The name of the game still is financial independence, so let’s see how I’m doing at one of its most important aspects: building and maintaining a gap between my income and expenses. Swiss Mustachian Post noticed I dropped off the 70% platinum podium place in his Blogger Savings Rate Index last month, but that doesn’t mean I’m not determined to climb back up.

If you want to know how long it will take you to reach financial independence or when you can comfortably retire, then your savings rate is by far the most important indicator. Not only does it show you how much money you manage to sock away each month, it will also provide you with a clear financial freedom date.

It shouldn’t come as a surprise to you guys that this is the main reason why I constantly log every little expense and all incoming cash. Over time, I’ve managed to cut out all unnecessary spending, apart from a couple of hobbies and a drink here and there with friends, with only one goal in mind: to quickly build my savings rate.

The past few months I’ve started sharing these numbers on this blog to show everyone that’s interested in achieving financial stability or independence that it’s possible to do so on an average worker’s salary. On top of that, everytime I publish these articles I keep myself accountable to a large audience that continues to motivate me or sets me straight whenever necessary.

As usual, you can find the breakdown of my June income and expenses below.

| Income | ||

|---|---|---|

| Paycheck | € 2,081 | As expected |

| Cycling | € 96 | Renumeration for cycling to work |

| Dividends | € 56 | Another good month |

| Other | € 250 | Side hustlin' |

| € 2,483 |

When tallying up all income sources in April, we can see a decent amount of income yet again. At over four fifths of June’s entire income, my monthly salary remained at its usual level, with a bunch of dividends and a little hustling on the side pushing the numbers higher like in previous months.

However, new for June is the “cycling” category. Indeed, I recently bought a brand-spanking-new road bike that I ride to work, as regular readers might know. As an incentive and to promote sustainable transportation I’ll receive almost one hundred Euros of tax-free money every month from now on from my employer and the Belgian federal government – awesome.

| Expenses | ||

|---|---|---|

| Rent | € 350 | As expected |

| Utilities | € 70 | As expected |

| Telecom | € 20 | As expected |

| Groceries | € 174 | Three birthday parties |

| Restaurant | € 17 | Work lunch |

| Public transport | € 25 | Train tickets |

| Bike | € 346 | Equipment for my new road bike |

| Games | € 5 | Metro: Last Light |

| Subscriptions | € 8 | Google Play Music |

| Entertainment | € 28 | Beers with friends |

| Gifts | € 18 | Presents |

| € 1,058 |

The outgoing money is less awesome though. It’s not often that I spend over one thousand Euros in any given month, but June is the second month in a row. Again the new road bike is the culprit because I bought some equipment to keep it in pristine condition. On top of that I bought a new cycling outfit because I now ride to work more often and don’t own enough clean jerseys to get through an entire week.

All in all, I’m not too happy about having two spendy months back-to-back, but these expenses will not only save me money in the future – mostly bike maintenance costs – but even increase my income quite significantly through the cycling renumeration.

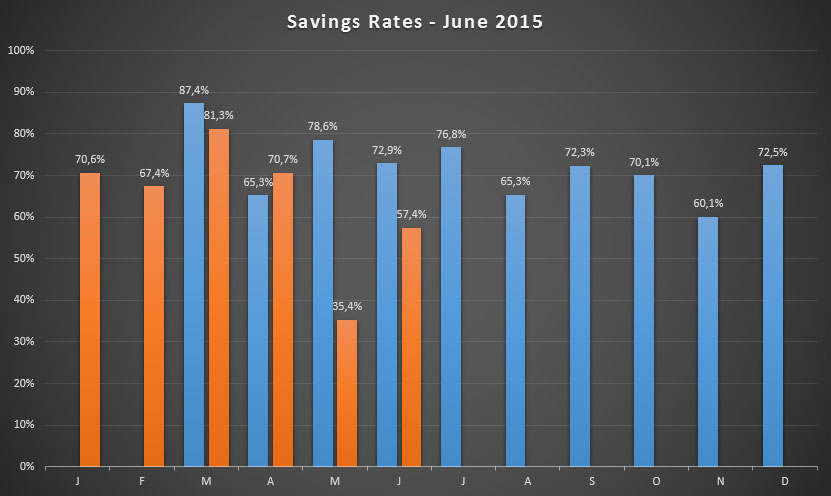

In total I managed to save €1,425 or 57.39% in June. These savings were immediately invested in new hiqh-quality dividend growth stocks, such as Spanish utility Enagas SA (BME:ENG). With its thousands of kilometres of gas pipelines Enagas will contribute about €40 to my annual income from now on.

At the moment I have saved 64.2% of all my 2015 income, a 1.1% drop from last month’s number. That’s well below my 70% goal for this year and quite a significant pull-back from April’s 74.1% average number. It’ll be interesting to see if I manage to jump back over the 70% threshold, but I expect that to be difficult.

At the moment I have saved 64.2% of all my 2015 income, a 1.1% drop from last month’s number. That’s well below my 70% goal for this year and quite a significant pull-back from April’s 74.1% average number. It’ll be interesting to see if I manage to jump back over the 70% threshold, but I expect that to be difficult.

Even with the additional cycling income, my usual year-end bonus and a rather large tax refund, there’s not much wiggle room anymore. While I prefer a smooth 70% annual savings rate, you won’t hear me complain if I land on a solid 65% rate, especially because I now get to enjoy my new road bike. I already feel like I’ve won for life!

How were your June numbers? Are you still on track to reach your savings goal with half of 2015 under your belt?

Happy belated birthday.

I was wondering what your side hustlin’ activities entail. I don’t think you’ve ever mentioned it. I ask because they are a substantial part of your monthly income (and perhaps replicable by me :))

My guess: advertising income from from this website 🙂

Ubist,

Indeed, advertising income slowly grew into a significant part of the additional income!

Cheers,

NMW

Luke,

Thank you! 🙂

Most of my side activities include building PCs for people I know (I charge a really small fee) and tutoring. The number also includes my advertising income from this website, like Ubist said. On top of that, there’s insurance payouts from doctor’s visits and the like.

It adds up after a while!

Cheers,

NMW

I would venture to say that the NMW blog is starting to earn some decent online income. Hope you get to earn more and more!

DGI,

Indeed, online income is a major part of my side activities, but I also build and repair computers , and tutor a couple of children whenever I have the chance. Both are great ways to earn some extra money.

Best wishes,

NMW

Hi Nmw,

Seems like a solid month there. My savings rate was a tad under 50% but I had to pay my property taxes in june.

Cheers,

G

Geblin,

There are worse things than nearly missing out on a 50% savings rate when you also paid your property taxes! I’m sure you’re still maintaining an incredible savings rate.

Cheers,

NMW

Hey NMW,

Thanks for sharing the word about the #BSRI, I find it very useful for the FI wannabe to check who they should follow closely if they wanna learn things from the best in class!

Regarding your spendy months, first above 50% remains a honorable savings rate. Second, buying cycling stuff is for me more to be seen as an investment that a withdrawal!

Healthier condition = less healthcare fees on the long run.

You’re doing it great bro! Keep it up!

Cheers,

MP

MP,

You’re welcome, always glad to share a great initiative! 🙂

Don’t get me wrong, my savings rate remains excellent, but it’s not enough to get to where I want to be at the end of the year, namely 70%. You’re right about the health benefits of cycling to work and in my free time a lot though.

Best wishes to you and your family,

NMW

Dear NMW,

Congrats for this saving, I am pretty sure that MP as myself would loved to have this saving rates…

Cheers,

RA50

RA50,

Thank you! I’m sure you two will get to those levels as well if you continue to invest and reap the rewards in the form of fat dividend cheques. 😉 Keep it up!

Best wishes,

NMW

Excellent progress, NMW.

I am pretty impressed by how generous the cycling cash is. It is a lot more than I was really expecting. Very nice indeed. Healthy in mind, body and wallet!

You still have plenty of time to pull your savings rate above the 70% mark! Keep plugging away!

DD,

It’s a lot of money indeed, which is the main reason why I went ahead and purchased myself a high quality bike. At €0.21/km and a 60km drive to and from work (in total) the numbers add up quickly. If I biked to work every single day I’d be earning over €250 a month.

Let’s hope I manage to get back up to the 70% range. It’ll be a difficult task, but that hasn’t stopped any of us before, right?

Best wishes,

NMW

Hi NMW,

Congrats on the saving rate achievement once again!

Could you share what are these Side hustlin in the income part as they tend to be quite stable on monthly basis :).

Assetwings,

Thank you for your support, greatly appreciated!

As I’ve mentioned in reply to Luke, most of the side income stems from building computers and tutoring. On top of that there’s the advertising revenue from this blog and some odd jobs here and there. The reason why it’s relatively stable is because of the tutoring and ad income.

Hope you find some nice side hustles as well,

NMW

Still a great savings rate there NMW! Yes, another spendy month but it’s not every month that you will be shopping for cycling stuff! I see your spending on your bike/gear as ‘investing’ as they enable you to generate more funds, ie from your employer!

Weenie,

Let’s hope I don’t have to shop for cycling stuff every month, that would kill my savings potential! 🙂

Most people see the cycling gear and road bike as an investment in myself and my health rather than an actual expense – let’s hope that holds true over time. Besides, I managed to bump up my paycheck with a solid 5% through the cycling cash from my employer.

Best wishes,

NMW