With energy prices mostly trading sideways for the past few years and worldwide economic growth being slow, times have been rough for Big Oil. Despite these unfavourable market conditions French power house Total SA remains one of the best dividend paying investments of all large oil companies.

Total (EPA:FP) is a major energy player, active in over 130 countries and almost every sector of the oil and gas industry. With a market cap of over €100 billion and sales exceeding €189 billion in 2013 the French oil giant is the fifth-largest publicly-traded international oil and gas company in the world.

Total (EPA:FP) is a major energy player, active in over 130 countries and almost every sector of the oil and gas industry. With a market cap of over €100 billion and sales exceeding €189 billion in 2013 the French oil giant is the fifth-largest publicly-traded international oil and gas company in the world.

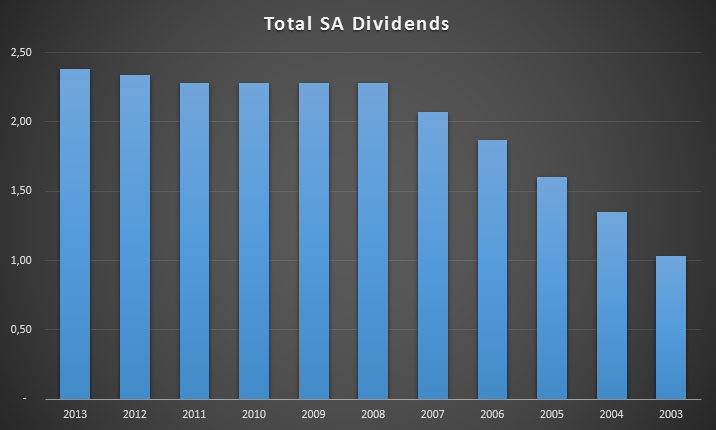

After an internal reorganisation in 2012, the company now builds its activities around the following business segments: Upstream, Refinining & Chemicals, and Marketing & Services. Even though the actual dividend history of Total is hard to track down because of mergers, currency changes and stock splits, France’s second largest corporation has been paying dividends consecutively since 1945. Ever since the introduction of the Euro in 1999 the company has not reduced its dividend.

With its current yield of 5.07%, Total offers the highest dividend yield among its peers. Because the company changed to a quarterly dividend in 2011, shareholders currently receive a quarterly dividend of €0.61 or €2.44 annualized. Because of the already high yield and sluggish revenue growth the five-year dividend growth rate is only 0.86%, whereas the ten-year DGR is over 8%. The payout ratio remained well under 60% for over five years.

Although oil prices have been going sideways since 2010 and are at a nine-month low despite geopolitical turmoil in Ukraine and Libya, Total succeeded in keeping its production and profits stable in 2012 and 2013. Regardless of the fact that business prospects for the near future are not especially bright given the current state of the economy, Total can rely on a reserve replacement rate of over 130% for the past five years.

This means that the French discovered more sources of oil than they pulled from current known reserves. According to its 2013 fact sheet, Total can continue its operations for another 13.7 years without discovering any new oil reserves. Even though Total raised some eyebrows because of its partnership with Lukoil (LON:LKOH) to develop shale gas fields in Russia, the future should bode well for Total and its shareholders.

At its current price of €47.33, investors are rather bearish about the stock, trading 25% below its peak in 2007 and 13.49% below its 52-week high. Because the EPS were €4.11 in 2013, the current P/E ratio is only 11.5. As such, it seems Total is reasonably undervalued.

When considering all of the above Total looks like a great addition to any dividend growth portfolio because of its high yield and operational stability. Even though the stock has traded as low as €40.41 in the past year the current price with its 5.07% yield is still a great entry point.

International investors should, however, be mindful of France’s 30% withholding tax on dividends which also applies to the ADRs listed on the NYSE. Even though most of you will be able to recover at least half of any withheld taxes, double taxation and yield loss is something you should consider before buying into Total.

Despite the revenue loss, I’m a buyer at current prices – even though I have to pay an extra 25% tax to the Belgian treasury on top of the French withholding tax. How about you?

Good analysis. I didn’t realized the French government taxed that much on dividends. The double taxation is a bummer. But Total looks like a good investment nonetheless.

Cheers.

The Belgian, French, Swiss and German government all tax dividends at least at 25%! It sucks, I know, but I’ve made my peace with it. Taxes are high in Europe, but you get a lot in return, so it doesn’t bother me too much.

Thank you for reading!

NMW

I think it is a good stock. I looked into it last year. In the end I did pick up Royal Dutch Shell at a average price of 24.94 EUR. So it was a good deal to.

Cheers,

G

Geblin,

I’m also looking at Royal Dutch Shell right now, both are great value companies.

Which stock of RDS did you buy? I think it’s best to buy the B-class shares that are listed in Euros (Amsterdam) and have them pay you a dividend in euros because the withholding tax on B-shares is 0% whereas a Dutch 15% withholdings tax applies to the A-class shares.

Am I right in saying that?

NMW

I did buy the A class shares since when I bought them you could get the dividend payed out in shares. I sold my share after they cancelled the scrip program( selling with a profit from 20% isn’t a hard choice). After my buy for september I will probably look back to the oilmajors. And indeed on the B-class no witholding: http://www.shell.com/global/aboutshell/investor/share-price-information/difference-a-b.html. The lesser taxes the better.

Thanks for the confirmation! I’ll gladly pay the premium of the B-class shares if that means no withholding taxes for the future.

Too bad about the scrip programme, but at least you sold your shares at a 20% profit!

What do you think of AT&T? Yield is fat, PE is low, infrastructure heavy meaning it won’t be going away anytime soon.

Jay,

I think AT&T deserves a place in almost every dividend portfolio, even though growth has been slow the past few years. It’s a great stock to get a dividend growth portfolio off the ground.

Infrastructure and network heavy companies are often a good investment because there are high barriers to market entry. As a result, there’s an almost never-ending steady stream of income, which makes the current high yield sustainable in the long run.

At the moment I’m looking into AT&T to my portfolio myself. It’s been on my watch list since I started trying my hand at dividend growth investing.

Thanks for the great question,

NMW

glad to have a foreign tax credit : ) that usually helps relieve the double taxation

Happy for you, Liz! Do you receive a full refund or only a creti up to a certain percentage of the foreign tax?

Thanks for stopping by,

NMW

I’ve been a bit confused about taxation on foreign companies… My tax-free account for shares in the UK has occasional lines on my statement saying ‘tax reclaim’, and I know that if I buy RDSA, I should buy it in my taxable account, as I can claim back tax up to a certain amount (ca. £10k)… I wonder what the difference would be, if I bought TOT through the NYSE as opposed to a European market?!!! It has been on my watchlist for a while… Thanks for all the analysis, very interesting

Taxes are confusing, especially in Europe, because there’s a lot of different mechanisms in each of the EU’s member states. I don’t know how it works in the UK, but for Shell you should look into the B-shares of the stock. They sell at a premium because the Dutch withholding tax of 15% doesn’t apply to them.

For Total the withholding tax is 30% minus any reductions from a double taxation treaty between France and your home country (most likely 15%). It doesn’t matter if you buy the stock on the NYSE or on Euronext Paris.

If you’re not sure about the tax implications of a stock try asking your broker!

I hope this answers your question,

NMW

yes, I’ve often compared the price between RDSA and RDSB, I do know that if I want to buy it in my tax-free account, it needs to be the ‘B’ share.

taxation issues are so confusing when it comes to foreign shares. I bet you have an absolute nightmare trying to figure it all out. You would think that the Belgian system would allow you to claim a certain portion back though? That is what we have here, when we buy outside of the taxfree accounts. Then, you can sell your holdings (if you want) and take advantage of a certain level of capital gains tax exemption

We don’t have tax free or advantaged accounts. On top of that we also don’t have any capital gains tax! The weird thing is that we do have a high tax on dividends and a stock market tax for every transaction we make (between 0.25 and 1% of the purchase price.)

The Belgian government increased the Belgian dividend tax by 10% to 25% about two or three years ago to reduce the budgetary deficit we are running. I don’t think we can expect a reducation any time soon.

I wouldn’t mind too terribly if it was only the Belgian taxes though… If I buy stocks in Germany, for example, I’ll lose almost 45% on dividends because there’s no double taxation treaty between Germany and Belgium!

!!!!!! O.m.g!!!!!! I can hardly believe my eyes! No double taxation treaty?! Crazy.

Great write up NMW! I’m going to have to put some more research into Total. I’ve got some XOM, but would love to add Chevron, RDS-B, and Total to the mix!

Those are all high quality oil and energy companies you can hardly go wrong with! Make sure to consider the French withholding tax for Total when buying into any one of them.

I have not looked closely at Total, instead I have been buying BP, RDS, and CVX. RDS has run up quite a bit recently so I have been more focused on BP. There are a lot of good oil companies to choose from. You might also look at ESV if you are looking for a good high yielder. It is yielding close to 6% right now.

Holy cow, that’s an insane dividend growth rate for the past five years! Great tip, I’ll definitely look into ESV.

BP, RDS and CVX are also very good oil companies and dividend stocks. Total is often overlooked because of the French taxes, I think. Even so, it’s a massive cash cow for its shareholders.

Thanks for stopping by,

NMW