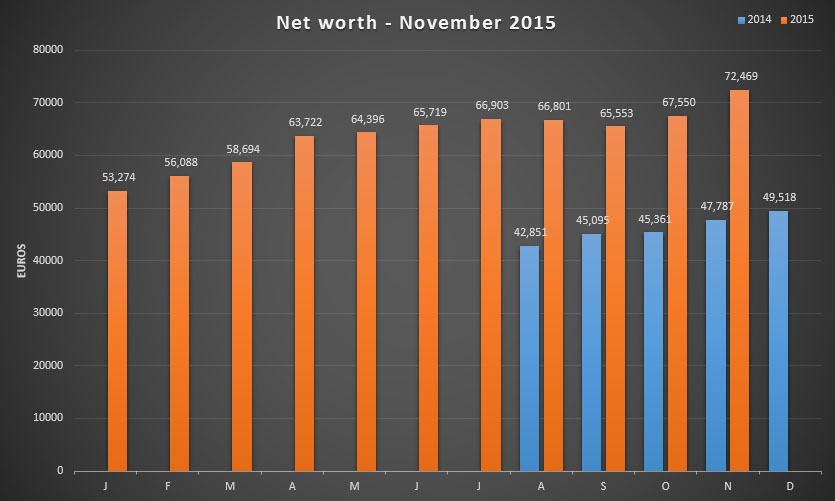

What a run we’ve been on the past few weeks! Stocks soared after being in the gutter since August. The reason? No one knows! What I do know, however, is the effect the rebounding markets have had on my assets and consequently my net worth. Let’s take a look.

You all know that portfolio size in absolute numbers doesn’t matter all too much for a dividend growth investor. Nevertheless, there’s a direct correlation between the amount of assets you own and the passive income they throw off, so that’s why I like to keep close tabs on my net worth too.

In the beginning of the year net worth growth mostly came from my excellent savings rate, slightly helped by the European Central Bank‘s quantitative easing policy, which is set to continue at least throughout 2016. However, these days it’s mostly Mr. Market that decides wether my freedom fund trends upwards or downwards.

For November Mr. Market decided to bump my portflio over the €70,000 threshold with a massive €4,919 increase, a staggering amount of money in just one month. It’s almost three times more than I managed to save from my October income!

You can clearly see the big spike towards the end of this year in the graph above. It’s a welcome change after the nearly flat numbers from April onwards and a testament to the fact that perseverance and a solid savings rate are by far the most important factors in quickly building wealth.

November’s 7.29% increase brings with it another 410 hours of work-free capital in the bank. With early retirement in mind that’s almost 2,5 months less spent at the office before I can hand in my final notice.

Like in past net worth updates you’ll find a detailed description of my dividend growth stocks, exchange-traded funds and cash below. I also highlight their performance since the time of purchase. Foreign securities were converted to Euros using the last-known exchange rate.

Dividend growth stocks

I previously noted that the value of my dividend portfolio isn’t all that important, but that doesn’t mean I shouldn’t pay close attention to it. After all, when dabbling in individual stocks the importance of focussing on geographic and sector diversification increases. On top of that, I try to purchase into strong businesses that are likely to pay out a stable and growing dividend over time.

Last month I mentioned how my dividend portfolio performed similarly to the exchange-traded funds you’ll find below. Apart from some outliers, that trend seems to continue, which shows once more that daily stock pricing is impacted more by the inherently irrational stock market than the underlying value and business fundamentals of those stocks. Furthermore, it tells me that comparing stocks to a specific index doesn’t hold much meaning.

One of the outliers mentioned in the previous paragraph is natural gas and petroleum pipeline operator Kinder Morgan Inc. (NYSE:KMI), my most recent purchase. The stock was beaten down significantly due to the weak oil and commodity prices, but declined even further after I thought it provided excellent value. It’s true that KMI’s short term prospects are hurting, but I believe the company is available at bargain bin prices if you’re looking to hold on for the long-term.

You can find the gains in absolute and relative numbers for each company in the table below. The cost basis for each position includes the price of the shares, a 0.27% stock market tax and brokerage fees.

| Ticker | Company | Shares | Cost basis | Mkt. value | Gain |

|---|---|---|---|---|---|

| ABI | AB Inbev | 22 | 2,385.18 | 2,598.20 | +8.93% |

| AFL | Aflac Inc. | 9 | 419.41 | 554.95 | +32.32% |

| T | AT&T | 37 | 972.16 | 1,169.23 | +20.27% |

| BLT | BHP Billiton plc | 110 | 1,908.56 | 1,389.61 | -27.19% |

| BP | BP plc | 92 | 507.24 | 500.46 | -1.34% |

| CAT | Caterpillar Inc. | 25 | 1,465.40 | 1,670.42 | +13.99% |

| DE | Deere & Company | 7 | 452.61 | 496.18 | +9.63% |

| DGE | Diageo plc | 41 | 994.34 | 1,125.38 | +13.18% |

| ENG | Enagas SA | 50 | 1,258.60 | 1,396.50 | +10.96% |

| GE | General Electric | 22 | 450.70 | 633.85 | +40.64% |

| GSK | GlaxoSmithKline | 33 | 610.15 | 640.69 | +5.01% |

| HOME | Home Invest Belgium | 30 | 2,682.00 | 2,761.50 | +2.96% |

| INDV | Indivior plc | 10 | 3.89 | 27.99 | +619.55% |

| IBM | IBM Corp. | 6 | 736.76 | 780.62 | +5.95% |

| JNJ | Johnson & Johnson | 20 | 1,769.41 | 1,924.21 | +8.75% |

| KMI | Kinder Morgan Inc. | 50 | 1,285.19 | 1,098.80 | -14.51% |

| KIN | Kinepolis Group | 40 | 1,399.25 | 1,580.80 | +12.97% |

| MCD | McDonald's Corp | 14 | 1,003.47 | 1,497.62 | +49.24% |

| MUV2 | Munich RE | 14 | 2,582.65 | 2,587.20 | +0.18% |

| NG | National Grid plc | 100 | 1,332.11 | 1,355.30 | +1.74% |

| NOVN | Novartis AG | 12 | 1,061.53 | 999.58 | -5.84% |

| PG | Procter & Gamble | 23 | 1,594.66 | 1,637.66 | +2.70% |

| QCOM | Qualcomm Inc. | 9 | 520.23 | 419.38 | -19.38% |

| RB | Reckitt Benckiser plc | 10 | 630.34 | 901.38 | +43.00% |

| ROG | Roche Holding AG | 5 | 1,233.71 | 1,263.07 | +2.38% |

| RDSB | Royal Dutch Shell | 60 | 1,745.65 | 1,437.00 | -17.68% |

| S32 | South 32 Ltd. | 48 | 20.04 | 42.11 | +110.15% |

| KO | The Coca Cola Company | 17 | 540.05 | 677.54 | +25.46% |

| FP | Total SA | 45 | 2,045.95 | 2,81.70 | +1.75% |

| ULVR | Unilever plc | 60 | 2,029.35 | 2,431.46 | +19.80% |

| VZ | Verizon Communications Inc. | 20 | 785.07 | 852.51 | +8.59% |

| VOD | Vodafone plc | 188 | 536.19 | 599.44 | +11.80% |

| Total | 36,961.84 | 39,132.12 | +5.87% |

Exchange-traded funds

On top of my dividend portfolio I’m also invested in what I like to call set-it-and-forget-it assets; exchange-traded funds that track the World, European and Emerging Markets indices to be more specific. These funds hold the largest companies worldwide and have performed quite well since I first bought into them in May 2014.

Over the coming months I plan on adding to the World fund as a way to rebalance things a bit and to take advantage of the tax benefits ETFs offer me.

| Ticker | ETF | Cost basis | Mkt. value | Gain |

|---|---|---|---|---|

| IWDA | iShares Core MSCI World | 5,214.95 | 6,629.28 | +27.12% |

| IEMA | iShares MSCI Emerging Markets | 1,214.59 | 1,290.06 | +6.21% |

| IMAE | iShares MSCI Europe | 3,561.94 | 4,039.20 | +13.40% |

| Total | 9,991.48 | 11,958.54 | +19.69% |

Other

Next to the stock market’s upward and downard bursts, this category remains relatively stable since it mostly consists of guaranteed saving accounts. As per usual I added another €77.5 towards the yearly maximum of €930 in my personal tax-advantaged pension fund, while my emergency fund and savings accounts mostly remain untouched.

Regular readers know that I dipped into my emergency fund at the end of August to take advantage of some opportunities in the market, so I’m still rebuilding it to it’s previous level. After all, I prefer to keep a rather large amont of cash on the side.

| Name | Cost basis | Current value | Gain |

|---|---|---|---|

| Pension fund | 1,705.00 | 1,878.46 | +10.17% and 30% tax break |

| Savings account | N/A | 18,000.00 | N/A |

| Emergency fund | N/A | 1,500 | N/A |

| Total | 21,378.46 |

Going forward

And of course I’m saving the best news for last: I cracked the €70,000 net worth goal I set myself for this year with one more month to go! With the performance of the past months in mind, cracking the 70,000 ceiling seemed like a far-away dream, but the past two months really have pushed me forward.

This goes to show that consistently saving is far more important than anything else. Keep your money in your pocket and some time in the future it will start working for you. You will never know when exactly, but you can be sure that it’s going to build your wealth.

Because my assets are growing so fast, the passive income they throw off couldn’t stay behind. As most of you know I already broke my dividend income goal in September, which is just spectacular.

What’s not to love about all of this? Upward and onward!

I often hear how financial independence can’t be done in Europe – due to high taxes, expensive social security, lower income, you name it – but I’m glad to say that I’m living proof that it can be done when you apply yourself. Of course, you’ll need a bunch of luck too, but if you don’t even try and set yourself up for early retirement you’ll never get there anyway.

I sincerely hope you guys feel the same way and and I hope that my report once again invigorated your spirits to reach financial freedom! Thank you for reading.

PS: The dividend income report and savings rate report for October will be added to those of November – I’ve been slacking off posting regularly, I know.

Congrats on surpassing that €70k barrier! I look forward to seeing the end of year report…

Just a quick note on KMI – they sold a bunch of shares and had to issue debt to pay their last dividend… I’m therefore not as sure as you are that they are such good value after all

Cheers

M,

Just read your post on KMI. As you know I already sold the shares – at quite a loss too. You were right and I miscalculated. What’s worse though is how management completely undercut my trust by stating two diametrically opposed things just two months apart and because of their own doing.

Oh well, lesson learned! 🙂

Cheers,

NMW

Hi NMW,

It seems you had a great month. Congrats on breaking that 70K barrier.

Cheers,

G

Thanks, Geblin!

Great progress, NMW. Congrats on an nice bump in net worth numbers.

cheers

R2R

Thanks, R2R! Hope you’re doing well over there too!

Hi NMW,

Well done mate, cracking one goal is always something special. It really great to see how quickly a net worth can increase with some basic rules: saving and investing.

Continue like that and 100K goal is just a couple a step away.

Cheers, RA50

RA50,

You know all about saving and investing, so I’m definitely taking your advise. At the moment it’s my savings potential that propels my net worth forward, so I’ll continue saving as much as possible.

Best wishes,

NMW

Very nice month over month increase, as noted by RA50, that 100K mark is coming in sight!

We’ve debated over Kinder Morgan, eventually ended up with TransCanada Pipelines. But we may still add Kinder Morgan at a later date to further diversify, will see what the stock price does over time.

Question, if you had the funds/purchasing power, would you buy dividend stocks in sufficiently large quantities as to automatically trigger the purchase of a new stock (or stocks) at each dividend payment (i.e. automatic reinvestment into stocks rather than cash)?

We are trying this buying strategy, but are wondering what other dividend investors think of this approach. We try to do this to limit transaction cost (as the re-investment into new stock comes without fees) and to facilitate the “snowball” effect. There is the “downside” (and occasionally the upside) that you cannot pick what price you pay for the stocks. Furthermore, when the stock price increases too much the purchase is not triggered (i.e. you don’t get enough dividend to afford another share).

Thanks!

Team CF,

Many stocks I won don’t allow for a DRIP, so I use the cash to pick future purchases myself. With that being said, I don’t think I’d ever take advantage of a DRIP programme, unless the newly acquired shares would go under the market price (as is the case with Total’s current programme). I much rather prefer to invest where I see value rather than having additional purchases trigger automatically across all my stocks.

Cheers,

NMW

Congratulations on hitting that £70k milestone – well done!

Great to see you back posting – hope you’ve been busy enjoying life! 🙂

Weenie,

Still not as active on my blog – and yours, as you’ve probably noticed – as I would have liked, but I’m downsizing my workload to more manageable levels. It seems I have a habit of taking on too much, both work and life related. 🙂

Best wishes,

NMW

Great stuff NMW, nice to see a good spike in the portfolio balance to crack the 70k! That’s what happens when you stick at it consistently – you get to ride the waves that come through! Keep up the great work.

Cheers,

Jason

Thanks, Jason!

Onwards and upwards, right?

Fantastic progress. It’s great to see the charts heading up. Keep up the good work.

I’ll do everything my can to keep the charts going up, IH!

Thank you for dropping by and taking the time to leave a comment.

Nice month!

Congrats

Thanks, eljoveninversor!

Great job. It is going higher and higher! BHP Billiton is only one of few that is not doing well. I have it as well and it has falling like there is no tomorrow however it will eventually catch up. It is definitely oversold. Thanks for sharing!

Cheers!

BSR

BSR,

BHP is an interesting stock to watch lately. It’s up again the past week after being so ridiculously low that I was tempted to buy it again even though I was already overweight on it.

Even with a very possible dividend cut in the near future this is a fantastic long-term hold.

Cheers,

NMW

Hi, greetings from Finland!

I thought that we had high tax rate, but I guess not =) Average income in Finland is 3500€/ month and you have to pay 32% tax. How much is average income in Belgium?

Feel free to take a look at my blog (even though in Finnish) http://www.osinkokuningas.com

If you open “Salkku” from navigation you will find link for my stock portfolio (google spreadsheet)

Osinkokuningas,

The average income in Belgium is in the same ballpark, between €3,000-3,500 gross. The average tax on that depends, but is also around 35%. However, on top of our gross numbers the employer also pays tax (often this number is included in the gross earnings in other countries), so you come out at 50-60% on income from labour.

Even though my Finnish is non-existent I’ll take a look at your stock portfolio, very interested to see what you’re investing in over there!

Cheers,

NMW

Hi NMW,

Great site. Only just discovered it and it is proving a great asset to me in researching what stocks to invest in. New to the game at the moment and have turned over nice value on both VW shares and Infineon Tech.

I have also invested in a number of US stocks but have a naive question.

The dollar and the euro and nearly equal at the moment and i have US stocks. If the euro starts to strengthen against the dollar back to say .87 does this weaken my investment?

I am struggling with this one and thinking should I just stick with euro stock. I am in for the long haul.

Thanks,

Ken

Guggi,

Exchange rates average out in the long-run, so I wouldn’t worry too much about it if you plan to buy and hold. You can read more about it here: http://www.nomorewaffles.com/2015/01/do-you-need-to-hedge-against-exchange-rate-fluctuations/

When the Dollar strengthens against the Euro (e.g. 1 EUR = 1.5 USD > 1.0 USD), your US investments gain in value if you sell them and convert back to Euros. The reverse logic holds as well, of course.

Cheers,

NMW

NMW,

Great work on hitting your target a month ahead of time. A +4k gain is always nice to see psychologically while the downside being that it means the stocks you buy may cost you more!

Keep up the momentum!

– Ryan

Ryan,

It’s a nice psychological boost indeed and definitely needed after a couple of flat months. 🙂

Best wishes,

NMW

Wow! INDV is something else. That is a heck of a return.

Keep cranking,

Robert the DividendDreamer

AKA — Seeking Dividends

Follow me on Twitter– Seeking Dividends@DividendDreamer

Robert,

The gain on INDV is superficial since it’s a spin-off from Reckitt Benckiser. So it only cost me a 25% initial tax. That’s why the return is so high! 🙂

Cheers,

NMW

Glad to see you break 70k NMW!

Thanks, DFG! Really happy to have hit my mark. Let’s hope the gains continue in 2016.