Are you ready to discover how much I managed to save in July and compare your results to mine? I sure am! The past few months have been quite interesting in that my overall savings rate droped significantly, so let’s see if I managed to climb back up to previous savings levels.

Why, you ask? Because the amount of money I save relative to my income is by far the best indicator to track my progress towards financial independence. Basically, the more you save, the faster you’ll reach a moment in time where you no longer have to work to support your life style. Awesome, right?

I don’t just write these savings reports to keep myself motivated, but also to show you guys how my financial situation supports the life I’m enjoying – believe me when I say I have a great life. And maybe you can even learn a thing or two to optimize your own spending and thus increase your savings rate.

This series of posts doesn’t discuss in detail whether you should rent or buy a home, or if you should go completely car free, but it tries to show you the financial consequences of the lifestyle choices I make. Establishing an accurate picture of your cash flow is the first step towards a frugal lifestyle after all.

As most of you know, I use my own Excel spreadsheet to keep track of all things money. Feel free to check it out and see if it helps you too!

Enough tittle-tattle – let’s get to the detailed breakdown, shall we?

| Income | ||

|---|---|---|

| Paycheck | € 2,069 | As expected |

| Cycling | € 96 | Renumeration for cycling to work |

| Dividends | € 43 | Another good month |

| Other | € 121 | Side hustlin' |

| € 2,329 |

July’s income remained relatively stable even though it’s on the lower end of what I’m used to. As you can see, cycling to work brought in another €96, thus paying for my new road bike over time. So far the spending money to make money experiment is going well, hurrah!

The dividends category, which contains my fully passive and free-of-work income, performed great again. €43 might not seem like much, but I’m happy with that number after just one year as a dividend growth investor.

| Expenses | ||

|---|---|---|

| Rent | € 350 | As expected |

| Utilities | € 70 | As expected |

| Telecom | € 18 | Reduced compared to previous months |

| Home maintenance | € 45 | New chairs |

| Groceries | € 105 | Right on track |

| Restaurant | € 7 | Fries |

| Public transport | € 13 | Train tickets |

| Bike | € 30 | Replacement inner tires for road bike |

| Healthcare | € 20 | Haircut, etc. |

| Subscriptions | € 8 | Google Play Music |

| Entertainment | € 17 | Beers with friends |

| Gifts | € 73 | Wedding gift |

| € 756 |

Of course, I could be making ten times the amount I bring in now each month, but that wouldn’t render me closer to financial independence if I spend it all. That’s why I try to keep my cost of living as low as possible. As you can see in the table above, July was another good month even though I didn’t get up to the 70% goal that I set for myself.

July’s savings rate comes out at 67.5%!

All things considered, I’m really happy about my savings because of a couple of one-time expenses that pushed the numbers higher. When you substract two new chairs, a whole bunch of replacement inner tires for my bike and a wedding gift, you’ll find that I only had about €600 worth of recurring expenses – that’s just 25% of this month’s income.

However, financial independence isn’t about saving as much as possible or being greedy, but about maximising your happiness and adjusting your spending accordingly. Enjoying an expensive hobby isn’t an issue as long as you have your financial priorities straight, for example. Besides, you can have anything you want as long as you don’t want everything.

Of the €1,573 I managed to save the past month, I invested a large chunk into the American consumer goods business Procter and Gamble (NYSE:PG). At the moment P&G finds itself in troubled waters, but I’m sure management will be able to turn the tide. It’s hard to imagine they won’t when they have a portfolio with such highly visible brands to rely on.

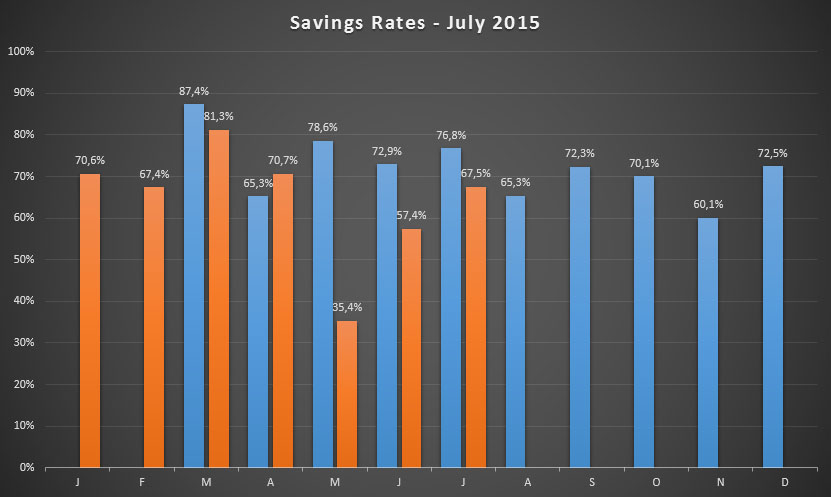

The graph below shows the past performance for this year, but also a year-over-year comparison since I started blogging.

This year I’ve saved almost 65% of my income, up by 1% from last month. Think that number is insanely high? Think again!

Insanity is something completely different. I continue my frugal lifestyle month after month in the hopes of achieving a different outcome – a lifestyle in which I don’t have to work to keep a roof over my head, keep myself fed, and pursue my interests.

You too will be amazed to discover your own savings potential when you set yourself a clear goal and an accompanying plan. And I know many of you already are from reading your blogs and interacting with you in the comments section, which continues to be a huge motivator for me.

Incidentally, now that we’re half way into 2015, I hope everyone is closing in on their savings targets. I know I still have my work cut out for me to climb back up to the 70% range, for example. Will I regret not getting there by the end of the year? Absolutely not, my road bike – purchased in May as you can see in the graph above – just is too much fun!

Do you have similar expenses that you just can’t cut out?

Thank you for reading.

Hello NMW,

another month with a very respectable savings rate. Well done neighbour! Ours will be non-existent this (and last) month as we (still) do not have income/jobs (nor our container with our belongings/PC…..it’s unfortunately delayed until late august). Not really upset though, enjoying this mini-retirement/sabbatical quite a bit. If this is what full blown financial retirement feels like, I’m even more motivated!

Thought it was funny that you actually earned more with cycling then from your shares this month, but I have a feeling this won’t be true for the future. Good luck!

Mr. FSF,

There are worse things than not having any income the first month after moving halfway across the world, right? You guys are doing great anyway and have made excellent progress in the past already!

Besides, it’s like you said, you’re already getting a quick peek at what life’s going to be like when you actually retire early.

I find that funny too… I’ve even thought of cycling to work every single day as to bump up that number to about €250! 🙂

Hope you get your stuff back soon,

NMW

Hi NMW,

Keep on rocking those high saving rates!

Side hustling, Dividends, biking to work and low expenses are working wonders for you. Well done!

Anything over 50% is good in my books, and you’re comfortably above that currently.

I agree with your observation that comment section interaction is a great motivator to a Blog writer. It’s changed my life to be honest (Blogging that is), and I’m not over-egging it. Having support, advice and encouragement from others is wonderful.

Your road bike is a fantastic ‘investment’ for numerous reasons – Money saved travelling by car, money paid to you by biking to work, health, happiness etc. Great purchase in my books!

I could possibly drive my expenses lower, but I’m comfortable with where they are. I want to earn more money this year to create more disposable income to invest with, as I feel this is an easier win for me. I could save £100-£150 a month by driving down my expenses, but I can make £1,000’s+ more (the sky’s the limit) by working on increasing my income whilst maintaining low expenses overall.

Keep up the good work NMW and good luck with the 2015 saving rate goal.

Cheers

Huw

Huw,

I try to scramble together as much income as I possible can. The earlier you start, the better right?

By the way, look who’s talking… You’re doing awesome with those e-books, pal. Really impressive numbers. I hope you can keep them up for a very long time.

The road bike shouldn’t be classified as an investment, but I still feel like it is. At this rate it’ll take me less than two years to recuperate all costs. Before I was taking the train (free) to work, so the financial advantage could be even bigger if you take the car to the office, like you said. I highly recommend this solution to all Belgians, to be honest!

Sounds like a no brainer not to lower your expenses! Besides, it’s not about having the lowest expenses, it’s about balancing with your needs, wants, hobbies and future income.

Keep it up over there, I’m still amazed at your e-book efforts!

Cheers,

NMW

Hi NMW

Very good saving rate, for me it is hard to save with no day job and paying alimony, hope things would be better.

Keep the good job you are doing in the saving side.

Divorcedff,

Don’t let things get you down, man! I understand it’s difficult to save a ton of money when you have to take care of children and when you can’t count on a stable job and the income that brings with it.

From what I’ve read on your blog, I’m 100% sure you’ll find a way to make things better and get to where you want to be in a couple of years!

Best of luck,

NMW

Excellent savings rate again, NMW. Very pleased to see that! I am still staggered by the return you are getting from that bike scheme. Very generous indeed!

I have been sorely tempted by P&G recently. Seems very much undervalued to me. I think you’re right, it should turn itself around well in no time.

Keep up the good work!

DD,

Ha, you’re not the only one! 🙂 At €0.20/km the total amount quickly climbs when you have a 60km return trip to work every day. I wish I could cycle to work every day to bump up that number to about €250. How amazing would that be?!

PG’s drop continued right after I bought, so I believe you’d be getting an excellent price for such a high quality company. Yes, they’re facing some short-term issues, but over the long-run you can’t go wrong with a product line like PG’s.

Best wishes,

NMW

Awesome NMW. Keep it up! Reaching your goals, as long as you give it your best and focus on them, it’s all good. Try your best.

Nice to see posts from you. Take care and Keep hustling it up! Cheers my friend.

Tyler,

Exactly, we can’t do anything else but give it our all! I believe that once you focus on achieving one particular only, hardly anything will stop you from doing so.

Cheers,

NMW

Great savings rate as ever, NMW!

Your payment for cycling into work makes me chuckle – great for your investments, great for your health too!

I think I could probably get my expenses a bit lower but I’m happy with what I have achieved so far and have found that saving close to 50% of my salary has had no real impact on my quality of life.

What I do need to sort out though is to top up my emergency fund, which currently is pretty much empty – not great news! Topping that up will mean less to invest, so I need to balance it right.

I could do some more side hustling (ebay springs to mind), so perhaps rather than shave off more on my costs, like Huw, I’ll look at increasing my income (although unlike Huw, mine won’t be £1000s more, haha!)

Keep up the great work.

Weenie,

Great cycling scheme, right? I believe it’s even better than the British cycling to work policy, which is really quite good already.

When you’re saving 50% of your salary already it’s not much use to try even harder and maybe cut into things you enjoy. The savings rate is all about balancing spending and happiness, so don’t forgo the happiness component for reduced expenses.

Having to top up your emergency fund sucks when you’d rather invest your savings, but I think you’ll feel a lot more secure when you do. Besides, if the market plunges you’ll have a little bit of cash on the side to put to work immediately.

Huw’s progress is truly staggering! I’m amazed at how quickly he’s making new income sources for himself. At this rate he’ll be semi-retired in just a couple of years.

Cheers,

NMW

Your savings rate is enviable. I think it’s awesome that you get remuneration for biking to work. How does that work?

Mr. MM,

I did a post on the cycling scheme a while ago. You can check it out here: http://www.nomorewaffles.com/2015/06/the-experiment-spending-money-to-make-money/

Basically, I receive €0.20 from my employer (which then receives a tax break from the government) for every km I cycle to and from work. Because I live about 30km from my job, that’s €12 every day.

Cheers,

NMW

Wow very impressive savings rate. Congrats. Definitely try to keep up such high savings rate since that means more money to be invested.

With your high savings rate, does that mean when we bloggers come to Belgium to visit you, you’ll be able to buy us a few delicious waffles? 😀

Tawcan,

Will do! I’m trying to end at 70% by the end of the year. It seems really close already, but it’ll be hard to get up to that level on average.

Ha, if you ever visit Belgium I will definitely buy you a waffle! 😉

Cheers,

NMW

Awesome savings rate! I can hardly put aside a few bucks a month as a student! Have you already decided on whats your next purchase going to be?

Philip,

As a student it was difficult to save a lot too, although I tried to put away 50% of my savings. Often I had to dip into those to go on a holiday or purchase something new for my PC, however.

Just you wait until you start your first job!

Next purchase was JNJ, as I already explained in a previous comment to you. Great value at the moment in my book, even with the low EUR-USD conversion rate.

Cheers,

NMW

Hi NMW,

It seems you had a solid month. My savingsrate is up again ( no property taxes anymore yay).

Keep pushing that snowball.

Cheers,

G

Geblin,

Good to hear you’re back to your usual saving levels. Keep on setting an example for the other Belgians!

Cheers,

NMW

That are some solid numbers NMW.

The bicycle already start to contribute nicely to your income.

Well under way to have your win for life.

Keep saving!

ATL,

The bike definitely puts in the work. Almost €100 is an insane amount of money every month for something I really enjoy doing.

Best wishes,

NMW

As always you are doing excellent. That saving rate is really solid. I wish I could be able to do the same but rent is a problem for me unfortunately. Thanks for sharing and keep up the great work!

BSR,

I hope you find a solution for your rent as that’s what keeps most people from achieving truly awesome savings rates. Maybe an (additional) roommate is a solution?

Best of luck!

Cheers,

NMW

I concur with anything over 50% is fantastic. Keep on trucking with your insanity!

Duncan,

Thanks, man! I most certainly will.

Best wishes,

NMW

How do you factor in the various insurances you have, such as health insurance, possible life insurance, insurances for your furniture (inboedelverzekering), and the like? I don’t see those in your breakdown, but I believe Belgium people have a similar insurance-package like Holland does right?

Joram,

Insurance is a tricky one.

Health insurance (i.e. ziekteverzekering) is covered through a one-off payment at the beginning of the year because most of those costs are covered by our national health system (which I pay into through my taxes). I believe it’s around €100 for the entire year. Full hospital insurance (i.e. hospitalisatieverzekering) is provided by my employer, as is the case for most Belgians. The difficult part is figuring out how much they will cost if I ever stop working because my employer surely won’t continue paying for hospital insurance, ha!

Life insurance isn’t needed since I have no one who depends on me and if I die there’s a good chunk of money left for my relatives anyway (as you can see from my net worth). My furniture isn’t insured either because it hardly has any value or because it’s provided by my landlord who insures everything.

Through my employer I also have legal assistance and some smaller types of insurances, so they don’t matter either. Then there’s car insurance, which I also don’t need because I don’t own a car. Fire and water insurance is provided by my landlord.

Basically, there’s nothing to insure except for bodily harm, which is covered. I’m sorry I couldn’t be more clear and I hope this answers your question.

Cheers,

NMW

Thanks! That’s definitely clear enough to me… it seems that Belgium does things quite different compared to Holland in regard of insurances. I have a monthly recurring health insurrance, and various annual ones because I own an apartment.

But not owning a car would definitely save me about €300 a month if it was possible to do everything with just public transport in our situation. My next car will definitely be a cheaper and more efficient one though! The amount of money people can save on car ownership and insurances is one of the biggest savings one can make 🙂

Joram,

You’re right. It’s weird how two very similar countries do some things completely different! I must add, though, that I’m not in the most common situation regarding my apartment, so that could explain some of the differences.

Getting rid of your car or even reducing your operating expenses is a big ticket item if you try to optimize your spending. I’m often flabbergasted to discover what some people spend on car maintenance and fuel alone, let alone the purchasing costs. It saves me between €300-400 a month, which is just huge at 20% of my income!

Cheers,

NMW