Two weeks ago I wrote about the Win for Life lottery in Belgium and how to build your own Win for Life fund. As you all know, I’ve been doing so since August of last year, when I purchased my first individual dividend growth stocks. Since then I’ve kept close tabs on all dividends hitting my account and today I’d like to once again share my progress towards building a sustainable passive income stream that covers all my living expenses.

I publish these write-ups for the sake of transparency, but also to keep myself motivated. Financial independence and dividend growth investing are long-term strategies, so it is important to keep my spirits up. Even though the stock market’s rollercoaster ride continues over here in Europe, dividend growth has been both steady and remarkable over the past few months. This has proven to be a massive boon to my anxiousness to press onward.

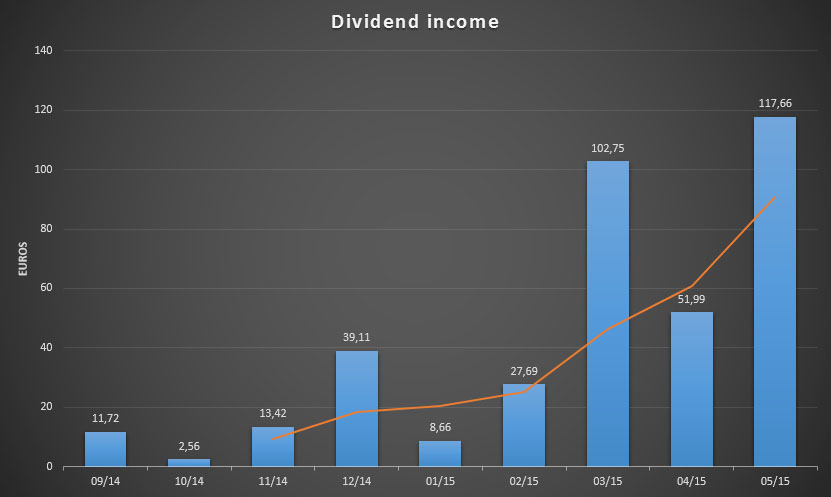

In March I crossed the €100 dividend income mark for the first time because many European stocks pay an annual dividend instead of sticking to a bi-annual or quarterly payment scheme like UK and US companies often do. Of course, it doesn’t stop there. My assets have been even busier than even myself, so I’m glad to report another record high this month.

Let’s dig through this month’s numbers!

Dividends Received

For 2015 the goal remains free-of-work income to the tune of €500 through high-quality dividend paying businesses from around the world. Five big ones might sound like a lot of money, especially when you take into account both foreign and domestic taxation, but I’ve found that it’s relatively easy to put together a portfolio that throws off that amount of money each year.

At the moment my dividend growth fund should conjure up a little under €700 in forward dividends every single year, so it’s safe to assume that I’ll manage €500 this year. That’s a lot of fresh and freely available money! And the best part? The total amount will continue to grow, even if I decide to stop buying new stocks.

All dividends below are listed in Euros, and are after foreign withholding taxes and a 25% income tax levied by the Belgian federal government.

| Date | Ticker | Company | Dividend |

|---|---|---|---|

| 01/05 | DE | Deere and Company | 2.33 |

| 01/05 | T | AT&T | 9.63 |

| 01/05 | VZ | Verizon Communications | 6.08 |

| 06/05 | ABI | Anheuser-Busch InBev | 15.00 |

| 15/05 | HOMI | Home Invest Belgium | 47.81 |

| 15/05 | PG | Procter and Gamble | 3.26 |

| 21/05 | KIN | Kinepolis Group | 25.50 |

| 29/05 | RB | Reckitt Benckiser plc | 8.05 |

| Total | 117.66 |

Eight payments – eight companies that managed to once again increase their earnings and rewarded their shareholders with a larger dividend cheque. As you can see, the majority of May’s income stems from three Belgian stocks. While it may seem like I have introduced a strong home bias into my portfolio, the high Belgian portion of May’s income simply stems from the fact that most Belgian companies distribute an annual payout this time of year.

In total I made just under €118 in dividends in May, which is the highest number yet – awesome! Home Invest Belgium‘s (EBR:HOMI) dividend put in much of the legwork this month, mainly because the Belgian REIT is one of the largest positions in my portfolio, but also because its subjected to a tax level of just 15%.

People often say that there’s no such thing as a free lunch, but I would beg to differ. I usually spend less than 100 Euros on food monthly, so that means I basically ate for free the entire past month. As you can see, I am already reaping the fruits of my efforts and this kind of tangible progress motivates me to continue going the extra mile in the future.

Growth

Unlike me, the stocks and the businesses I own a small piece off know no downtime. Their operations and hustling continue long after I’ve gone to bed and start plenty of hours before I get up in the morning. By doing so, they grow in size and subsequently build their earnings. That in turn means more future dividends for me, especially if I continue to invest over time.

The graph below captures the effect of this proces beautifully. As you can see, the trend line below moves up relentlessly, partly because of the annual payouts mentioned before, but also because I have continued purchasing new stocks and because of the organic dividend growth inherent to the strategy.

The strong gain this month is nu surprise when you take into consideration that first-time payers Anheuser-Busch InBev (EBR:ABI or NYSE:BUD), Home Invest Belgium (EBR:HOMI), Kinepolis Group (EBR:KIN) and Reckitt Benckiser (LON:RB) make up the bulk of May’s payout. Still, two quarters ago my passive income was a meager €13.42 compared to €117.66 now.

Quarter-over-quarter growth tops out at 400%, a massive increase yet again!

Going forward

When adding May’s payout to the dividend piggy bank, total passive income from investments for 2015 jumped to €308.75 or 61.75% of my annual goal. Whoa, we’re just five months into the year and already we’re way passed the midway point. European companies sure do give a nice boost at the beginning of the year, it seems.

Nevertheless, the speed at which new and increased dividend payments hit my account will taper off over the coming months. That’s why I’ll continue to purchase small chunks of large corporations worldwide. For example, a couple of days ago I added the British utility National Grid plc (LON:NG) after reading about it on both There’s Value and Dividend Drive not too long ago.

In my book, you simply can’t go wrong with a government mandated utility the size of NG. Consequently, I’m happy to now own 100 shares of National Grid, mainly because its high yield pushes my forward dividend income higher by roughly €45. That’s a hefty additional paycheck I can reasonably rely on for many years into the future.

Are you happy with this month’s dividend income like I am? Be sure to let everyone know in the comments!

Thank you for reading and for your continued support.

Another awesome month, well done you! 🙂 Are you going to change your target for income over the year, as you’re already over 60% of the way there?

Another great month Waffles. You’re coming off a low base, but 400% is HUGE. The chart says it all. Have a great evening.

-Bryan

The more I read your and other dividend investing blogs, the more appealing the investment strategy seems to become. Impressive rate of return to say the least. Congrats.

With the sale of the house nearly completed and the move back to the Netherlands scheduled, its time to start dividend investing in the coming months! Looking forward to your future posts to help us get started.

Congrats on another solid month of growth. Its crazy how quickly you can make progress when youre first starting out and those first fee dividend checks are great reinforcement of the strategy. Keep up the good work.

Loving that trend line going higher and higher. Just shows you how good of a progress you’re making. Keep it up.

Awesome month of you NMW. We’re all proud of you. Success creates more success. You see that every month with your dividend updates. Keep tracking your progress and staying on top of your numbers and BOOM! PoW! You’re gonna do it up.

Thanks for sharing your journey with us and I wish you continued success. Cheers my friend.

Congrats, NMW! What’s your dividend return in percentage for your entire portfolio and each stock?

Great month NMW, great to see your growth of your dividend income month by month. Keep up!

Excellent progress, NMW. Another €100+ month!

As has become increasingly the case, your progress is mirroring mine quite closely! I will give a fuller review when my own post gets published early this week.

However, I am about 61% towards my annual target with another £100+ dividend income month. Though it must be said that this time–unlike before–I share none of the companies you hold. Not even the British consumer stalwart, Reckitt Benckiser. Though I will eventually hold RB. It is just a little too expensive for my liking at the moment!

Thanks for the link to my National Grid post. I am glad you found it of interest.

It is an excellent company. Of all the utilities in the UK it is by far the most solid looking (even including the water utilities). I suspect it will see some share price weakness when interest rates rise. However, hopefully that will be time for another top up!

Keep up the good work. Even if your dividend payments do taper off a little you’re going very strong indeed. My next couple of months are weaker as well. However, it should still see me making sterling progress towards my goals!

Nice income! May was good for me too thanks to big yearly dividends from two Belgian stocks.

Congrats on another record-breaking dividends month, NMW – it’s awesome that it mean that you whole food budget was covered…and then some!

A fantastic quarter over quarter increase – you must be really happy and motivated with this kind of progress! Well done!

NWM,

Congrats on another record breaking month! I have just topped my all time high with a whopping $25 in divi income for may as well. The shape that is building with your monthly income updates is inspiring, every few months there should continue to build a new high.

Keep up the great work with regards to investing and writing!

Cheers,

Dividend Odyssey

NMW,

I wish I could hop in a time machine and go back to 1995 and find someone like you to use as a mentor. You are on another level with your mind set and have won the game of life in my opinion! Great job and keep the focus!

MDP

Congrats on the solid growth, we share a few common names up there in DE, T, VZ and PG. Keep up the great work!

I know what you’re saying about EUR-based dividend in the early months. It seems most/all euro stocks are focussed on payments in Q1/2 (March-May timespan mainly).

As result payments (and income) tend to get very unstable very quickly.

Shell/total/unilever/banco santander come to mind as the only ones so far with a quarterly dividend. Luckily these are also some of the biggest names out there. Also plenty bi-annual stocks to choose from, from utilities to consumer staples to communications companies.

Those tend to help cover the late months, and altough they also push the earlier months up even more at least the relative difference goes down.

Other areas of the world have plenty to choose from, but then you face a ~30% currency risk (just look at the EUR-USD in 1 year time) which doesnt exactly help stabilize the income.

Going to be interesting to look into the best approach on this. Take the currency risk, or take the annual payments, and withdraw 1/12th of the lump sum each month?

NMW,

Nice job! Big month, over halfway there.

I remembered your post about video games a while back, reminds me because I have started to view investing like a game such as Civilization (if you’ve played). As it is a game that promotes similar compounding and the like.

Also in reference to the ‘no such thing as a free lunch’, I recommend reading Robert Heinlein’s “The Moon is a Harsh Mistress”. There is an entire section called TANSTAAFL – “There ain’t no such thing as a free lunch”. He says it because even if you are getting something for free someone had to do something for you to get it. In this case you did the work saving and smartly investing, and the company continued to play its game. So don’t take away your effort you put in.

-Gremlin

Fun! These are the best posts to read and write. Keep that dividend snowball rolling and growing. I see we have PG in common for the month of May. I’ll be posting my results soon. Thanks for sharing this inspiring update.

Congrats NMW! Looks like an awesome month for you and even if the payments slow down, at least the additional purchases you plan will help out and add to your future income.

Hopefully more EU and UK stocks will start moving towards a quarterly payment; I’ve seen a couple of UK stocks transition recently but maybe it costs companies more to pay on such a schedule.

I need to get on with my own May results now!

Best wishes,

-DL

Great Job Waffles! Your plan is working! I’m excited to the see the trend line a year from now when you have more months under your belt and its even more defined.

Strong growth. SMART dividend goal was set!

Hey man, thanks for the mention. Love these posts so much, it just goes to show what a bit of effort can achieve when you don’t waste money and invest it in quality companies instead. Well done!

Cheers

Quick question, did Bolero charge tax on your South32 spin-off shares? I received my spin-off shares from Binck last week but so far they haven’t taken any money out of my account to cover the taxes.

NMW,

Congrats on the new high in dividend income. Although, in this game, you’ll be saying that same thing every month or two 🙂 .

Does Belgium withhold 25% of dividend upon distribution, like an income tax? Or do you just need to make estimated payments or pay at the end of the year, like in the U.S.?

Retire29