Here you can find an overview of my monthly income and expenses reports. Because maintaining a high savings rate is essential to building a sizeable portfolio and achieving financial freedom, it’s mandatory to keep track of my budget. For the sake of transparency I disclose my cashflow every month.

All savings numbers below are in Euros.

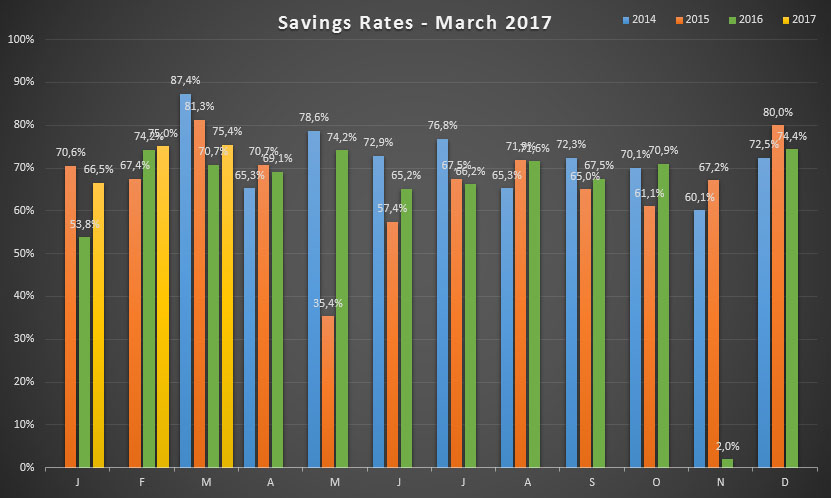

2017

| Month | Savings rate | Savings |

|---|---|---|

| January 2017 | 66.52% | 1,822 |

| February 2017 | 75.04% | 2,062 |

| March 2017 | 75.41% | 2,572 |

| Total | 72.51% | 6,456 |

2016

| Month | Savings rate | Savings |

|---|---|---|

| January 2016 | 53.83% | 1,343 |

| February 2016 | 74.21% | 1,914 |

| March 2016 | 70.73% | 1,925 |

| April 2016 | 69.10% | 1,868 |

| May 2016 | 74.17% | 2,993 |

| June 2016 | 65.21% | 1,818 |

| July 2016 | 66.18% | 1,770 |

| August 2016 | 71.59% | 1,950 |

| September 2016 | 67.50% | 1,857 |

| October 2016 | 70.92% | 1,842 |

| November 2016 | 1.97% | 53 |

| December 2016 | 74.40% | 2,890 |

| Total | 64.51% | 22,343 |

2015

| Month | Savings rate | Savings |

|---|---|---|

| January 2015 | 70.5% | 1,897 |

| February 2015 | 67.4% | 1,569 |

| March 2015 | 81.3% | 3,770 |

| April 2015 | 70.7% | 1,715 |

| May 2015 | 35.4% | 1,258 |

| June 2015 | 57.39% | 1,425 |

| July 2015 | 67.53% | 1,573 |

| August 2015 | 71.94% | 1,736 |

| September 2015 | 65.00% | 1,587 |

| October 2015 | 61.07% | 1,395 |

| November 2015 | 67.15% | 1,587 |

| December 2015 | 79.99% | 4,005 |

| Total | 67.27% | 23,515 |

2014

| Month | Savings rate | Savings |

|---|---|---|

| June 2014 | 72.9% | 1,580 |

| July 2014 | 76.7% | 1,645 |

| August 2014 | 65.3% | 1,660 |

| September 2014 | 72.3% | 1,556 |

| October 2014 | 70.0% | 1,493 |

| November 2014 | 60.1% | 1,498 |

| December 2014 | 72.5% | 2,456 |

| Total | N/A | N/A |

Hello NMW,

Well done my Belgian friend! Keep up those staggering saving rates. Once upon a time we were able to make similar saving rates, this was right out of University when we were still living the simple life, but the rat-race took over. We are however on our way back though to see if we can get there again!

Cheers, Mr. FSF

Mr. FSF,

Having just left university myself I agree with your statement. If you continue the frugal student life style, there’s not much you’ll be spending money on. As such, your savings rate is likely to be huge if you make a decent chunck of change every month.

I’m sure you can get your savings rate back up. You guys have the right spirit, mind-set and skills to make it happen. Best of luck!

Thank you for dropping by,

NMW

Those are some mighty impressive numbers! I just ran into your blog after someone gave me a budgeting excel sheet that came from your website, and I have to say: It’s really nice to see a fellow European do what mostly Americans do. Good to see that a dividend and frugal lifestyle also pay off if you’re in Europe.

Something I am wondering though: these are really staggering saving rates. Have you ever thought about how your plan will work out if you ever decide to have kids? (assuming you don’t already have them) With me and my wife’s situations right now I can see us cranking up our savings by a lot if we change a few of our habits, but kids obviously are a life changing decision, also in the financial aspect.

Do you have any plans/desires to have kids in the future, and have you thought about how this will/could affect your plans regarding financial independence?

Joram,

Thank you for the kind words – I really appreciate them! And I hope you found the spreadsheet useful.

A lot of people have noted that my savings rates are unrealistic if I ever marry and/or have children, but I don’t really see that as a problem. At the moment I’m single and have very little expenses, so it makes sense to save as much as possible. So what if that drops in the future because I want to have children? I would never trade something that would made me happy for an extra 5% or even 50% in savings.

However, I sometimes do wonder if I want to have children. The financial aspect certainly plays a factor, but it’s never a deciding factor. I have plenty of money and I make plenty of money (and am likely to do so in the future) to have children if I want and still be able to put some money to the side. It could postpone my FI date by quite a bit, but if it’s truly something I want out of life, it doesn’t matter.

Besides, there’s always another person involved when having children, so I’d have to take into account their opinion and goals too! I find it very difficult to make predictions like this, so I just let life run its course.

Cheers,

NMW

PS: you ask some of the hardest questions of all my readers… Food for more thought! 🙂

Haha, it’s the difficult questions that make people thinkthings through I think 🙂 But thanks for the reply though… even though having a partner helps a tón with saving extra each month, expanding the family really has the opposite effect. But I totally agree: FO-goals shouldn’t come above the (possible) desire to have a baby. And since people’s income usually tends to go up, it only has a temporary financial “setback” 🙂

And thanks for the list of European companies that are dividend-friendly. I had no idea of the existence of most of them. I’ve started buying stock since February of this year, so it’s still a lot of hits-and-misses with all the terms and learning how and when to buy… not to mention the research into the whole thing, like dividend yield, P/E ratio. Pretty interesting but sometimes confusing stuff! 🙂

Are you savings based on your monthly net salary? If so, why is it consistently different every month? Unless I missed something or maybe I am misinterpreting your figures? (eg Sept 2015 you saved 1587€, which according to your numbers is 65% of your net. So your net was 2444€. but then in May your saved 1258€ which is 35.4% of your net. So your net was then 3553€.

Why such a big difference? Also I’ve always been told that salaries in Belgium were pretty low because you pay so much taxes so isn’t 2444€ a lot by all standards for a 26yo ?

Enlighten me =)

Tom,

The savings are based on my total income (salary, dividend income, side hustles, etc.), which is why the numbers fluctuate from month to month. You could take a look at the savings rate reports if you’d like to get a good look at the numbers and the logic behind them – it’s explained there.

Also, my salary sometimes differs because of bonusses or one-off things. May 2015 is such an example: almost all Belgians receive “holiday money” then from their employer, which bumped my income by about €1,400 compared to other months if I’m not mistaken. (For December this year you’ll see something similar with a year-end bonus and tax returns.)

Net salaries are a bit lower compared to other European countries because we pay more taxes for social security and health care, but the difference isn’t all too large. At the moment my (gross) salaried income is the average number in Belgium, which is on the upper end for someone who just started his first job, but not unheard of.

Again, the €2,444 you refer to also includes other income outside my day job!

I hope this answered your question?

Best wishes,

NMW

So your gross salaried income is about ~3.2k? that seems very high for a starter, even if you have a master in finance, engineering or IT that is still very high. I must be doing something wrong because mine is nowhere near that (even though I have a company car).

dd,

Sorry for the really late reply, I seem to have missed your comment.

My gross salary is indeed about 3,200 Euros with some small additional benefits on top. It’s indeed on the higher end for a starter, but I possess all the qualifications and skills to perform well at my job and to carry out the responsibilities given to me. Some of my friends earn more though, but they’re in big law, IT or engineering.

Also, don’t forget that the gross hit from receiving a company car is quite high, but that the net loss in salary is relatively small. I usually think of a company car as 600-800 Euros gross salaried income depending on the model of car. (Not that I need a car though! I’m happy to live without one.)

Cheers,

NMW

Wow NMW, those are impressive numbers! You’re certainly in the fast lane. Very nice for you to make these savings early in life. Good luck!

Cheers, Mr. FOB!