With the publication of my dividend income a couple of days ago you know a follow-up post containing my savings rate is about to make an appearance soon. You don’t have to wait any longer now that I’ve checked the numbers one final time in my budget tracker. Read on to find out how much I managed to save during a rather eventful February.

While 2015 started out great, February was a bit all over the place. Having pushed myself too far at work and in my personal life, my body finally decided to give in. I don’t often fall sick and I definitely can’t remember the last time I felt so miserable, but it clearly was high time to cut back on work and after-work activities even though I love both of them.

You see, it’s not just peer pressure, irrational savings behaviour, or fear of the stock market that can kill your financial independence dreams. Your own behaviour, financial or otherwise, could very well constitute a roadblock in and of itself. I almost lost sight of that, but honestly, what’s the point of becoming financially free if I’m forgoing good health?

Let’s jump into February’s income and expenses to see if my epiphany had an outspoken effect on my savings rate.

| Income | ||

|---|---|---|

| Paycheck | € 2,069 | As expected |

| Dividends | € 27 | Picking up steam compared to last month |

| Other | € 231 | Side hustlin' |

| € 2,327 |

Sweet! Salary increase! Because February marks my job’s first anniversary, my employer thought it fit to bestowe a higher paycheck upon me. It’s not much, but I’ll take an increase of a little over 3% after taxes any day since it’ll go a long way towards keeping up an average savings rate of 70% for 2015.

I was furthermore pretty happy to find that my dividend portfolio threw off over €27 already, making it the second highest month to date. On top of my 3% paycheck increase, I actually gave myself another 1% increase by saving and investing past salaried income. That’s fresh and immediately available income that I didn’t have to do a thing for apart from being invested in high quality businesses.

| Expenses | ||

|---|---|---|

| Rent | € 350 | As expected |

| Utilities | € 70 | As expected |

| Telecom | € 20 | As expected |

| Home maintenance | € 3 | Light bulbs |

| Groceries | € 89 | Below my goal of €100 |

| Restaurant | € 14 | Date night |

| Doctor's visit | € 50 | Will be reimbursed later |

| Healtcare | € 22 | Drugs and a haircut |

| Clothing | € 74 | Buttoned shirts |

| Subscriptions | € 8 | Google Play Music |

| Entertainment | € 33 | Drinks with friends and a party |

| Charity | € 25 | Donation to cancer research |

| € 758 |

February’s outgoing money contains a lot of familiar and recurring items, but also two rather large one time expenses. First, my physician was happy to find me sniffing and coughing in his waiting room twice, which cost me €50. Thankfully that money will flow back to me through health insurance. Second, I bought two new buttoned shirts on sale for €74 as to make sure that my wardrobe remains fully stocked.

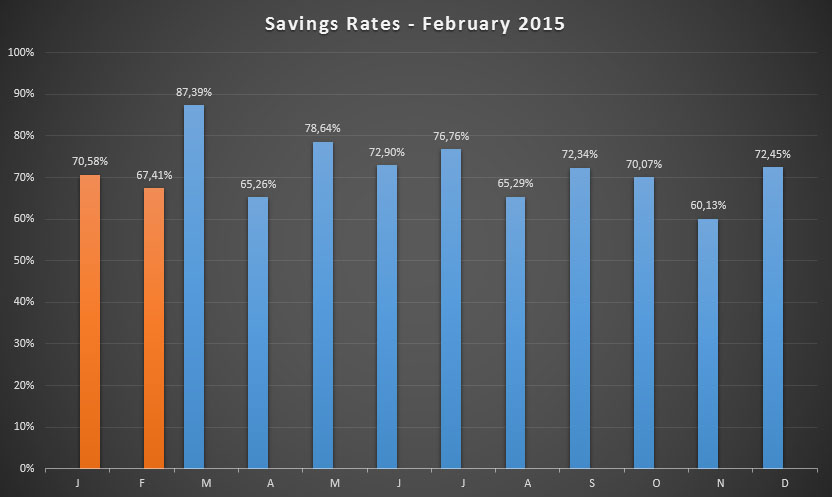

As a result, I fell short to make my 70% goal this month with a savings rate of just 67.4%. While that’s too bad, I don’t see this as a failure. Remember that I’m aiming to save 70% on average for the entire year and that there are ten more months to make up the admittedly very small difference of this month. Besides, anybody saving well over 50% of their income is bound to make rapid progress towards financial freedom!

Another reason why I shouldn’t sob is that I still managed to save €1,569 in absolute terms. That’s more than a lot of fully employed people make for an entire month, which says something about how much I make, but even more about how low I manage to keep my expenses. Those savings were immediately deployed on the Swiss stock market to purchase a stake in pharma giant Roche (VTX:ROG) and to prop up my personal pension fund.

The graph below shows how I’ve done over the past few months. As you can see, and this comes as no surprise, February doesn’t differ much from other months. The orange bars show 2015’s savings rates, while the blue bars contain my performance in 2014 for comparison.

Next month I’ll be able to truly start comparing savings rates across years, which should prove interesting. As I slowly increasing my monthly cash flow, my overall savings rate should follow the same upward trend, unless I succumb to lifestyle inflation. For now, though, we’ll have to make due with my average savings rate for 2015, which comes out at 68.5%.

I sincerely hope you enjoyed this post as reading about savings rates is a not-so-secret guilty pleasure of mine. I’ve already devoured some of the income and expenses reports that popped up over the past few days, but I’m looking forward to reading more. So that’s why I’m now off to check out your blogs and see what’s what! If you don’t have a blog, be sure to leave a comment on how you did last month as I’d love to hear about your progress towards financial freedom.

Thank you for reading and for your continued support.

Look NMW, 68.5% saving is JUST amazing, you can really be proud of you and don’t forget the ROG.VX dividend that increase your Saving rate next month.

Just bought 200 additional shares this morning at 1.4% discount.

Cheers, RA50

RA50,

You’re absolutely right that 68.5% is fantastic – no complaining on my part! March should push my overall savings rate higher with a lot of companies forwarding me a divindend indeed.

Man, you’re moving tons of money about. Here I am with just five shares! 🙂

Keep it up over there,

NMW

NMW,

I want to retired by 50, so there is no way I can just wait to much, I need to push.

I am preparing a post on our mix investment strategy (dividend and capital gain),hope you will like it.

Cheers and good weekend.

RA50

Looking forward to it, RA50! Love the Swiss perspective on things!

Hi NMW,

Nice savingsrate. For the cancer research you would get a 50% taxreduction if you paid 40 EUR ( in most cases). Keep up the good work.

Cheers,

G

Geblin,

I forgot about that, but it doesn’t matter too much. It’s for a research fund that I’m close with. Next time I’ll donate at least €40! 🙂

Cheers,

NMW

I think you can give 15 € more and combine those on your tax form for a return. Doesn’t have to be the same charity! 🙂

Your savings rate is amazing and inspiring.

Thanks, DD!

“but honestly, what’s the point of becoming financially free if I’m forgoing good health?” Nothing at all mate. Becoming free is all about enjoying life right!? But falling sick can just happen. Just got to remember to ease back every now and then.

But you are smashing it again buddy! Keep it up.

(PS – me and Mrs Z are thinking of a potential summer trip…Bruges or Ghent? 🙂 )

Mr Z

Do both? I studied in Bruges and work in Ghent. Both cities are very nice to visit. If you visit Bruges make sure you visit The Bruges Beer Museum.

Cheers,

G

Exactly! Both beautiful cities!

The Beer Museum sounds superb. Will check it out! 🙂

Mr. Z,

Falling sick can definitely happen, but when it’s because you haven’t been treating yourself right (not enough sleep, etc.), you know it’s easy to overcome by simply changing your ways. So that’s why I plan on easing back every now and then like you said.

Why not both like Geblin already said? 😉 Belgium is really small, so it’s not difficult to get around to a couple of cities. You should do Brussels too! Let me know what you decide on, maybe we can arrange a meet-up.

Cheers,

NMW

Not a bad shout, pop across on the Eurostar and take in a couple of cities. Happy days 🙂

Yeah – if we head across to Brussels as well some waffles would be good 😀

Mr Z

3% salary increase is pretty sweet, what’s sweeter is that you managed to save 67.4% of your income. That’s really impressive! I hope you’re not eating too many waffles to save. 😉 :p

Tawcan,

More money, less problems! 😉

No waffles here, I’m more of a pancake guy anyway. I hope to push my savings rate over 70% again next month.

Hope you, Mrs. T and Baby T are great over there,

NMW

Your savings rate is just unbelievable!

I appreciate the kind words, Nuno!

NMW,

Amazing as always. It actually seems disappointing when I see you report a savings rate below 70%. I guess that is a testament to how high a bar that you have consistent set and met month in and month out.

Awesome job!!

MDP

MDP,

Ha, that’s exactly how I feel – even though it’s a bit silly. In the long run the difference between 67% or 70% is much smaller than between 12% and 15% even though in absolute numbers there’s no difference at all.

Thank you for your continued support.

Keep it up over there too,

NMW

Great job NMW. Wicked month. Your snowball will just power up slowly and surely so keep it up. Thank you my friend for sharing your journey with us. Take care and see you soon.

Dividend Hustler,

Thank you for your encouragement! It’s comments like yours that keep me going and make the road towards financial independence so much more enjoyable.

Glad to share my progress and thoughts with you guys!

Best wishes,

NMW

Wow, impressive savings rate. You even invested in button shirt for date night, that’s even more impressive. 🙂

Vivianne,

Haha, I wish I could say it was for date night, but I actually always wear buttoned shirts. My date appreciated it though! 🙂

Best wishes,

NMW

Typically unreal, my friend! You are clearly an inspiration to many of us! Congrats on the raise 🙂

Ryan,

You saying that means a lot to me, thank you! If it wasn’t for the encouragement and inspiration we all give each other, I think a lot of people would have quite the race towards FI a long time ago already.

Best wishes,

NMW

Hey NMW

67.4% is just absolutely awesome, despite being short of your goal – it’s incredible that you can maintain such a high savings rate month on month!

And congrats on the pay rise too! I got a similar one which will kick in in April.

Hope you are all better now after your illness last month – sounds like you were run down.

Weenie,

Congrats on your own pay rise! It’s funny how such a small percentage can mean quite a lot in absolute numbers. It’ll definitely make our journey towards financial independence easier.

I’m doing much better now! Catching enough sleep every night works miracles. I really was run down, but I’m glad that I noticed it before any real damage was done.

Thank you for checking in again,

NMW

That’s really an impressive savings rate! I know a lot of people who have a higher salary, but by far less savings like you! A frugal living is really a key to become financially independent in a moderate time scale. Keep on!

Regards

Marco

Marco,

Unlike many others I don’t have children or a spouse that depends on me, so it’s far easier to live on very little. With that being said though, many people making a lot more could very easily scale down their expenses and maintain a much higher savings rate, like you said.

Best wishes,

NMW

NMW,

That is a great % you have there. It is very nice and smart to do it when you are younger too, so you can put that money to effective use sooner.

– Gremlin

Gremlin,

Exactly! Starting sooner will make the effect of compounding growth so much more pronounced.

Cheers,

NMW

NMW, it is admirable to manage a high savings rate like yours and to make a donation anyway. Well done!

Charlie,

If you have the means, it’s only right to put them to good use once in a while and donate to something you strongly believe in.

Cheers,

NMW

Oh no a 67% savings rate!!!! Seriously though, while it did not hit your goal that is still incredible.

PMU,

Haha, you’re right! No reason to complain here. It’s like My Dividend Pipeline said a couple of comments ago… Even though 67% is amazing, you become disappointed because you don’t make your goal.

I’ll get there in March though, mark my words! 🙂

Cheers,

NMW

Hi NMW,

Congrats on a great month – 67.4% is still an amazing achievement. Based on last year’s results for March you should be able to regain some lost ground!

Best wishes and look after your body – you’ll feel good now and likely have fewer medical bills later in life too.

-DL

DL,

Thanks, buddy! I’m really happy with my savings rate even though I didn’t achieve my goal completely. March this year is going to be pretty great too, but for completely different reasons as last year – I’m writing a post about that as we speak.

I’m on top again health-wise, thank you.

Cheers,

NMW

Great savings rate! I think you should be pleased; you are doing fantastic 🙂

Thank you, Nicola! I definitely am!

Hey mate,

Congrats on the not so bad savings rate 😉

I hope you recovered well?

I had the same issue from last December until end of February: too much work, near-burnout.

Thankfully, I took a step back before it was too late and I re-organized everything (mainly at work) so I can now breath and enjoy life as I should!

Funny thing is that I’m currently reading “Essentialism: The Disciplined Pursuit of Less” as one of my 2015 goals and it is simply the perfect timing. This helps me on re-focusing my life on what truly matters!

I can only recommend you this reading mate.

Take care!

MP

MP,

Thanks, buddy!

Recovery wasn’t swift, but it was effective. I’m feeling much better now. More sleep and less rushing does wonders. I’m sorry to hear you experienced something similar the past few weeks, but glad to hear you realized it soon enough. Enjoying life shouldn’t start with FI, we have to make the best of it right now too! 🙂

I’ve never heard of the book you’re reading, but I’ll definitely check it out. Sometimes it’s the small things that help us re-focus on what really matters – and that’s ultimately what financial freedom is all about anyway!

Best wishes and hope the family is great over there in Switzerland,

NMW

Date night?

DFG,

Nudge nudge, wink wink!

Had a lot of fun, we’re probably meeting up again next week.

Thank you for dropping by,

NMW