Another month flew by, just like that! Even though most of us enjoyed a great Christmas dinner with friends and family not too long ago, that time has come and gone, with New Year’s receptions at the office heralding busy work schedules once again. Hopefully that gives everyone the opportunity to recover from the often expensive December festivities. Let’s see how my January turned out, shall we?

As most of you know I set a savings goal of 70% on average for the entire year in 2014. Having reached that magical threshold without too many problems, I decided to stick to it in 2015 even though I no longer live with my parents and, as a result, spend more money on housing and other living-related expenses. It won’t be easy, but if I don’t challenge myself I’d better call it quits now and abandon the financial freedom dream.

It’s true that I sometimes still feel like a fish out of water when it comes to the whole idea of financial independence, but having others in our community who show that saving a large portion of your income is a sure-fire way to success helps to keep my motivation up. I have decided that I’m tired of being a caveman and I’ll do everything within my power to bask in the sunlight of financial freedom.

On top of that, some of the events that transpired in January showed me yet again the importance of enjoying the road to financial independence and possibly early retirement instead of waiting until I cross the finishing line. Even though it’s way out of my comfort zone, I decided to sign up for dance classes with a couple of friends, for example. And those turn out to be good fun!

Let’s dive into January’s numbers.

| Income | ||

|---|---|---|

| Paycheck | € 2,022 | As expected |

| Dividends | € 9 | Pretty good for a slow month |

| Other | € 656 | Side hustlin' and a lot of interest on my savings account |

| € 2,687 |

With almost €2,700 in income we can classify January as a solid month. The real difference compared to a normal month lies in the fact that my savings account with a 3.15% interest rate deposited the accrued interest on the first of January. That money will now start working on its own at 3.15%, thus yielding me even more interest payments next year.

Dividend income wasn’t nearly as good as in December’s income and expenses report, but I was still pretty happy to put up my post yesterday detailling my dividend income. Only €8.66 might be a laughable amount of money now, but over time that amount will grow to an unstoppable snowball. Furthermore, those dividends now already cover my Google Play Music subscription as you can see in the list of expenses below.

| Expenses | ||

|---|---|---|

| Rent | € 350 | As expected |

| Utilities | € 70 | As expected |

| Telecom | € 20 | As expected |

| Groceries | € 99 | Below my goal of €100 |

| Restaurant | € 42 | Date night |

| Health insurance | € 90 | Health insurance for the entire year |

| Healtcare | € 16 | Haircut |

| Clothing | € 10 | Socks on sale |

| Sports | € 80 | Dance class |

| Subscriptions | € 8 | Google Play Music |

| Entertainment | € 5 | Theatre |

| € 790 |

Staying under €800 wasn’t easy this month because of one time expenses like health insurance, for example. Even though €90 is no small amount, I happily pay that much because it covers my butt for an entire year for everything you can possibly imagine. As you can see, high taxes do have their advantages in the form of excellent and cheap healthcare. Other rare expenses included the aforementioned dance classes and a date which I payed for.

When considering the above, I’m thankful for the interest in my savings account because it pushed me to a savings rate of 70.5%. I made it by the narrowest of margins without losing out on quality of life, as so many people fear they have to do to reach financial independence. It feels good to be able to continue my excellent progress from last year.

January’s savings amount to €1,897, which is almost as much as the monthly net salary from my dayjob. It’s crazy to think that my passive income almost completely covered my living expenses this month. Just like every other month, I made a contribution towards my personal pension fund which has a limit of €930 in 2015.

On top of that, I also bought into Swiss pharmaceutical company Novartis (VTX:NOVN). The Swiss healthcare giant recently announced its 2014 earnings and is set to continue its excellent past performance. Because Novartis rewarded investors with higher dividends every year since its inception in 1996, I thought it a good time to jump in on the fun by purchasing 12 shares.

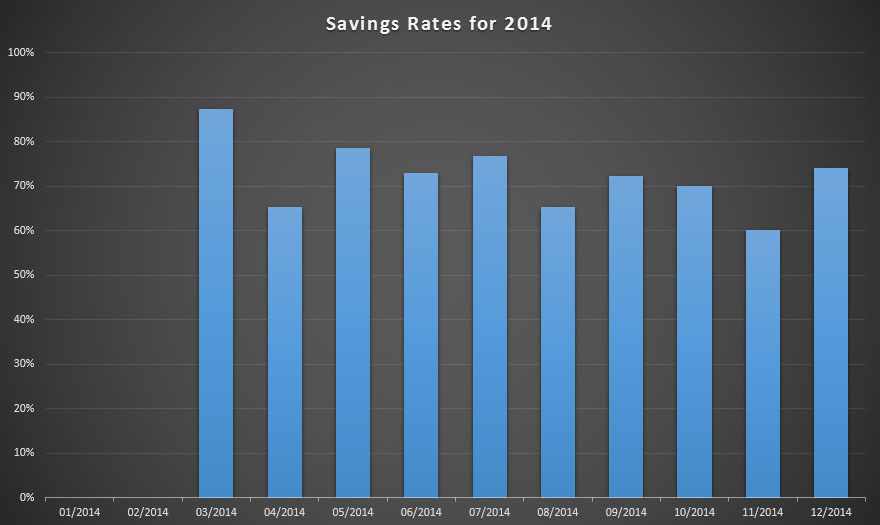

The graph below details my savings performance in 2014. As you can see, January was right on track with most other months.

You can imagine why I’m a happy camper. Having a high savings rate is the number one success factor in the financial independence game. The more you save, the faster you’ll have your money working for you, thus compounding your returns year after year.

I hope everyone else had a great start to the new year and was able to put away a big chunk of their January income. Be sure to share how you did in the comments as I love reading your success stories and learning from them. Did you find ways to reduce your expenses or maybe even boost your income?

Thank you for your support.

Good work there NMW!

“Only €8.66 might be a laughable amount of money now” – its better than nowt. And like you mentioned, January is a quiet month for you dividend dudes.

“It’s crazy to think that my passive income almost completely covered my living expenses this month” – Almost FI already my man! Smashing it.

Mr Z

Mr. Zombie,

Absolutely! I’ll take €8.66 over nothing without any hesitation. February is shaping up to be a good dividend month, so my passive income definitely is picking up steam.

Hope everything is well over there,

NMW

Any extra money earned is a plus to me. I can’t believe how deep you break your finances down. I just don’t have the patience, but maybe I need to find some patience. Awesome on the monthly savings. Good luck with your February goals.

Petrish,

The trick to my minute tracking is that I don’t spend much, so it’s not a lot of work to log the nitty and gritty of my expenses. My Excel sheet does the rest.

I’ve found that keeping tabs on all your expenses really does help to keep them down, so I suggest you try it out for a couple of weeks!

Best of luck to you too in February,

NMW

NMW,

Great work on achieving your goal of 70% savings rate for the month of January!

You are making great progress towards reaching Financial Independence.

Mr. CC,

Thanks, man! Progress is fast indeed, much faster than I orginally anticipated. And your support really does help, I appreciate it.

Cheers,

NMW

Hi mate,

You are doing so well that I am really jealous of your saving rate! We achieve with difficulty the 30%-35% level.

The excellent point is that your saving rate should increase considering that you are going to re-invest it and therefore dividend will continue to grow and it will grow quicker and quicker.

Keep going and you will retired before me 🙂

Cheers, RA50

RA50,

Don’t be jealous! We’re in two completely separate places and times in our lives, so comparing one-on-one doesn’t mean much. And you’re doing quite well yourself over there! If you save 35% of your income, you’ll also make rapid progress towards FI.

I doubt I’ll be able to retire before you, but I doubt it! 😉

Best wishes and good luck,

NMW

Wow, an interest rate of 3.15% … seems high in Belgium! Using a foreign bank or a dodgy one 🙂

Erik,

You’re right. It’s not a traditional savings account, but rather a insurance account. I’m one of the lucky ones to have taken advantage of the much-lauded Ethias First accounts before the European Commission shut them down. My very first deposits still yield over 4%, but on average it’s about 3.15%.

I’ll probably be using that money to buy a house at some point in the future, so I keep it in there because it’s 100% safe and still has a nice yield.

Thank you for stopping by,

NMW

I love that you’re saving 70%, but still have lots of living up in those expenses! Your side hustling number is fantastic!

Emily,

Having a nice work-life-saving balance is important to me, so I’m glad you’ve gathered that from my post. I’m lucky in that my hobbies don’t cost a lot of money and that my friends aren’t major spenders either.

Side hustling has steadily been increasing, although the number seems higher this month because of the interest on my savings account. I’m sorry if that wasn’t fully clear from the text.

Best wishes,

NMW

NMW,

70% Holy cow! That is awesome. I see you have a side hustle in there, what kind of work is it?

As you can see from other places though, if you are extremely frugal for a solid amount of time it can really catapult your investment capabilities and bring your dividends up to the point where they begin doing some of your investment lifting.

Well done,

Gremlin

DG,

Thanks, man! 🙂

Side hustling mainly consisted of blogging income (in the form of AdSense), and after-school teaching English to high school students. I wish I had more time to teach English though, because you can charge up to €35 an hour. Another thing I often do is build computers for people, for which I then charge a (very) small premium.

My invested capital has definitely sky-rocketed over the past few months. I never thought I’d cross the €50,000 so quickly, but now I’m almost over €55,000!

Best wishes,

NMW

NMW,

Before clicking on your link I knew already you are on the 70% savings rate! Amazing! As your passive income and other income grows (and if you keep the same lifestyle) your savings rate graph should trend higher. Great job!

FFF

FFF,

Ha, am I becoming that predictable? Maybe this month I should spend an outrageous amount of money on unnecessary luxuries instead to throw you off balance? 😉

True, the beauty of dividend growth investing is that it pushes your savings rate higher all the time if you manage to keep your expenses the same.

Thank you for the support.

Hope you had a great month too,

NMW

Great work on saving more than 70%! Very impressive man! I hope you’re not eating waffles all month. 😉

Novartis is a great buy. I’ve been looking at it for a while now. I’m a bit surprised that Belgium offers such high interest rate for deposits.

Tawcan,

Apart from weighing a ton after just a couple of weeks, I’d have to spend way more than €99 a month on groceries if I ate waffles all month! 🙂

Novartis is a very stable business with an excellent pipeline. It’s dividend policy is also what we’re looking for: sustained growing distributions every year. Too bad they only pay once a year as this slows the compounding process, but that’s just a minor issue.

Belgium banks don’t offer high interest rates on deposits anymore, but my account is linked to insurance products that have a life-long fixed interest rate (or until I withdraw my money, of course). As such, I’m still enjoying pre-2010 interest rates completely risk-free. The European Commission shut these types of accounts down for new customers though because it was too risky for the insurer.

Cheers,

NMW

Hi NMW,

Seems like a solid month there. Oh the limit for the pension fund this year is 940 EUR but I guess you paid 950 last year?

Cheers,

G

Geblin,

Solid month indeed, I’m happy about it.

You’re right that the limit for the pension fund is €940 like last year, but with the original limit being €950 in 2014 I can only add €930 in 2015 to receive the full tax-back.

Which pension fund or insurance do you have?

Cheers,

NMW

NMW,

Excellent. Just excellent.

As you stated, your savings rate will be the primary factor in regards to how fast you reach FI. And you’re basically on a superhighway right now. 🙂

Best regards.

Jason,

I don’t like cars, but I won’t say no to the superhighway! 🙂 I’m really glad and thankful that I’m able to save as much as I have over the past few months. Growth has been incredible.

Looking forward to your next income and expenses report. Because you’re self-employed now it’s always exciting to read how much you still managed to save and invest. And I’m hoping that you won’t have to pay too much back-taxes to the IRS.

Cheers,

NMW

Impressive savings rate as usual! Keep up the amazing work! You’re putting me to shame given that I still live at home.

Henry,

Thanks, buddy!

I wouldn’t say I put you to shame. You guys earn more in the US, but after-taxes life is also way more expensive. I don’t think it’s possible to have full health and dental insurance for just €90 in the US, for example.

Keep it up over there, you’re doing great.

Cheers,

NMW

What’s side hustle did you do? Giving tours to us financial bloggers when we visit you? Hehehe us North American can only admire the 3% salina Internet rate from afar. Keep up the good work of saving rate.

Vivianne,

That would be awesome, although I doubt the other frugal folks in our community would be willing to pay me for my horribe guided tours services! 🙂

Like I said above, I build PCs for people I know, I teach English to children that have difficulties keeping up in school, and there’s the small income from this blog too.

Thank you for your support,

NMW

NMW,

I love that 70% savings rate. I see a lot of people hit 50% which is outstanding, but you are definitely on another level. For every year you work you can almost take off three. That is a great path to FI you are on. It will be cool to see you hit 100% one of these months.

MDP

MDP,

That’s a pretty neat way of looking at things. Without taking inflation and the like into consideration, I can effectively enjoy two to three years off for every year I work.

Even though 100% is mathematically impossible, I’ll do my best to get as close as possible. That shouldn’t be a problem though if I manage to keep my expenses low and with my dividend income pushing my overall income higher.

Keep showing us how it’s done over there! I hope to one day be able to invest as much as you on a monthly basis.

Best wishes,

NMW

Nice work NMW,

Congratulations on your 70% savings rate! And I love the €656 side hustle income. I’ve been developing some secondary income over the last couple of months, but I am nowhere near your level yet. Great work!

Mark,

Thank you, I appreciate the kind words!

The €656 sadly isn’t just from side hustles, sorry for the confusion. The majority of that money comes from interest on my savings/insurance account. Over time, however, my side hustles have started generating more and more money. Teaching English to kids with difficulties probably is my major source of extra income.

With your IT knowledge it should be possible to build a steady stream of income from side hustles too. Best of luck with your endeavours.

Best wishes,

NMW

Hi NMW,

No worries, I do that too – I group everything under “secondary income”. Primary income is my day job, and secondary income is everything else. One day I hope my secondary income exceeds my primary, and on that day I’ll quit my day job.

Cool that you mention IT knowledge, because I’m working on a new IT-related side hustle that hopefully is going to have a dramatic impact on my total income. This year is going to be a make or break for me 🙂

Hi NMW,

Awesome work my friend!

You managed to pull in 70% saving rate with an annual health insurance expense, which in itself was over 10% of your total monthly spend. 655 Euros of side income is a substantial amount of your income overall. Could I ask how much of it was interest related and how much were side hustles?

You’re well on your way to FI with a 70% saving rate, and I have no doubt there’s more to come. Keep up the good work!

Cheers

Huw

Huw,

Thanks, bud!

Health insurance sure did drag my savings rate down, but if it’s just €90 for an entire year I’m not one to complain. When I see how much our American peers sometimes pay for basic coverage, I’m happy with the ways things are over here.

About 75% of my side income comes from interest. The other 25% was from teaching English, blog income and building a couple of computers for people I know. Income from side hustles varies from month to month, but if I make over €150 a month I’m happy about it.

Keep it up over there too! You’re also doing great.

Best wishes,

NMW

Love reading about your awesome savings rate – it’s incredible! What a great start to the year!

Weenie,

I’m glad you like these kind of posts! Truth be told, they’re my favourite posts to read too – financial voyeurism, I guess.

Here’s to even better savings for both of us in the upcoming months,

NMW

Wow–way to go! That’s a killer savings rate! I’m super impressed with how low your spending is–seriously admirable. Also, I think it’s fabulous you’re taking a dance class. And, did I spy a date night on there :)???

Mrs. F,

Thank you, means a lot coming from you with your super-high savings rate! Sometimes I think it’s harder to spend money than it is to actually save it – I’m sure you feel the same way.

Dance class is a lot of fun, should have done it much earlier! And I definitely had a date. We both had a good time, but we decided to leave it at that for the time being because we’re both heading completely separate ways in our lives. We’ll see about the future.

Hope everything is well over there,

NMW

Wonderful work here. You have a truly incredible low spending level. Even with dates and dancing! Glad to see you keep the fun in there too. I find it refreshing to see someone so young embracing the idea of FI… You have time working on your side!!

Mrs. Maroon,

Thank you! Low housing costs and almost zero transportation costs make the biggest difference from most other people, I believe. And having fun shouldn’t be expensive. Some of my best nights with friends were completely for free.

Best wishes,

NMW

Wow. Saving 70% is just tooooo awesome. I wish I could save 70% of income every month. My rent alone is killing me. Keep up the great work man!

BeSmartRich,

Reduce that rent as soon as possible then! It’s useless to pay someone else’s mortgage when you can’t even save for your own downpayment! 😉

Thank you for dropping by and for the kind words,

NMW

Great month and side income!

Keep going!

I’ll be a reader!

Nuno Miguel,

Thank you very much for taking the time to leave a comment and for being a reader. Much appreciated. Hope you continue to do so!

Best wishes,

NMW

Awesome savings rate. I am very impressed!

What are your side hustles out of interest? 🙂

Firestarter,

Thanks, much appreciated!

Side hustles include this blog (which produces a little income every month), building and maintaining websites (although not as much as I used to), teaching English to 12-14 year olds, and putting together computers for people I know (I charge a small fee on top of the components or I ask for a free dinner when the friends are really close, ha).

Best wishes,

NMW

Great! Thanks for the reply.