A blog dedicated to financial independence through frugality and dividend growth investing without a monthly recap of dividends received is like a car without an engine. That’s why I’ve decided to start a monthly recurring series that logs and details the passive income performance of my portfolio. Hardly original with everyone and their dog in the dividend growth community doing the same thing, but I find it necessary for the sake of transparency.

Another reason why I’d like to write these kind of posts is because they keep me motivated. Nothing beats a monthly overview of free and fresh money coming into your checking account! Well, except maybe waking up in the morning only to find out you’ve grown richer than before you went to bed because McDonald’s payed you a handsome amount of cash because you put your money hard at work long ago.

On top of that I hope to inspire others to start their own dividend journey by showing the month-to-month progress of my approach. The power of dividend growth investing is very much in the growth component of the strategy, which peeks its head around the corner after just a couple of months, but shows some real teeth in the long-run. The remarkable growth long-time bloggers have experienced motivated me to invest in dividend paying companies too. Now I wish to return the favour to new community members.

Dividends received

Because I bought my first dividend paying stock in August, it comes as no surprise that December is my highest passive income month yet. Below you can find a list of the companies that payed me a royalty for simply believing in their business and products. Please note that all dividends are denominated in Euros and are after foreign withholding taxes, if any, and a 25% Belgian income tax.

| Date | Ticker | Company | Dividend |

|---|---|---|---|

| 01/12 | AFL | Aflac Inc. | 1.74 |

| 09/12 | JNJ | Johnson and Johnson | 2.13 |

| 10/12 | ULVR | Unilever plc | 6.05 |

| 15/12 | MCD | McDonald's | 5.93 |

| 15/12 | KO | The Coca Cola Company | 2.60 |

| 17/12 | FP | Total SA | 7.62 |

| 18/12 | QCOM | Qualcomm Inc. | 1.90 |

| 19/12 | BP | BP plc | 5.49 |

| 22/12 | RDSB | Royal Dutch Shell | 5.56 |

| Total | 39.11 |

Awesome, right? That’s almost €40 of brand-new and fresh money I didn’t have to do a damn thing for. Since you all know I earn about €12 an hour after taxes because of Belgium’s extremely high tax rate on personal income, December’s dividends amount to the equivalent of three hours of work. Impressive!

The thing that really stood out to me this month was the fact that most of the dividends started rolling in while I was out on a quick vacation to Dublin. I was actually having a great time abroad when the aforementioned companies decided to reward me a share of their profits.

You can imagine my surprise when my smartphone decided to interrupt a guided tour around the Guinness brewery – I’ll add you to my portfolio soon, Diageo (LON:DGE) – because Unilever chipped in €6.05 towards my passive income goals. Or when I saw McDonald’s had forwarded an increased dividend while I was actually enjoying a Big Mac on-the-go.

While we’re on the subject of my quick city trip, it might be a good idea to point out that this month’s dividends almost completely covered the costs of my plane ticket from Brussels to Dublin, as you can read in the income and expenses report of October. Dividend growth investing definitely won’t pay for my living expenses yet, but it’s these little things that make all the hard work and the road to financial independence much more enjoyable.

Growth

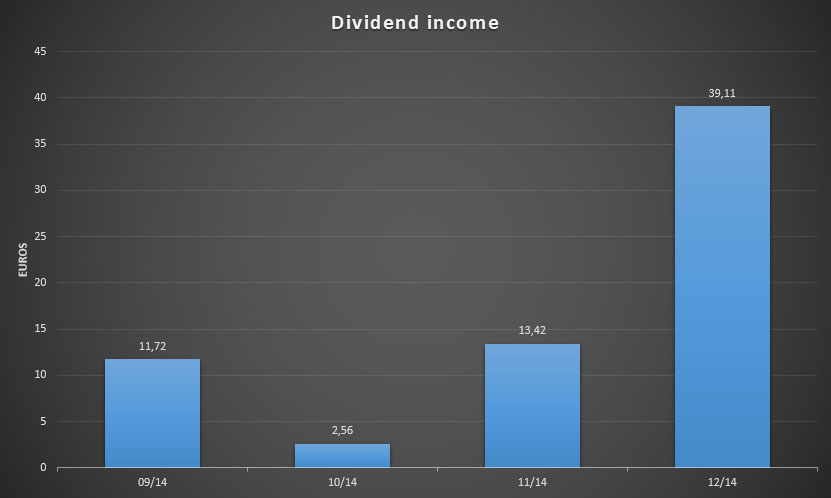

This paragraph should explain the growth component of my dividend stock portfolio, but visualising year-over-year growth is hard to do when you didn’t receive any dividends the year before. Nevertheless, the graph below shows my dividend income since my first payment in September. With most of my stocks paying quarterly, you can see the first inkling of increasing payouts, which are almost completely the result of fresh capital being added to the portfolio.

December’s income was a whopping 330% higher than in September, which is a stellar increase if nothing else. Too bad I won’t be able to keep up quarterly growth like that with my portfolio and dividends growing in size the coming months. Talk about a first world problem!

Going forward

With 2014 already over I’m a little sad to say I didn’t make the €100 goal I set for myself in August, even though it’s quite hard to predict dividend income for only a third of an entire year. Nevertheless, the grand total of €84 dividends this year is a nice start to a long journey of ever increasing payouts. I’m pretty sure that next year will be fantastic.

As you might have read already, I decided to evaluate my 2014 goals and set new objectives and milestones for 2015. A much higher passive income stream from dividend paying stocks obviously is a big part of that equation. Even though €100 in dividends remained out of reach, I’m really happy about the progress I made this year, both on a personal level and as an investor.

That’s why I can’t wait for the first success stories of 2015 to start rolling in. I hope you guys are all feeling the same way! Are you?

Congrats,

All though you did not reach your target, €84 is a really nice amount for half a year.

Keep up the good work!

Cheers,

Pollie

Pollie,

You’re absolutely right. Any amount of dividend income is nice because it took no effort on my part at all except not spending my money, but investing it instead. Can’t wait to see that number grow this year though! 🙂

Thanks for stopping by,

Best wishes,

NMW

Happy new year! And good job with the first dividends!

Do you only get taxed 25% for the dividends or is it on top of the 30% of the US tax?

Giorgos,

Happy New Year to you too! I hope 2015 brings you nothing but joy.

The Belgian tax rate is always 25% and it is on top of any foreign withholding tax. For the US I can claim a reduced withholding tax of 15%. In total that means 37.5% of taxes on US dividends.

It’s not ideal, but it is what it is.

Cheers,

NMW

NMW,

Fantastic job! I think focusing on the free money part, rather than your goal or a pesky tax rate, keeps it all in perspective. Your money is working for you while you work and play, nothing beats that financially. And to know that it’s just going to increase, well what’s not to feel great about?

Good luck and good fortune in 2015!

– HMB

HMB,

Thank you, pal!

You’re right that it’s important to keep things in perspective. I could go on and on about the ridiculous disadvantage I have compared to other dividend growth investors out there because of my tax rate, but that won’t help me one bit. Don’t get yourself worked up about things you can’t change!

Like I wrote in my post, receiving free and fresh cash is by far the best part of dividends. The sense of joy and pride I experienced when McDonald’s payed me a dividend while I was enjoying one of their burgers was overwhelming.

Best of luck to you too in 2015,

NMW

You are spot on with your comment on monthly updates giving motivation. Its a great part of this community to see and share in that.

PMU,

Absolutely! I always love reading everyone else’s dividend income and savings rate reports, so it made sense to also publish one every month.

Thank you for visiting. Have a wonderful 2015,

NMW

Congrats on the dividend income, NMW. Keep up the great work. That 25% tax hurts. A lot. Arent there any tax sheltered accounts that you could use to protect your income?

Best wishes for 2015 and beyond

R2R

R2R,

Thank you! I’ll continue to do my utmost.

The 25% tax definitely hurts, but there’s nothing that can be done about it. We don’t have sheltered accounts over here, mostly because pensions and retirements accounts are taken care of by employers. The only retirement account we have is very limited and only contains expensive mutual funds.

Look at it this way, 25% is nothing compared to my income tax on labour, and I’m getting excellent social security and health care in return.

All the best for 2015,

NMW

DEO has been on my watchlist for ages. Valuation is a tad high still for me. Whats your target price for DEO, are you planning to buy at current levels?

Kostaja,

Funny that you ask! I actually wrote this post on Thursday evening and forgot to change it when I bought Diageo on Friday after seeing it pull back a bit more. I bought 41 shares at £18.17 a piece.

DGE/DEO is indeed rather expensive, but I believe it’s well worth the price. It currently sits a little below half its 52-week-high if I’m not mistaken. The stock also provides a decent yield and lots of long-turn growth potential. The one downside to this company is its long-term debt, but it’s quite well managed and very stable, so nothing to really worry about.

Let me know when you decide to pull the trigger!

Thanks for stopping by and commenting,

NMW

Happy New Year and a successful 2015!

Just a little quibble with your line – “That’s almost €40 of brand-new and fresh money I didn’t have to do a damn thing for.” – and a number of references to “free” (after tax) money” in the comments.

The dividend income is not “free” and you actually did do something for it, in that you put your capital at risk and therefore put your work (labour) used to create that capital at risk. That is not “free”!

Now I will agree that you didn’t have to do physical/mental labour to gain the income, making it seem “free” – but it isn’t 🙂

You also worked hard at saving that capital and then investing the capital, again not “free”.

Free in my books is walking along and finding a banknote lying on the ground 🙂

Just a little different perspective.

Keep up the good work!

Gcai,

Happy New Year and all the best for 2015 to you too!

You’re right in that it’s not entirely free income in the literal sense. I definitely had to save up for that money and put it at risk of losing (a part of) it.

My perspective on dividends is that it’s ‘free’ simply because I believe in the long-term prospects of a company. I’ll definitely make sure to clarify my view in a future post as to not lead other readers on.

Thank you for your comment, always a pleasure to hear from you.

Best wishes,

NMW

NMW,

Congratulations on the December dividend income. That is great progress you are making from the end of August to now with a 330% increase from September.

Motivation is one of the reasons I decided to post my dividend income as it will be fun to look back as the years progress and see the results.

Thanks for sharing!

Mr. Captain Cash

Mr. CC,

Thank you very much! Great progress, but still nothing compared to your dividend income. Can’t wait to reach your level of dividends myself.

It’ll definitely be fun to look back on previous posts and see how far I’ve come in a couple of years. Even now it’s fun to read posts a couple of months old because they contain details I’ve since long forgotten.

Cheers,

NMW

Hi, NMW, and congrats with the dividend results.

The amounts are still low but the progress is very impressive. Keep up wit it!

Regards,

CZD.

CZD,

Thanks for stopping by! It’s nice to meet other dividend investors from Europe. Too bad my Spanish isn’t up to snuff to fully enjoy your website. Thank you for the useful Google Translate plugin though.

The amounts are still low, but set to grow quite well over the course of the next months. I’m pumping in more cash than ever in my dividend stocks to reach my goal of €500 by the end of the year.

I saw you own quite a lot of excellent dividend payers too. Glad to be a fellow shareholder for quite a lot of them.

Best wishes,

NMW

What a great way to end the year, NMW. These are some very solid companies paying you, way to go. You’re going to have some ridiculous year over year numbers toward the end of 2015 when you hit those goals. Keep at it!!

Best Wishes,

Ryan

Ryan,

Thank you for the kind words, much appreciated.

I’m really happy with how my portfolio is coming along. In the beginning I was quite heavy on US stocks, but recently I’ve been finding more and more European dividend growing companies. They should definitely add to my YoY growth and help me achieve my goal of €500 by the end of the year.

Cheers,

NMW

Hey NMW,

Congratz on your achievements for 2014. This is impressive. And good luck for your 2015 goals. I look forward to read updates on those.

I have some thoughts on being a dividend investor. From the stories I read, you all get motivated from the dividend flow and the yearly dividend number gives you an indication of how financially independent you are. I do understand this. It actually makes me doubt, as I moved into capitalization investing via ETF and mutuam mix funds. The fact that they are capitalizing is attarcative to me: I have no need to worry on the taxes yet ( I will get taxed at the end, I know), and I do not need to reinvest the dividends: This can be automated, I know, but still.

And then another benefit: using ETFs, I have from day 1 my diversification in a nearly 1000 stocks. Building up a diversified dividend stock portfolio would take me ages and forces me to think each month in what stock to invest. I now have my list of ETFs and funds and I just buy each month (Some of this is even automated by the bank).

What are you thoughts on this? I know and read you switched from ETF to Dividend stocks, and I wonder how you feel about this now. In ythe end, what is best is something we will only now in the futurs, so another main driver i probably: what fits your currentr needs, lazyness and indights.

regards

Belegger,

Thank you very much for your kind words!

Very good question! You’ve actually answered it yourself: “we will only know in the future”. There’s no absolute certainty which strategy is better. I believe it boils down to personal preference.

It’s true that ETFs are better for Belgians from a tax perspective, so if you’re worried about that definitely go the capitalizing ETF route. For most people I’m a strong supporter of ETFs because it’s cheap, easy to do, and an excellent long-term strategy. Another point of view would be that I don’t mind paying taxes if that makes me feel better about my investing strategy. That’s one of the reasons why I switched to individual stocks.

My advice would be (for Belgians): (1) if you want to grow your net worth as fast as possible, buy into well-diversified capitalizing ETFs or (2) if you want to build a stable and growing income stream, build yourself a dividend growth portfolio.

Regarding the diversification, you can see that I kept my ETF base because I prefered the instant worldwide diversification while I continue to build more positions in my dividend portfolio. Of course, you can do this too and have the best of both worlds.

I hope this answer was of help to you. If you have any further questions feel free to contact me through the contact form up top.

Best wishes and thanks for stopping by,

NMW

NMW,

Thx for your answer. It confirms my current thinking. I will stick to being an etf and fund investor with as much as possible capitalising funds.

My goal for now is to grow my assets, not to have a passive income. Once there is no more house loan and the kids have left the nest, this might change. At that time, I might swap to a dividend portfolio. Maybe I start a blog as well then.

Keep up the good work

Belegger,

You’re welcome. Glad I could help out.

If growing your net worth is your main goal, definitely go for a well-balanced and diversified index fund portfolio. Do you have any idea on which ETF’s you like and your prefered allocation?

Let me know if you ever decide to start your own blog, I’d like to follow your journey.

Cheers,

NMW

It’s nice to see your dividend strategy starting to slowly build up. Can’t wait to see the progress you make this year!

Thanks, Zee! Looking forward to that progress too.

Cheers,

NMW

NMW,

Nice end to the year. Yes the tax hurts, but I am sure there are plenty of positives that come with it – like healthcare. Still keep finding those European stocks, which should help with that. Plus its cool owning something closer to home.

Anyways you should shatter next year with some awesome growth.

Keep it up,

Gremlin

Dividend Gremlin,

The tax definitely hurts, but like you said and like I pointed out to Roadmap2Retire already, we get a lot in return over here. Great social security and possibly the best public healthcare in the entire world.

Finding good dividend companies in Europe isn’t easy and many of them are quite overvalued, but I’m definitely planning on adding more to my portfolio soon.

Thank you for stopping by and have a great 2015,

NMW

Love watching the dividend progress of your portfolio. I see we have quite a few names that overlap for the month of December. Always happy to be a fellow shareholder in many great names. Look forward to your dividend progress in 2015. Curious to see where your next buys will be.

Keith,

Thank you for the kind words. I’m glad to hear and see we have quite a few names in common since I highly value your opinion and judgement as a long-term dividend growth investor.

For the coming months I’ll probably focus a bit more on European stocks with the current slump in the markets over here again. It’s also close to the European dividend season, so a really good moment to pick up some last-minute bargains.

All the best for 2015,

Thank you for visiting again,

NMW

It’s nice to see your dividend building up over time. That 25% tax is pretty significant. Sucks to hear that you guys don’t have a tax sheltered account that you can invest the money in. I suppose with good social benefits it’s OK to pay that 25% of tax. Keep up the good work!

Tawcan,

Increasing dividends are great! Can’t wait to see my year-over-year progress in 2015.

The 25% tax isn’t great, but because of our good social benefits I’m OK with it. Can’t change the tax, so no reason to fuss about it.

Thanks for the support,

Cheers,

NMW

Even though it’s only been a few months, it’s brilliant to see such progress on the dividend front, especially when your dividend income was zero not that long ago!

I’m certain you’ll make massive strides this year with your dividends and other goals, looking forward to reading your updates this year!

Cheers,

Jason

Jason,

Even with the high tax burden on my dividend income, it’s quite amazing how fast the numbers grow. All those little payments definitely add up over time!

We’ll see if I manage to make over €500 this year, but if everything goes according to plan it should be smooth sailin’.

Thank you for being such a loyal follower. Really appreciate your kind words and input. Keep banging out your great views on your own blog.

Best wishes,

NMW

Yeah you’re doing great NMW smooth sailin’ indeed! haha

I have been following your blog since the beginning.

I’m living in Holland but we have 15% taxrate on our Dividends.. Im hoping to break the 100 euro dividend-income this year as im gonna try to spend atleast 1000 euro a month on high quality dividend growth stocks.

William,

Thank you for stopping by! I must have missed your comment, so sorry for the late reply.

Don’t feel too bad about the tax-rate in the Netherlands! Belgians pay a 25% flat rate and we can’t apply for a tax benefit on foreign withholding taxes like you guys can.

I’m pretty sure that you’ll break the €100 mark if your purchases provide quarterly payments. Putting in over a thousand Euros every month will really get your passive income stream flowing, trust me.

I’ll definitely following along on your blog.

Cheers,

NMW

I now tell my wife we have to eat at MCD every now and then now that I own part of the company. Anyway congrats on a good first December!

DFG

DFG,

And right you are in doing so! I try to purchase as much as possible from the companies I invest in. It’s a way for me to check out the quality. You’d be surprised by the amount of Unilever labels in my household.

Thank you for your support,

NMW

Awesome! Dividend investing is very rewarding. I find it a lot of fun to get the dividends every quarter as I’m sure you do too!

Great to see December was your biggest monthly dividend income total so far as well! Like you, mine was helped along by Unilever and BP as well as a number of others. My recent purchase of Shell will hopefully lead into another bumper December for 2015.

Johnson & Johnson really caught my eye. I have been watching it for some time but I am avoiding US stocks at the moment in order to max out my tax free ISA allowance courtesy of the UK government. Unfortunately, my broker has some quite high foreign exchange fees!

Keep up the good work!