It’s my favourite time of the month again! Nothing gets my little financial independence heart beating more than tallying up my income and expenses at the end of the month. That’s because the difference between those two numbers remains the best indicator of how long it will take me to achieve financial freedom. Was I able to improve my savings rate? Let’s find out.

The past few months my savings rate has dropped a bit because of a number of reasons. First, I bought an expensive road bike and a whole bunch of accessories, maintenace items and clothing. So far this semi-experiment has only cost me money, but I’m hopeful that it’ll make me money in just under two years’ time.

Second, I’ve noticed my overall spending went up a little bit compared to last year. That’s no surprise when considering that I still lived at my parents’ for the majority of 2014, but that’s not the whole story. Apparently, social activities increased quite a lot over the past few months – something to keep an eye on, although I’d never forgo hanging out with friends just to save more.

All in all I’m still happy with where I’m currently at. Writing these reports is a good way to reflect on how I’m spending my income and thus making my dream of one day living financially free possible. On top of that, they also show you guys the though-process that goes into my spending and saving. I don’t want to proclaim everyone should go completely car free though, rather I want to show the financial consequences of that choice.

As most of you know, I use my own Excel spreadsheet to keep track of all things money. Feel free to check it out and see if it helps you too.

Let’s get down to the cold, hard numbers!

| Income | ||

|---|---|---|

| Paycheck | € 2,081 | As expected |

| Cycling | € 96 | Renumeration for cycling to work |

| Dividends | € 110 | Another good month |

| Other | € 155 | Side hustlin' |

| € 2,442 |

September’s income continued the stable trend of the past months, where my salaried income hovers around €2,000 and my side hustles bring in anywhere between €100 and €200. On top of that there’s the generous cycling renumeration I receive from my employer and which will in time pay back for the race bike mentioned earlier.

However, my dividends hit the second highest number since I started my journey towards financial independence. I can’t stress enough how impressed I am by the free-of-work income that’s rolling into my account each and every month, especially because September’s dividends make up almost 5% of my total monthly income already.

| Expenses | ||

|---|---|---|

| Rent | € 350 | As expected |

| Utilities | € 70 | As expected |

| Telecom | € 18 | Reduced compared to previous months |

| Groceries | € 99 | Right on target |

| Restaurant | € 58 | Higher than usual due to social obligations |

| Public transport | € 18 | Train tickets |

| Bike | € 162 | Winter clothing at 50% to 75% off |

| Healthcare | € 16 | Haircut |

| Clothing | € 32 | Had my shoes repaired |

| Sports | € 5 | Wall climbing |

| Subscriptions | € 8 | Google Play Music |

| Entertainment | € 19 | Beers with friends |

| € 855 |

Even though I’m happy with my income level, I try to focus more on my expenses since the impact I can have on them is much larger. As most of you know, I aim to save 70% of my income on average for 2015 – doable, but not an easy feat by any stretch of the imagination. Keeping costs low enough to reach that number hasn’t been easy this year, as I’ve explained above.

In September I fell short once again with a savings rate of 65.0%! And once again the cycling experiment is to blame because I had to buy warm clothing to get me through the colder autumn and winter months. It’s a good thing I got most of the clothes at 75% off during a clearance sale because warm bibs and shirts are ridiculously expensive.

Now, don’t get me wrong, 65% remains an incredible number, even for a single earner in his twenties with no dependants. If I fail to reach my goal because I’m spending money on a hobby – one that is furthermore likely to make money in a couple of months – you won’t hear me complain at all.

In absolute numbers my financial independence stash grew by a solid €1,587. Most of that amount went straight into 25 shares of Caterpillar Inc. (NYSE:CAT), which manufactures construction and mininq equipment among other industrial machinery. Caterpillar saw it’s share price decimated because of the economy’s cyclical nature. Even with solid fundamentals, much of what ails the company right now is outside of its control, but that doesn’t mean its long-term prospects are in danger – a perfect moment to scoop up a high-quality and high-yielding stock, in my opinion.

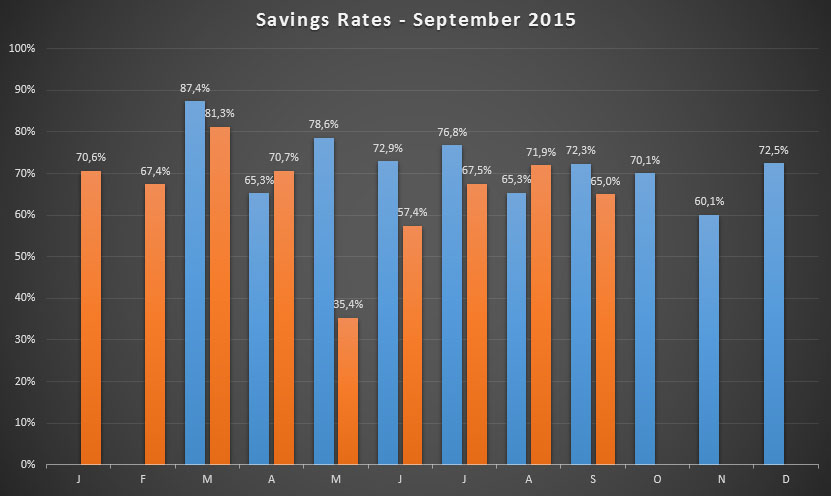

The graph below shows the past performance for this year, but also a year-over-year comparison since I started blogging.

This year I’ve saved 65% of my income on average, which is unchanged from last month. Even though the 70% threshold seems within reach, it’s still a long way off – the higher your savings rate, the harder it will be to increase it even more. However, a year-end bonus at work and a tax refund could provide a nice push towards the end of the year, so it’ll be close finish.

Here’s to a good last quarter for all of us!

Well done NMW! You’re still achieving an immensely high savings rate, whilst keeping expenses low, despite having more social and necessary expenditure recently. You should be proud of yourself! Keep up the good work.

We had a great September in terms of passive income, but not in terms of expenditure, but we somehow still managed to save about 30%, which is exactly our average over the last year or so. Fingers crossed, we can continue to save this portion as a minimum.

Cheers

M,

Thanks, appreciate your support as always! Spending is up a bit, but maybe that’s for the better. Can’t tighten your belt all the time, especially when it’s not necessary to achieve great results.

Good to hear your passive income is also shooting up! Also, you know when you’re doing great when it feels you’ve had a bad month and still manage to save 30% of your income! 😉 I’m sure you guys will find a way to increase that number over the coming months though.

Best wishes,

NMW

Well done NMW. I see you had to pay 16 euro for a haircut. How about finding a friend to cut your hair for you? I’m getting my haircut from Mrs. T and that has saved a few hundred dollars each year.

How do you like climbing?

I bought clippers a year ago and since then I cut my hair myself. There are a lot of movies on youtube to show you how to do it and to give some ideas. I consider my haircut not worse than before and even with clippers that doesn’t mean you will look like a soldier. You can work with different heights in different zones too!

Herbert,

Thank you for the advice! Like I answered Tawcan, I have difficult hair, so I prefer to have it done properly instead of doing a half-ass job myself or blaming one of my friends for ruining my hair.

Besides, €16 once in a while won’t break the bank when saving as much as I am!

Cheers,

NMW

Tawcan,

Getting my hair cut currently is the only recurring expense that I could cut out, you’re right. However, I have difficult hair (in that there’s a lot of it and it’s rather thick), so I prefer to get it done properly every six weeks instead of walking around with a bad hair cut and blaming one of my friends, ha. 🙂 Appearance isn’t everything, but it’s kind of important in my job, so I’ll gladly spend the money. Besides, €16 is relatively cheap.

I’m glad to hear Mrs. T is great at cutting your hair though – that’ll save you a bunch of money in the long-run. Do you also get to cut hers?

Climbing was fun, but not really my cup of tea! I enjoyed it for an hour or so, but got bored afterwards. I don’t think I could do it every weekend like some of my friends. And my hands and feel hurt like hell, so that probably doesn’t help either – I’m such a wuss! 😀

Cheers,

NMW

Still quite impressive you can keep your savings rate so high.

Thanks, DAC!

Pretty good management of your budget and cool income.

September was a “low” month but October is one of my 4 biggest ones in term of dividends.

Keep up the good work!

Cheers.

Farco,

I appreciate the compliment, thank you!

It’s kind of funny that October is one of your biggest dividend income months when September is often a bigger month for most people! Guess your portfolio is different to many of the other bloggers out there.

Thank you for dropping by and taking the time to leave a comment.

Cheers,

NMW

Yes it depends on the financial cycles of the companies; my quarterly dividend stocks pays me in October / January / April and July.

100% of Canadian companies for now (I’m waiting for the depressed $CAD to get back toward parity with the $US before buying any US asset, if it even happens one day…)

Cheers.

Oh the stock buying spree I could go on if I could save 65%. Awesome!

DFG

DFG,

Slow and steady also wins the race, buddy! You’re doing great over there, especially with your rather large family!

Best wishes,

NMW

Wow, our bare bones rental cost are already higher than your entire monthly expenses, and we don’t even have an expensive place to live for Dutch understandings!

Well done neighbour.

Team CF,

My rental costs are really low though, mostly because the place where I live is cheap with not much luxury comfort (which I don’t see as necessary) but also because I have a roommate. He really helps keeping costs down. Otherwise my expenses could easily be 50% higher.

Best wishes,

NMW

Funny you mention the shared accommodation, we were just talking about our scenario compared to yours (we are with 3 people, well, “2.5” actually) and it seems we are per person not even that far off from you! Seems were still doing something right 😉

Hey NMW

Despite missing your target, another incredible savings rate – well done! You are showing it’s done, having a balanced social life, keeping expenses down and saving an almighty part of your wages. Great stuff – keep up the great work!

Weenie,

Thanks once again! I’m trying my best to balance work life, social stuff and saving as much as possible and I think I’ve found a good optimum for the time being. I wouldn’t change anything to bump my savings rate by just 1%!

Hope you’re well over there too.

Cheers,

NMW

Hi NMW,

Landed on your blog a couple of days ago thanks to a link on spaargids.be if I recall correctly. (Article about ETFs & taxes in Belgium) Nice job so far!

As a fellow Belgian, I was wondering if you perosnally recommend any brokers? I’m planning on partially investing in index funds and eventually pick up some individual stocks. Leaning towards lynx.be at the moment because of the low costs.

Because of your research and knowledge you’ve done wrt taxes & the stock market, I figured you would have done the same to find a good broker 🙂

Thanks & keep it up

Hi jefke, i invest with degiro with accumulating ETF’s…. That’s free 🙂

Herbert,

Indeed, DeGiro is a cheap option for ETFs, but has some downsides too! I’d go for the custody account at the very minimum, but even then I don’t feel comfortable with their business model.

Free doesn’t exist in my book! 🙂

Cheers,

NMW

Jefke,

Glad to hear you guys took notice of me over there! Thank you for the kind words.

I personally use Binck for my ETFs and Bolero from KBC for dividend growth stocks. I enjoy Binck’s platform but it’s not as great as Bolero’s. The main reason why I continue using Binck is because I still have some free transactions costs because of referrals (if you want to, I can refer you too – this gets us €100 in transaction costs).

Lynx is cheaper indeed (marginally so), but some of the information on their website wasn’t fully transparent back when I was looking for a broker. I have no further experience with them, however.

If I had to recommend any one broker it would be Bolero: awesome platform, great customer service (also over the phone) and you can always walk into a KBC office when something else is up! Yes, you pay a bit more, but the service they offer simply is better (especially with regards to foreign withholding taxes and the likes).

If you’re looking to buy just ETFs you could look into DeGiro, but personally I’m not a fan of the way their business is run. On top of that it counts as a foreign bank account to the Belgian tax authority, so you’ll have to provide information on it in your taxes. You get to buy/sell ETFs for free though and you don’t have to pay the 0.27% stock market tax like with Belgian brokers.

Good luck and let me know what you decided on,

NMW

Started off with some a simple ETF strategy on my Keytrade, mostly because I was already a client. Probably going for lynx or binckbank for individual stocks. Already emailed lynx support about divididends coming from US stocks, they told there will be a tax of 15% (“bronheffing”). Seems like this is the same as what any other bank can do (reducing it from 30 to 15%)? Agree that the information on their website could be more clear.

If I end up picking binck, I’ll let you know, so we can set up a referral deal 🙂

Cracking figures there NMW and well done on another great month. Even though you’re below target I think most FIRE seekers, myself included, would kill for a 65% savings rate!

I’m looking at starting to bike to work as well. Unfortunately I’ll not get any cash from my employer for the privilege but every journey bike’d saves money on fuel for the car and hopefully makes me that bit healthier.

Fibrarian,

Not being on target isn’t the worst thing in the world when you’re still saving 65%, so I’m really happy to be where I am at the moment. When you consider that the main reason I’m not at 70% is a bike purchase that will make me money in a couple of months, that’s not a bad spot to be in!

Too bad you’re not getting a cycling incentive at work, but the reduced fuel and car maintenance costs should easily make up for that! And like you said, you can’t buy good health – it’s amazing how fast your physique improves if you cycle all the time (and this is coming from someone who was in tip-top shape before).

Best of luck biking to work,

NMW

Congratulations! Keep up the good work.

Thank you, will do my utmost! 😉

Hi NMW,

Congrats on the high savings rate for September. It is always impressive to see such a high rate. Well said when you mentioned finding the right balance in terms of friends and saving. I look forward to seeing your next stock purchases.

Cheers,

Dividendniche

Dividendniche,

Thanks for the encouragement! It’s not always easy to find a good balance between friends and saving, but I think I’ve done a great job over the past few months.

Cheers,

NMW

Hi!

Would you mind telling us what those secret “Hustlin'” incomes are based upon, since e.g. ~150e ain’t a bad amount of money.

An another student here trying to learn more ways to make money on the side :).

No need to answer if it gets personal etc., and excuse me if this question already has been asked and answered!

Great job btw!!

William,

The secret side hustles mostly relate to teaching English in my off hours, income from this blog, building and maintaining PCs for people I know, and the like. Find something you love and make money with it, would be my advice! 🙂

Cheers,

NMW

Yes, I do always have a vision on making money out of most situations :p .

Just nice to know what other people are doing regarding this!

Thanks!

William

NMW,

Great job on the savings rate this month.

I believe once a person comes to the realization that expenses is every bit as important as income, they’re already a good portion of the way to financial independence.

To find good examples of this, just look at celebrities who often make more in one year than the average person will see go through their hands in an entire lifetime. The income was huge but the expenses simply inflated right along with it so there was no long-term benefit.

Keep up the hard work.

– Ryan from GRB

Ryan,

You’re absolutely right! Income is important, but how much you spend of that income decides if you’ll ever become rich or not. Being rich is only relative to how much you spend, so keeping the expenses low is a must if you don’t make big bucks (as most people do).

Celebrities are one of the best examples of people who make a whole bunch of money, but spend it all. Yes, they’re cash flow rich, but very poor all things considered.

Cheers,

NMW

I hear that argument all the time, but it’s only valid up until a point. Someone raking in 30K pre-tax annually will probably never become ‘rich’, even at a 60-70% savings rate (or it will take that person until retirement). To me, focusing on maximizing one’s income is paramount, paving the way for a much easier path to financial independence. Imagine how much faster you would get there if you’d take home 3-4k every month instead of 2. Even at a much lower savings rate. So not only will you reach FI much quicker, you will do so in a way that enables you to still fully enjoy the nice things in life.

Keep in mind, bloggers such as currycracker and moneymoustache had six digit incomes for most of their (short-lived) careers, making it significantly easier for them to retire so damn early. So focus on savings (and investments), yes. But income maximization comes first by far.

Mike,

You’re right in a way, but I don’t agree with your point of view because of a couple of reasons:

1) “Rich” isn’t an absolute standard. It’s a very personal and thus subjective Dollar/Euro/GBP amount that’s highly dependent on your living situation, country, health, etc.

2) Making twice as much as I am now is hardly possible unless I was working over 80 hours a week. I’m already a high earner (especially for my age) and in the highest tax bracket and I’d lose between 50-65% of every extra Euro earned… Not worth the time in my book.

3) I am enjoying the nice things in life! Someone who’s trying to reach Financial Independence through deprivation is doing it wrong in my book.

4) Most people don’t have the skillset to earn a boatload of money. Most of the financial independence blogs are run by well-educated folks who have high-earning jobs or the skillset to start their own company. The majority of our fellow citizens didn’t have or don’t have the same privilige.

Thanks for chiming in! And best of luck maximising your income – I sure am trying to!

Cheers,

NMW