When the British still ruled over the Indian subcontinent in the late eighteenth and early nineteenth century, the British colonial government grew concerned over the amount of cobras in Delhi. From a preventative public health perspective the Raj, allegedly, decided to pay a bounty for every dead cobra. As you might guess, this strategy proved highly succesful and drastically reduced the population of the venomous snakes.

Ofcourse, it didn’t take long for a select few entrepreneurial people to breed cobras for the income. When the colonial rulers got wind of the ingenuity of the local population, they promptly scrapped the bounty, leaving the cobra breeders with worthless snake pits. Not being able to monetize their investment any further, the locals saw no other recourse than to release the snakes, thereby increasing the wild cobra population beyond any level previously seen.

Even though this anecdote from economost Horst Siebert probably is ahistorical, there are plenty of other contemporary examples of good intentions leading to unintended or even undesireable consequences. It’s true that the road to hell is paved with good intentions, but sometimes we also forget why we decided to travel down a specific road at all – who wants to go to hell anyway?

And that’s how it feels with financial independence sometimes, at least to me.

I’ve been going down the saving and investing road for over eight years now, almost on auto-pilot, but I don’t fully remember why my internal GPS decided to point me this way. Or it feels like I forgot. I tell myself I do it to become financially secure and independent, so I can have a relaxed or even luxurious life afterwards, but over the years I believe more and more that financial independence isn’t a goal to reach by a certain date, but a process.

Of course, being in debt, feeling stuck in the 9-to-5 grind, or not being able to enjoy your free time the way you want are horrible cobras to have slithering about, but it’s an illusion to think you’ll be rid of all venomous snakes in your life by reaching financial independence, let alone early retirement. The cobras will still be there when you reach your magic number. Maybe they won’t be as numerous, but the fear of running into just one might be enough to undermine the supposedly exhalted feeling of not being beholden to anyone else.

My critical oversight

So what went wrong?

Essentialy, I don’t like my job. It feels like an obligation. I don’t believe it adds much inherent value to society. There’s barely anyone around that I learn new things from. My abilities are not being pushed to the limits. I feel hardly any challenge. As a result, I don’t feel valued and sometimes even doubt my competence.

To me financial independence has become an escape route, even though I never intended it to be nor can it be one. It has become a finish line made up of rainbows with a unicorn leading me to paradise. Early retirement is the happy ending that will solve all my problems.

This kind of thinking is self-deception of the highest order.

It offers us the mental comfortability to not look at the way we are living our lives. We stop asking questions about what makes us happy. We forget which activities bring us the most joy. We don’t actively surround ourselves with people we really value anymore. And we stop trying. Because once we reach 25 times our annual spending level, we are set for life and those problems will sort out themselves. We’ll then finally be able to focus on what truly matters to us.

The point is, money still doesn’t buy hapiness. It won’t now and it also won’t in the future.

Disconnecting life and money

How does this reasoning emerge? It happens when we causally connect our lifestyle and problems to the amount of money we have. That way we introduce a confounding variable into our thinking.

When you’re hungry or thirsty, you solve your hunger or quench your thirst by eating and drinking. We can satisfy an on going visceral need like hunger in the short term easily. It’s a straight arrow from hunger to food to not being hungry anymore.

In the example of me not liking my job, the need is not as visceral nor is the arrow straight. I won’t die in a week if I still have to go to the office. Neither does not being financially free fully capture my problem as mentioned in the questions above: what and who make me happy? Yet, some reptilian part of our brain still treats the problem the same way: being miserable in a job equals feeling hungry, and financial independence stands in for delicious food.

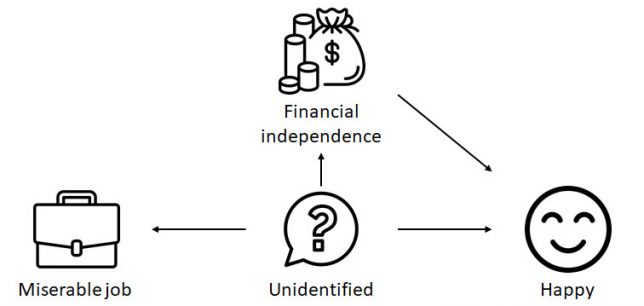

We replace the hard question “what do I need to be happy?” with the easy question “how can I get rid of this job?” Kahneman and Tversky have called this kind of problem-solving ‘heuristics’: mental shortcuts to find a quick solution to a complex problem. In the diagram below, we take a shortcut by erroneously connecting the miserable job with financial independence and happiness, forgoing the unidentified issues. On top of that, it’s highly likely that the unsolved deeper questions keep us in a miserable job instead of the other way around, but we think it’s the other way around.

Instead, the truth is that financial freedom is only one of the aspects that could make us happy. It allows us to do more of what we already love with who we love, but it’ll never be able to define those things for us. Furthermore, waiting for our wealth to catch up to our expenses to start being truly happy is completely irrational. Why not start living a happy life now? The two aren’t mutually exclusive.

Focus on the hard questions

So what’s the point of financial independence then?

There probably isn’t one right answer for everyone, but for me at the moment its point is very clear: we can leverage financial freedom to make it easier for ourselves to live more purposefully. But to do that we first need to figure out what gives us purpose.

Purpose is the hard questions:

- What do I really enjoy doing? What makes me feel on top of the world?

- When do I lose track of time? When do I feel like the best version of myself?

- What would I do in life if I was sure I couldn’t fail?

- Who would I be doing those things with? Who for?

- What scares me and why? How do I overcome these fears?

- Who do I look up to? How can I be around them or people like them (more)?

I have been struggling with these questions for a while now – they’re really hard. But after a while common topics and patterns emerge. You’ll find it easier to name what you should be doing in life and who you should be doing it with to feel happy. So please don’t sell yourself short by satisficing with a simpler heuristic.

And financial independence? It’s a powerful tool you can leverage, but it’s nothing more than a tool. Don’t think you need to reach it first before you can be happy, because you’ll find nothing at the finish line that’s worth your time but the hard questions.

There will always be cobras and no amount of bounty hunting will eradicate them all. Enjoy your life to the fullest, be grateful for every amazing moment you enjoy, and treat financial independence like a background process that’s working for you, diligently and silently making every day even better than the previous one.

Thank you for reading. This article is the reason why I started blogging again. I have felt stuck for a while now, but the insights I have tried to convey here helped me to start asking the hard questions. My sincere hope is it triggers the same thought process in you too. Do you know what financial independence means to you?

Interesting article! Been there done that. I think happiness, purpose consists out of growth. You find your mission/purpose and are intrigued by it, fills your everyday free time. But once you reached said mission/purpose (i.e. reached FI, or the knowledge/path towards it), then what’s left but waiting to reach it? Where’s the growth? There is none. Hence why you need a new purpose/mission and the process starts all over again.

In short: going towards a goal makes us happier than actually reaching the goal.

Joost,

I think there’s much wisdom in your words. It closely resonates with the concept of “flow” by Csikszentmihaly (yes, I have to look up his name every time, haha).

We are at our happiest when we’re so engrossed in an activity that we lose track of time and space. The goal we want to reach or the task at hand needs a certain level of challenge, but not so much as to discourage us. Essentially, we are driven by growth and learning.

Thank you for sharing your thoughts,

NMW

I wanted to add an anecdote to this. Coming from my background (mathematician here) I came to know the story of Andrew Wiles. This guy found an unresolved mathematical problem on his childhood. He made his purpose to solve this problem and, once he achieve it, he lost purpose in life and dove in a deep depression.

René,

I was expecting a super cool and exciting anecdote… This one really ended with a bummer. Poor Andrew! 🙁

His Wikipedia page is pretty succinct, but he’s quite the character. To work seven years in solitude on a single mathematical problem, wow.

Thank you for sharing,

NMW

Hmmm. Thought about this for a while… and then some more.

If my saved/invested assets are 25 times or more of my spening rate, and then if my assets generate 4% (or more) income, then at the Trinity Study of spending up to 4% of my assets, I theoretically won’t ever run our of money.

Another idea is to spend no more then the inflation rate.

Another idea is to spend no more than the income generated by my portfolio.

Another way to look at it is that pension income (ie, Social Security) plus dividend/interest income meets or exceeds by spending rate then I have no need to worry.

Whew!

Smile If You Dare,

What do you mean exactly by “spend no more than the inflation rate”?

Be careful to blindly follow the 4% rule based on the Trinity study. The study had specific conditions (30 year timeframe, etc).

I’m not saying 4% isn’t possible or isn’t safe, but it’s best to apply it with your own situation and context in mind.

Thank you for taking the time to commment,

NMW

Fully agree with your ‘purpose’ questions! My 2 cents to add would be that there is a potential ‘unawareness’ risk as when you ask these questions, you are in a moment in time… you don’t know what you do not know or haven’t experienced before.

Something you could add on top of that is to add in questions like:

– What figures (past or present) do I admire?

– What kind of impact do I want to have?

– etc.

Then you will also be able to use these to plot your ‘course’. E.g. If you admire a leader or craftsperson, and you want to have impact etc. you will then ask yourself questions like:

– What skills would one need? What type of experience do I need or situations do I need to expose myself too…

– Where can I do that, or what type of job can help me here…

Doing so has helped me through certain ‘dips’ in my work-life, it helped me see opportunities were I thought there to be none. It made me put myself out there in situations where I was very much out-of-depth 🙂

Seems it turned out to be 3 to 4 cents 😉

PB,

Those are really insightful questions too! I’ll give them a try over the following days.

You’re right about unawareness risk. Then again, your purpose shouldn’t be set in stone. It can evolve according to your experiences and changing circumstances. At least, that’s how I try to look at it.

If my purpose never had changed I’d still want to be a 7-year old with tons of Legos, haha! 🙂

Glad to hear from you!

NMW

Good to see you are back writing articles – and what kind of article! Money is a tool which can create possibilities – nothing more and nothing less. In my own experience, happiness is a puzzle consisting of many pieces which if all fit together, lead to the wished end result. Money is one piece of the puzzle.

Thank you for the really kind words, Roy. I’m glad you enjoyed the article.

Money is one of the pieces of the puzzle, you’re right. It enables us to do all the other things that make us happy.

A very thought provoking read there, NMW. I am on a similar path to you and can relate to the scenarios you’ve described. Here is a very interesting piece from a guy who FIREd, and learned that FIRE is not necessarily a Valhalla with rainbow-farting unicorns gently floating past – maybe you already saw it:

https://livingafi.com/2021/03/17/the-2021-early-retirement-update/#more-15998

Well worth a read.

Thank you for sharing that article, TH. I just read it and found it very valuable.

It has left me a bit silent, to be honest. A feeling of being humbled.

It’s been almost 8 years since I started my DGI journey but I’ve come to realize that comfortable early retirement is still far away. I’m in a somewhat luxurious position of semi-financial independence, should things go awry I could easily quit my current job and wait half a year or even longer to find something new that I like. But being able to live off the dividend income is still a long way to go — especially in a non-frugal way.

DAC,

I think I’m in the same position. I could easily quit and do nothing or something that pays a lot less for the foreseeable future, but it’s not enough to live off indefinitely.

We’ll get there, slowly but eventually. 🙂

Cheers,

NMW

Couldn’t agree more! It’s the reason why on my blog I now talk more about my health than money. Priorities have changed and waiting until reaching FIRE to start working on my health was stupid!

You’re right about that! I’m glad you see it the same way.

I still have to check into your blog, but now I’m curious to read more.

Hi NMW, have you ever read ‘Work Optional’ by Tanja Hester? Among other topics she takes the reader by the hand to reflect on those hard ‘purpose’ questions. Following her instructions you get to distill them step by step into a life vision. It helped me a lot before making the big leap after having reached financial independence.