and impressed with the results of the past couple of weeks too! Now I’m just aching for lower stock prices again, haha – can’t seem to find any good deals anymore.

Cheers,

NMW

Sad to hear about your accident. The biggest surprise of the month for me was how quickly the market recovered after the Brexit vote, down for two days and after that my portfolio hit fresh all-time highs.

DAC,

Indeed, I was taken aback by the speed the market recovered after the Brexit ordeal. After five days we were back to the highest levels recorded thusfar. Luckily I got in a good trade here and there to take advantage of panick sales.

Cheers,

NMW

Hope your hand will heal and the bike survived! How did the accident happen? Net worth is growing rapidly, the 100k is not far off! Impressive!

Singvestor,

The bike survived, but barely. Had to get some repairs done, but it should be fine. Thank God I wasn’t on carbon or I could have thrown it out immediately.

I basically crashed at 40-45kph in a corner. There was a lot of dust and grime there from bad weather the past couple of days and I turned a bit too fast. Lesson learned!

Cheers,

NMW

Goog news: I think you saved up a 1000 days of work instead of 100. Good choice on Solvac!

Walter,

1000 might be stretching it a bit, but I’ll take 100 any day! Really glad with those numbers and I can’t wait to get to the magical six figure mark.

Cheers,

NMW

Hi NMW,

glad to see that Q2 went well for you!

Hopefully your accident will give you the insight that cycling is a very unfavorable way of traveling ;). I hope you’ll get better, soon!

For me: Mixed results.

My mainly German portfolio did not perform very well: Especially Bayer with the rumors about Monsanto and Allianz, which did not recover as well as other insurance shares, lost in value significantly.

On the other hand, with purchases of Unilever and Coca Cola I managed to further internationalize my portfolio. Both shares are now above their purchase price, too.

Also, I found out that due to special regulation, tax on US-share dividends in Germany is apparently a little lower than for domestic shares, so I will look further into this market!

Wagner

Wagner,

Still in love with cycling, no worries! 😉

Pretty weird that tax on US dividends is lower than on domestic German ones… I think a lot of non-US investors would love such a deal!

I’m sorry to hear your portfolio didn’t perform too well, but in the end Bayer will probably tick back up to its previous levels. It’s still a really good company and the Monsanto rumours are just temporary noise.

Best of luck!

Cheers,

NMW

I hope your injury doesn’t stop you from continuing with cycling. Hope the hand heals well. I would be out of a job if I lost mine.

Get well,

DFG

DFG,

Sadly I had to take a short break – brake? 😉 – from cycling the past month. My shoulder and left hip lost too much skin and my left hand was basically garbage. I couldn’t even lift a paper. Everything has healed nicely though, so I jumped back on the bike a couple of days ago.

Thanks!

NMW

Get better with your hand!

Solid net worth increase that’s for sure. Keep up the great work NMW!

Thanks, Tawcan!

Get well soon..

Thanks, Pavan! Much appreciated.

Hey Waffles,

That sucks about your hand, get well soon! Good job on the increased net worth (so far Brexit hasn’t been all that bad), but awesome job on picking up National Grid, that’s a great dividend buy.

Good luck for next quarter 🙂

Tristan

Tristan,

All healed and back on the bike already – thanks!

The Brexit has been anything but bad for my portfolio and I’m guessing I’m not the only one. Just look at the level most international markets are at: they’re all pushing new highs on a daily basis.

I’m really glad I bought some more National Grid and I’ll probably pick up some more when my portfolio and diversification goal allow it.

Best wishes,

NMW

Good luck with your cycling injury, hope it heals soon.

And boy, the financial Muscles from Brussels is at it again, what a stunning increase in your portfolio and net worth values. Fantastic YOY increase, well done.

Team CF,

Thanks, buddy! Both for the cycling injury as well as for the awesome title “financial muscles from Brussels”! 😀

Hope all is well in your neck of the woods too.

Cheers,

NMW

It seems you are on a roll! Good to see you bought the Belgian insurer Ageas. It is one of my biggest positions and I think it very attractive at the current price.

Keep up the good work.

Kisses,

Mrs. Moneypenny

Mrs. Moneypenny,

The past couple of weeks really felt like I was on a roll indeed. Talking about a good news show!

I’m really happy to have snagged Ageas near this price level. I know the company is under a bit of stress due to all of the bad weather claims, but this low of a level isn’t warranted by any stretch of imagination. Just a couple of months ago we were pushing the €40 barrier – what’s changed? Exactly, nothing that requires a 25% drop in price.

Cheers,

NMW

I bought some stocks right after BREXIT happened. It was great. All of them are up 10-12% now.

BSR,

Exactly! Most of the purchases I made are up to. Many stock splunged 10%+ only to recover almost immediately in the afternoon…

Cheers,

NMW

Hi NMW,

Love the blog by the way, I try and check in regularly.

Sorry to hear about the cycle crash, I can definitely relate since I had a bad crash in 2007. Take sufficient time out to regain your strength and composure, but make sure you get back on the saddle to make use of that tax-efficient method of transport you’ve got at your fingertips

Though, it’s it great to know that your portfolio is still cranking out dividends even though you are poorly? Justifies our collective pursuit of passive income in a way…

LSE: VOD –> good call on Vodafone. With their Project Spring capex demands becoming less and less of drain, I can see them covering generating healthy cashflows going forward, with concerns over dividend cover falling by the wayside; didn’t they just increase the dividend by 2%? Talk is also afoot of VOD moving their HQ to Europe now that Brexit has happened.

You and I have a few common: I see you are still keeping the faith with BHP Billiton, me too. Still underwater, but this company is among the best in the commodity space and should pick up with USD weakness and any signs of stability in China. India will be worth keeping an eye on, though that said, I’m still waiting for the great infrastructure build needed in the Developed World to boost commodity demand.

Next time I’m in Belgium – was there second week of June – I’ll give you a shout!

Best!

Financial Monkey,

Sorry to hear you had a bad crash too a couple of years back. Time heals all wounds though, and that’s definitely been the case the past month for me. I got back on my bike a couple of days ago and it felt better than ever. Can’t wait to up those rides and the kilometers.

VOD should do well in the future, especially if Project Spring is completed and the European telecoms market becomes even more liberated. The HQ move to the European mainland could spell some trouble for some dividend growth investors though since that almost always means an increased foreign withholding tax from 0% to 15% at the least.

I’m indeed still underwater on BHP, but I still think it’s a well-run company. Should have known the commodity cycle could dip this low, but lesson learned. In the long-run I’m sure BHP will climb back to its old level and start pumping out those dividends again.

Let me know when you’re near Brussels and we’ll grab a drink!

Cheers,

NMW

Hello,

Came across your blog, I like your goals.

I’m in a similar residential situation to you, I pay no capital gains taxes, and actually no taxes on dividends either, unless it’s taxed at source of course.

I see from your page about ETFs that you pay 25% tax on dividends, maybe because it’s an “income tax” in Belgium?

Either way, why don’t you invest in synthetic ETFs (backed by strong counterpart banks) or ETFs/stocks which have no dividends to avoid these taxes?

Also I suggest you split your net worth update to show what actually increased your net worth and by how much (stock appreciation vs savings) to paint a truer picture.

Cheers and all the best!

Uampak,

The ETFs I own accumulate incoming funds so they don’t pay out a dividend. I picked these type of ETFs specifically for the reasons you mention: as a way to avoid the 25% tax on dividends and to take advantage of the lack of capital gains tax.

I’ll try to make the difference between asset appreciation and additional savings more clear in future posts – thank you for that suggestion.

Cheers,

NMW

I see you have 3 Ishares ETFs, I just started investing in iShares Core MSCI World too but recently (after mailing Binckbank) noticed they also offer quite a few Vanguard funds, for example the Vanguard Total Stock Market ETF and Vanguard Total Bond Market. Any reason why Ishares over Vanguard? (might be a stupid question, I’m new to this 🙂 )

Kenny,

Two years ago Vanguard only offered ETFs that distributed dividends to shareholders and didn’t accumulate then. Since Belgium has no capital gains tax an accumulating ETF is much better since you won’t have to pay any taxes.

I’m not sure if Vanguard offers any accumulating ETFs at this time, but if they do there’s no particular reason anymore why I would pick iShares over Vanguard all else being equal.

Cheers,

NMW

Hmm, I got ahead of myself there it seems indeed. I presumed those were accumulating (Vanguard Total Stock market and Vanguard Growth) but looking at the website under dividend type, it says Interm. Bummer… also it doesn’t seem very easy to find them, there is, from what I can tell, usually no filter on accumulating or distributing ETFs…

No worries, Kenny! Happens to the best of us and the total amount of ETFs out there is staggering. Always read the prospectus of an ETF on the offerer’s website. You should find every little tidbit you need to know there.