In the bi-weekly Stuff Our Parents Never Taught Us series I will introduce and clarify basic financial concepts in an attempt to increase the level of financial literacy among my Millennial peers. For some bizar reason, the majority of our parents didn’t think it necessary to teach us the 101 course of personal finance. If you’re over 18 and have no idea what stocks and bonds are, or how interest rates and dividends work, this is for you!

Boy, did I feel like a simpleton when someone first explained the concept of compounding interest to me. At age 23.

You read that right; I was 23 years old when someone first introduced compounding interest to yours truly. Introduced is actually a much better word than explained, because the term compounding interest is so obvious in and of itself that I immediately understood its meaning – fellow linguistics majors raise your hand! Still, I was literally blown away by the strength of compounding interest, especially in the long run.

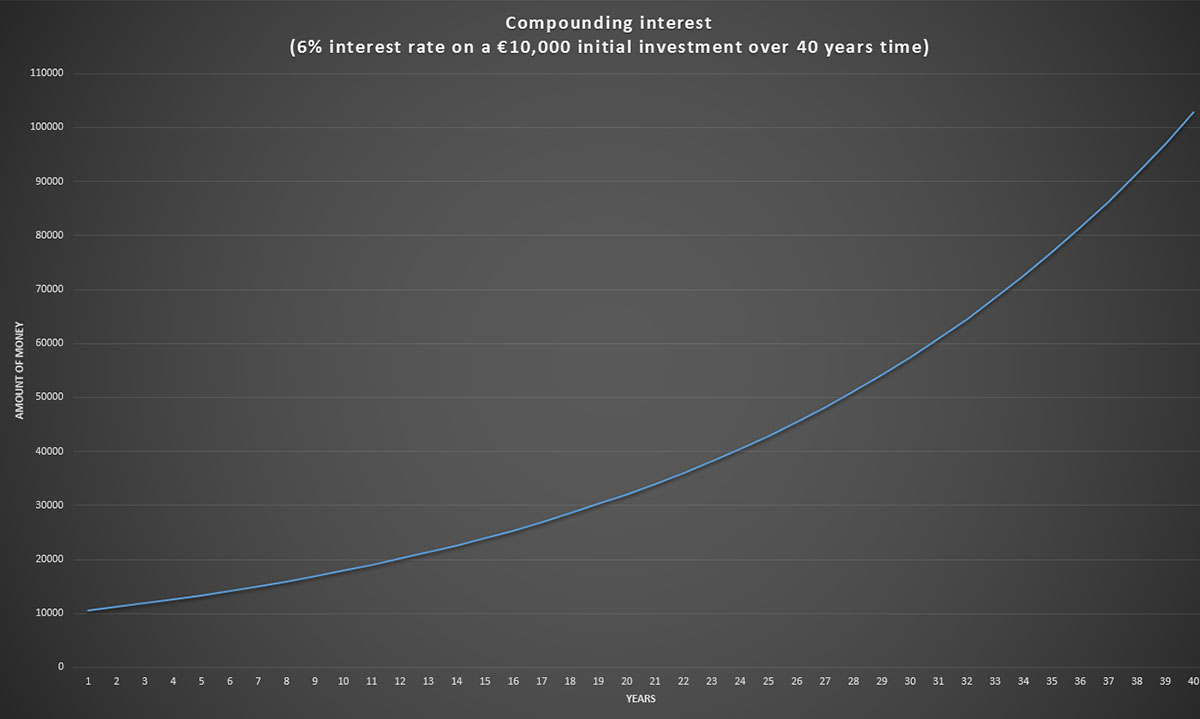

Per Wikipedia, the term compounding interest denotes interest added to the principal of a deposit or loan so that the added interest also earns interest from then on. Basically, if we deposit €10,000 at a 6% interest rate, the next year our deposit will have grown to €10,600 all by itself. The third year our deposit will be sitting at €11,236 and not €11,200 because the previous interest was added to the €10,000 principle of the first year. Yawn, boring! Let’s clarify with a graph (click to enlarge).

Per Wikipedia, the term compounding interest denotes interest added to the principal of a deposit or loan so that the added interest also earns interest from then on. Basically, if we deposit €10,000 at a 6% interest rate, the next year our deposit will have grown to €10,600 all by itself. The third year our deposit will be sitting at €11,236 and not €11,200 because the previous interest was added to the €10,000 principle of the first year. Yawn, boring! Let’s clarify with a graph (click to enlarge).

Pictured below is what happens to an investment of 10,000 euros at a 6% interest rate over 40 years time, with the X-axis showing the years that pass by and the Y-axis detailing what happens to our investment money-wise.

Lo and behold the power of compounding interest: over 40 years time your €10,000 initial investment will have compounded to over €100,000 without lifting a single finger! In layman’s terms that means your money earned you even more money.

The part that absolutely blew me away? The speed at which your pile of cash potentially grows. The curve above clearly is exponential in nature, meaning it will trend upwards faster and faster each year. After a hundred years the €10,000 will be worth almost €3.4 million at a continued 6% rate!

Of course, hardly any of us will reach that age, so imagine we put an extra €10,000 to work every year at the same conditions and we started investing at the age of 25. Basically, we’re investing ten thousand euros every year for forty years at 6% interest. By the time we turn 65, we’ll have €1,207,998 in the bank. That’s three times as much money as we actually set aside in the first place (40 times €10,000)!

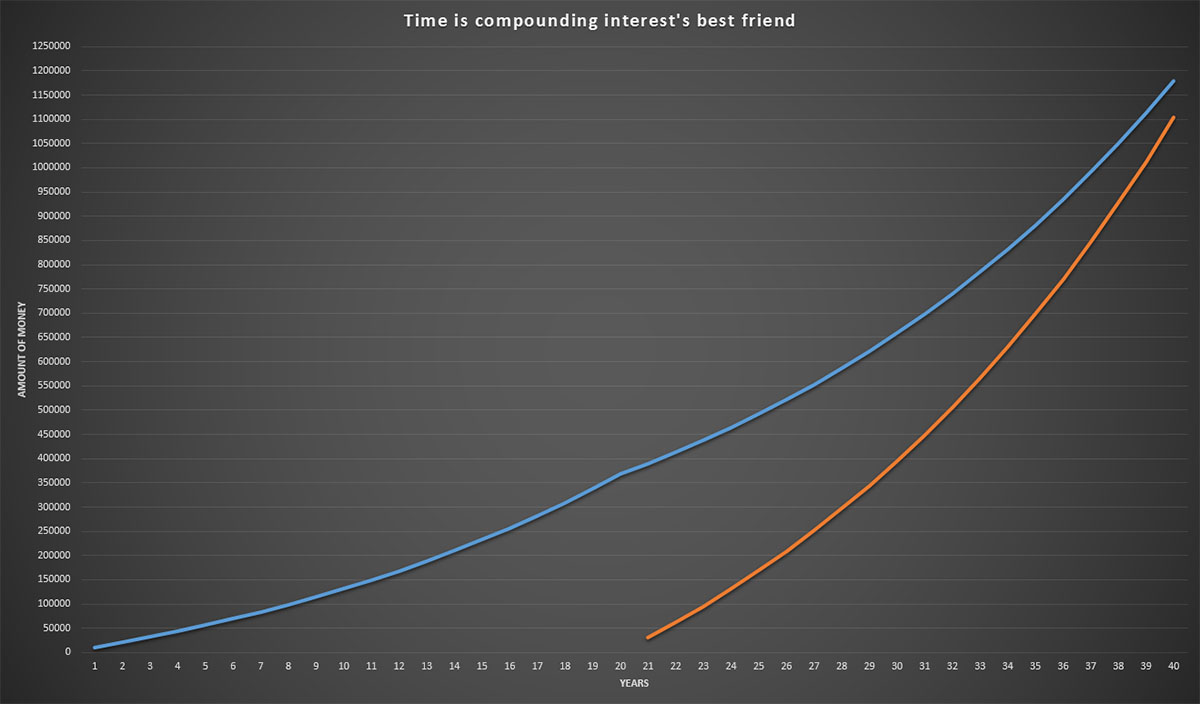

As a result, it’s paramount that you start investing your savings early on since time is compounding interest’s best friend. Consider two people aged 25. Person A, on the one hand, invests €10,000 yearly for twenty years and then completely stops adding money. Person B, on the other, puts in €30,000, but starts twenty years later. The graph below shows what happens by the time both reach age 65 (click to enlarge).

Person A (blue line) accumulates €367,856 in twenty years after which his money automatically grows to €1,179,764 without adding a single dollar. Meanwhile person B (orange line) starts investing when person A stops his automatic contributions, but even tripling the yearly amount of cash invested won’t help person B catch up with person A. Ultimately, he ends up accumulating only €1,103,568, while putting in a lot more of his own money.

I hope that the above shows why compounding interest is such an important financial concept. If you’re stil in your twenties I implore you to start saving and investing as soon as possible to enjoy the full benefits of compounding interest. Even if you’re in your thirties, forties, heck even your fifties, compounding interest can still make a big difference in the long run.

Were you already familiar with the power of compounding interest? If so, when did you start taking advantage of it? If not, do you plan to?

I’m not sure when I first learned about compound interest but I think about it each day. That’s why I preach to young people. Saving money while young is a heck of a lot more beneficial than saving it when you’re old.

Heck, waffle money will turn into caviar money if you just invest it instead and wait awhile!

Haha, waffle money turning into caviar money… Should use that as a tagline to my blog! 🙂

You are one of the very few people around my age that actually knows a thing or two about personal finance, Will, so I’m not to surprised you’re already familiar with compounding interest! Lots of my friends, who I consider to be pretty smart people, absolutely have no clue whatsoever. Their parents never told them and they never picked it up in school!

Thanks for reading (and probably being my only reader), 🙂

NMW

The problem with interest these days is the rates are so low! I like them that way while I’m paying off my mortgage but I wouldn’t mind if they went up a bit when I retire, but not for you young kids though! Thanks for visiting my blog. Looks like you’ve got a nice one starting up over here!

Interest rates are indeed extremely low these days. I think my savings account is at 0.3% right now, which is ridiculous!

Of course, if you have a mortgage low interests are a godsend, especially when inflation starts picking up and your interest rate is fixed. I hope the low interest help you pay off your debt faster!

Thanks for stopping by, much appreciated!

NMW

This is a great overview–I like the graphs! Mr. Frugalwoods calls compounding interest “the magical unicorn” because it’s so amazing. The wisdom to save young is paramount–we’re deeply grateful we had the wherewithal to start saving as soon as we graduated college (at age 22). It’s incredible what that money (which seemed so meager at the time!) is doing for us over the long-haul.

Haha, the magical unicorn! 🙂 It truly is magical to me though. I am sometimes still amazed by the speed at which money can multiply itself.

Age 22 is perfect to start taking advantage of compounding interest. In forty to fifty years time that money will more than likely be worth seven times as much!

Thank you for visiting!

Cheers,

NMW

I was lucky enough to learn about compounding intrest in school. To bad not many people don’t grasp the power of compounding at first glance. After five years I can already see the magic happen.

Cheers,

Ha, Geblin, my first ever reader! Nice to have you back! 🙂

You seriously learned about compounding intrest in school in Belgium? I have asked lots of friends and they all never heard of it. One of the big black holes of our secondary education, at least in my opinion, is personal finance. (Another one being law.) Maybe I’m just too demanding.

I’m glad you’re enjoying the power of compounding interest for five years already. Its compounding pace should pick up soon now!

Best regards,

NMW

Yup, I learned it in math( I guess). I think in my last year. And of course I learned it in high school( logical when you study finance and insurance). But personal finance is indeed a big black hole in our school system. Many friends can’t even make a ‘huishoudboekje’ or don’t know why they need insurances.

Guess you were lucky then! Finance and insurance does of course help! 🙂 I studied linguistics and political science, so not too many finance related courses there.

Hi,

Great… I am 24 and want to start using this magic trick. HOW?! interest rates are so low.. Is somemone able to recommend where you can invest and get interest rates of 5% or more in Belgium or Europe these days?

Simon,

Interest rates are at all-time lows indeed, but that doesn’t mean there aren’t good deals out there. If you’d like to get to a 5% return level, however, you pretty much have to enter the stock market at the moment. Safe investments netting you 5% don’t exist anymore.

However, also think about the fact that inflation has been nearly flat the past couple of years, so the lower interest rates didn’t hurt as much. Would you rather have a 2% interest rate and 0% inflation or a 5% interest rate and 4% inflation? I pick the former!

Cheers,

NMW

Hi,

Fair enough, I was asking because I’ve heard great return’s in the US with Roth IRA’s for e.g. and was looking for similar option’s in in the EU.

Stocks are a little too risky from my point of view except the S&P 500 which is the only one I trust 🙂 Some people do have great knowledge and experience dealing with stocks thought!

Being diversified is personally my most important goal to gain financial independence and that’s the reason I am looking for different options to place my money.

Which kind of investments in Belgium do you find interesting with return’s of around 2% ? (I am giving up on the 5% return for now…). I am very much interested in hearing your thoughts on that matter because 0.xxx return on my bank account is not what I am looking for.

Thanks!

Simon

Simon,

If I’m not mistaken, Roth IRA’s aren’t investments, but simple financial vehicles for tax optimisation – that’s why we don’t have them over here in Europe, for example. Many people use them to purchase mutual funds or exchange-traded funds in the US, which often consist of both stocks and bonds.

Why would you only “trust” the S&P500? It’s just a weighted index of the 500 largest US corporations just like the CAC40 is France or the BEL20 in Belgium?

At the moment there aren’t many investments that will get you 2% without having to put your money away for a couple of years. I personally would just keep my money in savings accounts if the stock market wasn’t for me. Maybe you could look at some insurance products (TAK21), but they’re not optimal either.

Cheers,

NMW

Hi NMW,

Thanks for the Roth IRA’s clarifications… not living in the states so I am not a specialist as well.

I said I ”trusted” only the S&P 500 because I think it’s the most reliable index of all. As you said, it is the best performing 500 US corporations which make it very strong & stable. When one company does worse, another replaces it, how great is that. If you look at historical trends S&P 500 has been doing better than CAC40 & Bel20 especially during crisis periods. Anyhow I know there are other great opportunities out there, I just like the S&P 500 a bit better 🙂

Keeping all my money in the bank isn’t really an option… I’ll have to stick to my second income (online/live poker) outside my full time job in Antwerp until I feel comfortable or find sweet investments! Poker contributed to around 15-20% of my income in 2015 so it’s worth the time. But that’s a whole other discussion

Simon