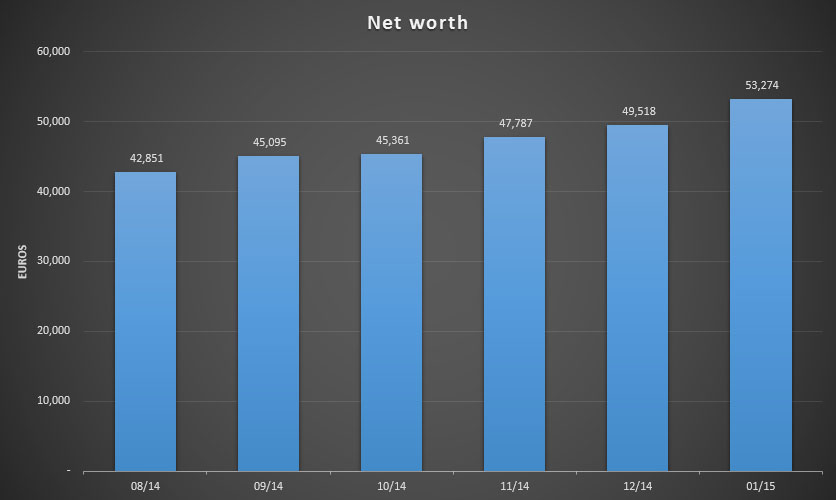

With 2015 now officially out of the starting blocks it’s time that we take a look at the progression my net worth has experienced. Even though a dividend growth investor’s total amount of assets doesn’t mean much on a month-to-month basis, it’s always exciting to see your net worth grow. On top of that, you guys get an unprecedented view into the rollercoaster ride that investing is.

If you remember correctly, December’s performance wasn’t too great with the markets tumbling and me splurging on a brand-new Nvidia GTX 970 graphics card the month before. Luckily, though, my employer came to the rescue with a nice annual bonus. As a result, I was able to grow my dividend portfolio for the first time above the €10,000 mark. On top of that, my entire net worth was now knocking on the door of the €50,000 threshold.

Guess what? By the end of the month, my portfolio decided to stop knocking, but to simply kick down the door and waltz in. US stocks miraculously recovered and my final paycheck for 2014 arrived, pushing my total net worth to an all-time high of €53,274. That’s an increase of €3,756 or over 7.5% in only one month’s time, an incredible result if nothing else considering how volatile the markets have been lately.

To put the absolute growth of the past thirty days into perspective, you could say that my net worth skyrocketed with almost two months’ worth of after-tax income. Considering that I earn about €12 net an hour, that’s 313 hours or a full 40 days of labour tied up in my bank account and investments. Who ever said that saving and investing doesn’t buy you freedom?

Let’s take a look at my portfolio, shall we? I once again would like to point out that all numbers below are denominated in Euros because that is my home currency. Foreign stocks were converted based on the last-known exchange rate using my dividend tracking spreadsheet.

Dividend growth stocks

Like I wrote three paragraphs ago, it wasn’t until last month that I had over 10,000 Euros invested in stocks that pay an ever-growing dividend to their shareholders. Because it took me about four months and a nice chunck of previous savings to get to that magic number, it’s crazy to think that I’ve now already crossed €15,000. I guess you could say that the frequent dividend payments of December really motivated me to push things forward.

Because last month’s income was incredibly high and because I decided to follow up on the advice of Dividend Family Guy to re-evaluate the amount of cash in my emergency fund, I had quite a lot of spare change lying around to add high-quality companies to my portfolio. As a result, I went on a stock buying rampage to make the most out of my free broker transactions until the end of 2014.

British distiller Diageo (LON:DGE) took a small hit right before the end of the year, so my trigger-happy right index-finger couldn’t resist to click the big “confirm transaction” button. As a result, I’m now the happy owner of 41 shares of Guinness’ and Kilkenny’s brewer, and Johnnie Walker, Captain Morgan, Baileys and Smirnoff’s distiller.

Right afterwards I completed another purchase on the LSE. Like most other dividend growth investors over the past few days, I was happy to add to my Unilever (LON:ULVR) position. Unilever now makes up the largest position in my portfolio and I believe it deserves the number one spot. The British consumer goods manufacturer has such an incredible line-up of products and such long-term growth potential, especially in the developing markets, that I’m sure it will remain among dividend growth investors’ favourites for a long time.

Since oil and commodity prices kept falling I furthermore decided to average down on my existing BHP Billiton (LON:BLT) position. The British mining company saw its share price decimated in 2014 because its profits are highly reliant on the principle of supply and demand in the commodities markets. My decision to buy 24 more shares of BLT might have been premature though, with oil prices sinking lower and lower every day.

Last but not least, American telecommunications giant Verizon’s (NYSE:VZ) drop in share price by mid-December didn’t go unnoticed either. As a result, I added 20 shares of AT&T’s biggest competitor to round-out and diversify my exposure to US telecommunications.

The cost basis for each position includes the price of the shares, a 0.25% stock market tax and brokerage fees.

| Ticker | Company | Shares | Cost basis | Mkt. value | Gain |

|---|---|---|---|---|---|

| AFL | Aflac Inc. | 9 | 419.41 | 446.15 | +6.38% |

| T | AT&T | 37 | 972.16 | 1,059.09 | +8.94% |

| BLT | BHP Billiton plc | 48 | 928.94 | 799.41 | -13.94% |

| BP | BP plc | 92 | 507.24 | 459.73 | -9.37% |

| DE | Deere & Company | 7 | 452.61 | 513.87 | +13.54% |

| DGE | Diageo plc | 41 | 994.34 | 989.59 | -0.48% |

| GE | General Electric | 22 | 450.70 | 448.65 | -0.46% |

| GSK | GlaxoSmithKline | 33 | 610.15 | 601.93 | -1.35% |

| INDV | Indivior plc | 10 | 3.89 | 19.75 | +407.80% |

| IBM | IBM Corp. | 6 | 736.76 | 804.15 | +9.15% |

| JNJ | Johnson & Johnson | 6 | 473.79 | 537.23 | +13.39% |

| MCD | McDonald's Corp | 14 | 1,003.47 | 1,110.79 | +10.69% |

| PG | Procter & Gamble | 9 | 575.36 | 694.62 | +20.73% |

| QCOM | Qualcomm Inc. | 9 | 520.23 | 561.31 | +7.90% |

| RB | Reckitt Benckiser plc | 10 | 630.34 | 690.81 | +9.59% |

| RDSB | Royal Dutch Shell | 20 | 585.25 | 536.40 | -8.35% |

| KO | The Coca Cola Company | 17 | 540.05 | 619.41 | +14.70% |

| FP | Total SA | 20 | 971.96 | 817.00 | -15.94% |

| ULVR | Unilever plc | 60 | 2,029.35 | 2,104.68 | +3.71% |

| VZ | Verizon Communications Inc. | 20 | 785.07 | 806.50 | +2.73% |

| VOD | Vodafone plc | 188 | 536.19 | 555.21 | +3.55% |

| Total | 14,727.25 | 15,176.26 | +3.05% |

Exchange-traded funds

Over the past couple of days, the exchange-traded funds I hold, have done what they were supposed to do: track the market and deliver near-market performance returns. I know that’s rather dull in comparison to the excitement that dividend paying stocks hold, but I’m really happy that my portfolio allocation is turning out great.

The worldwide ETF and emerging markets fund did particularly well, with the Europe one still not sure whether it wants to go up or down. Overall, a 7% gain from my last purchase at the end of july is pretty impressive. Let’s hope these index funds continue to hum along.

| Ticker | ETF | Cost basis | Mkt. value | Gain |

|---|---|---|---|---|

| IWDA | iShares Core MSCI World | 4,982.96 | 5,584.95 | +12.08% |

| IEMA | iShares MSCI Emerging Markets | 1,214.59 | 1,302.48 | +7.24% |

| IMAE | iShares MSCI Europe | 3,561.94 | 3,549.92 | -0.34% |

| Total | 9,759.49 | 10,437.35 | +6.95% |

Other

January will probably be one of the last months that my “other” category is bigger than both my dividend portfolio and exchange-traded funds combined. That’s because I decided to reduce my emergency fund by €2,000 and because I’m limited to yearly contributions of only €940 to my pension fund. My savings account, however, continues to yield 3.15% annually, but I’m not adding any fresh money to it.

| Name | Cost basis | Current value | Gain |

|---|---|---|---|

| Pension fund | 950.00 | 961.77 | +1.22% and 30% tax break |

| Savings account | N/A | 18,159.03 | +3.15% guaranteed yearly |

| Emergency fund | N/A | 8,000 | N/A |

| Total | 27,120.80 |

Going forward

What a month! Some of you might have noticed my optimism in my 2014 goals recap or when reading my very ambitious 2015 goals, but December has confirmed my belief that financial independence is the right way to go. Both my net worth and passive dividend income are growing exponentially, setting me up for a worry-free financial future.

In my daily dealings I’m often a very careful person and as such, I worry quickly. Sometimes I fear my portfolio diversification isn’t up to snuff, or I worry about my exposure to oil, or about the depreciating Euro. I’m still trying to learn not to worry too much.

Recently, for example, I researched how free-floating exchange rates hardly have any real impact on return over longer periods of time. It’s nice to know that all the time I spent reading books and articles turns out to be right and amounts to real-life results. Seeing other people implement dividend growth investing succesfully is one thing, but to do it yourself is another.

That’s why I was really happy with December’s outcome. Even though these small wins don’t mean much over the long-term, they help tremendously to keep my spirits up – almost as much as the support I receive in the generous comments on this blog or in the sometimes overwhelming stream of e-mails.

Thank you for reading.

Good work NMW (not BMW as autocorrect wants).

3.15% nearly risk free in cash is pretty good 🙂

But a 7% increase in the month is what we want to see! 😀

Do I also spy a 400% return on one share?

Let’s hope every month is like that.

Mr Z

Mr. Zombie,

Haha, I wish I was BMW! Or at least the owner of BMW. 🙂

3.15% is excellent considering it’s completely risk-free. It’s an insurance account fully guaranteed by the Belgian government up to €100,000 in case the insurance company goes bankrupt.

The increase in December was pretty stellar! I knew it was going to be a big one, but I was blown away by the fact that it was 7%. Too bad I won’t be able to keep up that pace every month.

I do indeed have 400% return on Indivior, but that’s because it’s a spin-off from Reckitt Benckiser. For every share owned of RB, shareholders received a share of INDV. Because I had to pay 25% tax on those shares they cost me €3.89 even though they were immediately listed at €1.50 each. The funny thing was that the RB share price didn’t even take a hit. Win-win!

All the best,

NMW

Hi NMW, a cracking month for you. Was just wondering if you’re gonna take advantage of recent falls in some of your shares again this month, e.g. RDSB in particular has gone down further towards the £20 mark.

I love how you’re being a bit flexible about the emergency fund, that’s cool.

As always, love reading your posts,

Cheers!

M,

At the moment I don’t have any spare capital left to deploy, so I probably already missed my opportunity to catch some falling stocks. I just glanced at my portfolio and most positions have gained another 2% since Wednesday. Oil especially has gone up a lot.

Also, I’m already quite heavy on energy companies. Not sure if I should increase my exposure some more. Before the Swiss Frank gained so much compared to the Euro, I was planning on adding either Novartis or Nestlé this month, but with the recent currency volatility, it may be better to wait some more.

Thanks for stopping by again and for the kind words!

Best wishes,

NMW

NMW,

Solid monthly improvement. I track my net worth more loosely than you do and try not to factor in checking or savings accounts. Although like Dividend Family Guy, I have a huge family and Christmas always costs. Like him I want to get my emergency fund / savings larger; every paycheck a little bit more makes its way there.

Otherwise, UL / UN is a great stock to have as your largest. I am adding more this month to my UL position as well.

Also I fixed the comments thing – something I had not previously paid attention to. Thanks for the information.

– Dividend Gremlin

DG,

Why don’t you factor in your savings account? Like you, I also don’t take my checking account into account (see what I did there?), but my savings account makes up a rather large portion of my portfolio and I see it as an important corner stone of my short-term financial security.

If I had a family or otherwise people depending on me, my emergency fund would definitely be a bit larger too. In Belgium €8,000 is about four months’ worth of after-tax average wage, which is more than enough for me because I simply can’t lose my job (civil servant privileges). I think it’s great that you’re trying to build yours bigger and bigger every month. Solid thinking!

Happy to be a fellow shareholder of Unilever! Well-run company with excellent products. If I was allowed to only buy five stocks, Unilever would definitely be one of them.

I’ll pop over to your blog asap then!

Cheers,

NMW

Wow a 7.5% increase in net worth? You’re totally killing it man. Keep up the good work.

Thank you for your continued support, Tawcan!

Congrats! You passed the $50k mark! Now just add another zero to that 😀

Henry,

It’ll be a long time before I’ll be able to add a zero at the end of these kind of posts, but one day I definitely plan on doing so. I believe saving and investing in high-quality dividend stocks is a surefire way to growing your net worth over time.

Cheers,

NMW

Wow, just awesome NMW.

At least managing the worry is something that’s within your control, and something that you can improve at. These behavioural traits are the things I spend most time working on, as this is what can most easily trip you up with investing, rather than getting any analysis wrong.

Hopefully you wont have too many worries when you’re portfolio keeps powering towards 100k and beyond!

Jason,

Thanks, man!

Managing the worry and making sure you’re 100% comfortable with your investing strategy is, in my view at least, by far the hardest thing about investing. As such, I put a lot of time and energy in getting my portfolio right.

I’m sure I’ll get more comfortable and comfortable once I see for myself how robust my strategy is!

Hope you’re well,

NMW

I am truly impressed with your net worth progress NMW!

Nice portfolio as well. I look forward to the next net worth update : )

Jeff,

Glad you like what I’m trying to achieve here and I hope it inspires you to keep it up over there too!

Bets wishes,

NMW

Someone actually took my advice! Wow now if only my kids and wife would listen. 🙂 Glad to hear you did the right thing with that extra cash.

DFG

DFG,

You could always threaten to leave your wife for me, maybe that’ll help! 😀

Thanks for the advice, much appreciated.

Cheers,

NMW

The numbers are definitely growing for you. Keep plugging at it. On another note, when our currency was week, we had all kinds of issues. Now that it is strong, we seem to have just as many issues. Good job.

Keep cranking,

Robert the DividendDreamer

Robert,

They definitely are! It’s quite impressive to see how fast my portfolio has been growing, mostly because of my high monthly savings rate.

Every currency exchange rate has its cons and pros. I believe Europe needs a weaker Euro badly to get the exports going again (the export motor of the EU – which is Belgium, Netherlands and Germany – hasn’t been performing too great lately), but also to combat deflation.

Also, I believe you’re not doing too badly over there considering you guys are responsible for the majority of global economic growth.

Cheers,

NMW

That increase is insane! Nice work December.

Thanks for your support, Emily!

You’re crushing it, NMW!

50,000 euros is a heck of a lot of money–congrats! 40 days’ worth of work being done for you by your money is no mean feat. It’s awesome!

Charles,

My thoughts exactly when I was writing this post, thanks!

Can’t wait for the effect of compounding to really show its teeth with my growing new worth in absolute numbers. I think €100,000 will come much faster than the first €50,000.

Best wishes,

NMW

Very inspirational series of posts NMW. Thanks for putting it all out there for everyone to see—and congratulations!

Noonan,

Thank you! Not only do I want to track my own net worth, I also wanted to motivate other people to save and invest as much as I do – goal accomplished if your comment holds true for other people as well.

Cheers,

NMW

Holy crap huge gains dude. Way to start the year off proper like. Keep on grinding!

Thanks, AG!

Let’s hope I can keep the momentum going!

Cheers,

NMW

Hi NMW,

Impressive net worth, most people of our age barely have 10% of that amount. You will slowly see the power of compounding picking up some speed.

Keep up the good work.

Cheers,

G

Geblin,

Thanks, man! You’re probably the only person in Belgium that did as good er even better at our current ages without any outside financial support.

It’s really weird to hear my friends boast about finally reaching their first €10,000 saved towards a future home when I’m already at €50,000. I guess that shows the different mind-set some folks have.

Hope everything is well over there,

NMW

NMW,

Great job once again. Fantastic progress. It’s especially impressive considering your age. I was still broke at your age. You’ll be in an incredible position by the time you’re in your mid 30s. Work, don’t work. Do whatever. It likely won’t matter. 🙂

Keep it up!

Best regards.

Jason,

Even though you were broke at my age, I can only hope to make the rapid progress you’ve experienced since applying yourself to the frugal lifestyle. Besides, you’re already living the dream without truly reaching financial independence yet!

Thank you for being such a great motivator and source of inspiration,

NMW

Nice job! I look forward to seeing how you do in 2015.

Emma,

Thank you for dropping by, leaving a comment, and for following along in 2015!

Best wishes,

NMW

NMW,

I like how your assets are distributed across the board, very well diversified, and now adding an REIT in the mix. Way to go on taking advantage on the pension fund tax break too. Congratulations on achieving an all time high! I will be rooting for your success.

FFF

FFF,

Diversification is key to building a portfolio that will last you until forever. If a couple of my positions don’t do as well, I’m certain the other ones will pick up its slack. I’m very grateful that my broker offered free transactions until the end of 2014 so I could quickly diversify my positions with small amounts.

The pension fund is a pretty sweet deal, even though I’m not certain about the fund’s performance until I’m 65! I’ll take a 30% cash-back through my tax filing anyday though.

Thank you for your support,

NMW