Like almost every other blogger out there that’s serious about financial freedom or investing, I’ve been keeping track of my income and expenses. I have been doing so meticulously as far back as 2005 in a quick-and-dirty Excel spreadsheet, but out in the open and on this blog since July of last year. There are a couple of reasons for doing so.

First, I want to show you guys that it is possible to become financially independent on an average worker’s salary. Because it’s hard to rapidly build my income, I have decided to focus on keeping my expenses as low as possible. Chances are low that I’ll ever become a member of the elusive 1% income group, but you can bet on it that I aim to join the ranks of the best savers out there. These posts show you how I do just that.

Second, the fact that you guys visit, read and comment on these type of articles motivates me to no end. Motivation is a crucial factor in ever becoming financially indepent, so I’m glad to be able to share my actions, my headwinds and my setbacks with like-minded people. Non-essential and frivolous spending are out of the picture when you’ve got almost 5,000 unique visitors checking in on you each month.

So that’s why you’ll find the nitty and gritty of my April income and expenses below. Maintaining a firm grip on my wallet is the only way I’ll ever make time my own again.

| Income | ||

|---|---|---|

| Paycheck | € 2,068 | As expected |

| Dividends | € 52 | In line with this year's goal |

| Other | €307 | Side hustlin' |

| € 2,427 |

When tallying up all income sources in April, we can see a decent amount of income yet again. As is normal for most people, my regular job’s paycheck makes up the bulk of my income, accounting for a little over 85%. That means 15% of April’s income comes from passive income sources or side activities already.

Even though the extra income isn’t much in the grand scheme of things, that money will be put through the compounding machine, thus building new income all on its own without requiring any active input from yours truly. As such, the passive portion of my monthly income knows only one way, and that’s up!

| Expenses | ||

|---|---|---|

| Rent | € 350 | As expected |

| Utilities | € 70 | As expected |

| Telecom | € 20 | As expected |

| Home maintenance | € 10 | Wrenches |

| Groceries | € 75 | Quite low |

| Restaurant | € 18 | Fries and sushi |

| Public transport | € 12 | Train tickets |

| Doctor's visit | € 28 | Dental checkup, will mostly be reimbursed later |

| Healthcare | € 16 | Haircut |

| Holidays | € 76 | City trip to Dublin |

| Subscriptions | € 8 | Google Play Music |

| Entertainment | € 26 | Drinks with friends and paintball |

| Gifts | € 3 | Large bottle of Chimay Bleu |

| € 712 |

Even though I went on a quick holiday to Dublin to visit my best friend two weeks ago, April’s expenses are the lowest so far this year. Actually, it’s one of the best months since living on my own. Even though I haven’t tried especially hard this month, I believe the low spending can be explained by the nice weather outside: walking, running and cycling don’t cost much.

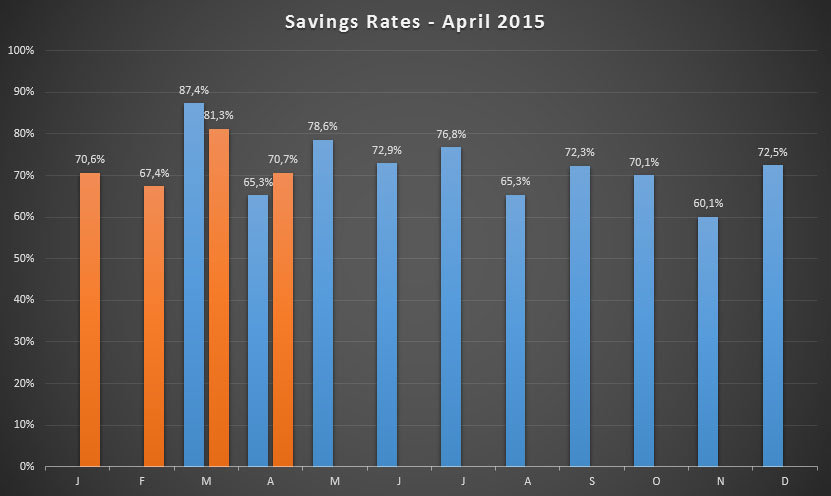

As a result, I managed to save 70.7% in April. That’s dead on target to save 70% on average annually, which is my main goal in 2015.

In absolute numbers I stashed away €1,715. Those savings have already been used to purchase additional dividend growth stocks. After researching and writing a short analysis on Anheuser-Busch InBev (EBR:ABI or NYSE:BUD), it didn’t take me long to deploy my available funds and add the American-Belgian-Brazilian brewer to my portfolio, thus increasing my forward dividend income with at least €22 every year.

The graph above quickly becomes useful now that we can compare year-over-year progress. Of course, savings rates are quite volatile from one month to another, but in general the orange bars should be higher than the blue ones since I’m aiming to save more over time.

So far I’ve managed to save 74.1% on average this year, mainly because of the extra and unexpected income from an insurance premium in March. Sometimes you need a little luck on your side to compliment your own efforts, as you can see.

If you take a close look at the graph, you’ll notice that May’s savings rate took the second spot in 2014. I’m excited for next month because I’m hoping to repeat last year’s success with the additional holiday bonus I receive every year. Stay tuned!

How was your April? Did your savings rate meet your expectations?

NMW,

I’m really excited that you’re manage to save more than 70 %. I just need approx. 300 € more in expenses. I just need to figure out where I can save more!

Keep up with that

Patrick,

I’m sure you’ll figure out a way to bump up your savings rate! €300 might sound like a ton of money, but shaving of a couple of Euros here and there goes a long way. And if you feel like there’s no more room to improve your expenses, you can always try to increase your income as the additional money will be pure savings.

Best of luck,

NMW

That is top work! To save over 70% even during a month when you were not really trying and took a short break. Shows that you have already built that fundamental mentality where saving becomes second nature. You’re onto a winner!

Keep up the good work.

DD,

Saving as a second nature is exactly what you need to become financially independent. Actually, I’m not even trying to save at all. I have found what makes me happiest, so that’s those are the only things worth spending money on. Everything else is just noise. As such, not spending a lot of money isn’t hard at all.

Keep it up on your end too! Since you’re the same age as I am, you’re bound to be on a winning path too.

Cheers,

NMW

Spot on! that is exactly what you should be looking to get to. Being able to be happier with less. Its such a peculiar thought to so many people nowadays they can’t quite get their head round it. I hope they do eventually though!

Yes, by starting early we are already looking in good form for the future. Certainly plenty of reasons to feel optimistic anyway!

I have an nearly identical pay-check, but that puts me outside of the welfare rent units here and as such i dont qualify for such cheap housing. Result is that im stuck with a rent of 762 – that alone is more than your entire expenses together!

So i’d say dont ever move from that location, it can only get worse your savings rate and even more impact towards your save withdrawal rate.

GoT,

I’m not sure if you’re from Belgium or not, but I can’t apply for welfare housing either – not by a long shot. Currently a good friend of mine and I rent an apartment/house (it’s something in between) together, which really drives down living costs.

If I had to rent a place on my own, my entire spending would jump up by €350, thus putting me in your territory. As you can see, cutting costs here makes a big difference in the long-run.

If you really wish to cut down your rent cheque you could maybe find someone to live with?

Best wishes,

NMW

Truly inspiring month NMW! Go outside and celebrate with a long bike ride!

Thanks, Noonan! I’ll definitely do that!

NMW,

Well done Mate, you continue to smash your savings rate!

Cheers,

RA50

Cheers, Steve!

Well done for keep keeping your expenses so low and saving so much of the left over money. You’re a great inspiration, keep up the fantastic work

Cheers

TV,

Thank you for the kind words and for the support the past few months. I couldn’t have done it without you guys.

Hope all is well over there.

Best wishes,

NMW

Hey NMW,

Remains very impressive to say the least! We are still trying to close in on you, however that is a bit of a futile effort as we have too many fixed cost (which we cannot get rid off) to boost our savings rate further. Not counting the one off negative expenses for last month.

Mr. FSF,

You guys are doing really great too, don’t you worry about that. And you’re not that far behind with a savings rate of 65%! Not many people can boast about such a number.

Keep it up,

NMW

Your incredible savings rate never ceases to amaze (and inspire) me – WELL DONE!

Thanks, Weenie! Couldn’t have done it with your kind and encouraging comments each time!

Very impressive savings rate yet again NMW! Good job!

Cheers, Tawcan!

Why don’t you buy Vanguard’s ETF funds? They trade on the Amsterdam exchange and can be bought trough Binck.be

€70 on utilities is quite high I believe, take a look at Essent.be ‘s “VOORAF” tarrif. It means you pay all your advances at once and get a final invoice in the end.

This means you don’t have to pay each month AND you get a better rate.

€350 on rent is VERY NICE, do you share a room of some sort?

JJ,

Although Vanguard’s funds distribute a dividend, the goal of the ETFs is not to pay an increased dividend each year. As such, the funds don’t follow my strategy particularly well. Besides, if I were to buy more ETFs I’d go for accumulating ones as that’s better from a tax perspective in Belgium. (You can see the iShares ETFs I own on my portfolio page if you’re interested.)

€70 on utilities sounds quite high, but that’s for electricity, gas ánd water. And it’s a fixed fee, which gets reimbursed up to the actual usage at the end of the rental year. At the moment I believe that I’ll be getting some money back, but I’m note sure yet. With my current landlord I can’t choose the supplier, so I’m stuck with what I’ve got.

Rent is very cheap for me indeed. That’s because I share an apartment/house with a room mate. That’s not a solution that I’ll be able to maintain for the rest of my life, but I’ll gladly take advantage of it as long as I can.

Thank you for dropping by,

NMW

Wow NMW! Over 70% saving rate is really great! I wish I’d the fortune to achieve this last month, but an unsuspected tax arrears payment, some vacation and expensive birthday gifts where between me and my goal 😉

For this month, I already dressed up in my frugal monk’s cowl except…maybe for one extra expense “the witcher 3”. We’ll see 🙂

Really, I do envy your low costs! No health insurance, low rental and a low groceries costs seems to be the main points in the equation.

I wish you best of luck to achieve or even improve your savings rate from last may!

Divrider,

First time I’ve bumped into your blog – great read! I’ll definitely be following along.

I saw you had some one-off expenses the past two months, but overall you have a particularly strong savings rate too. That’ll get you a long way to building your dividend portfolio!

Can’t say I have anything against buying The Witcher 3. I almost bought it too last weekend when the pre-order was only €49.99 on Steam, but I held off since I have a ton more games to play and because The Witcher series drops in price relatively fast. Besides, I also want to play Project Cars. Decisions, decisions, …

Overall my costs are low, mainly because I have a room mate and because food is cheap too. Health insurance is a mixed bag because that comes out of my gross pay check as it’s a government provided service for the most part. But you won’t hear me complain about the high tax rates in Belgium because life is really cheap overall.

Best of luck to yourself!

Keep it up,

NMW

Man! You are saving a killing (instead of saying you’re making a killing.. Haha)

Anyhow, your saving rate is very admirable. My friend who never went to college. Started work for costco at the age of 18. When I was a broke college student, she was already makinf $20/hr. 15 years ago, $20/hr is a massive number. Yet, she was broke, and still broke.

She said I have more because I made more. I told her, I had more because I spend the same level as I was in college. She has a cellphone plan, with unlimited everything. $120/mo x 15 years, that’s like $20k, with interests, that’s like $40k. She eats out on every meals, I pack every meal. She had a 8 years head start before I was even making a living wage.

Anyhow, it is difficult to get people to understand it’s not how much you make, it’s how much you save. You are on a great track to FI.

Vivianne,

Ha, saving a killing! 🙂

An eight year head start and nothing to show for it… That’s quite painful for your friend. I hope you get her to see the advantages of saving, especially since you guys have to provide for your own retirement.

Best wishes,

NMW

Always amazed at the consistency of your savings rate NMW. You’re setting yourself up incredibly well, so even if life changes and that savings rate drops in future, you’re well and truly on track for some great things!

Keep up the great work!

Cheers,

Jason

Jason,

As always, a pleasure to read your motivating comment! Thank you for checking in once in a while.

Hope you and the family are great too over there,

NMW

I love these posts! Good job on continuing to save at 70% (and go to paintball) Proving that it can be done.

Thanks, Michelle! Glad to be able to write these monthly overviews.

Best wishes,

NMW

NMW,

76€ to Dublin is nuts! I am jealous. Great job saving, and still doing fun stuff. Also I wish the Chimay Blue was 3€ here, its around $10-14 depending on which store you go to.

– Gremlin

Gremlin,

€76 is for activities there! The plane tickets were about €50, but I paid for them last month already. All in all, very cheap city trip.

Damn, that’s a lot of money for beer. If there’s any way to get a couple of Chimay bottles shipped to you, I would gladly do so?

Cheers,

NMW

NMW

Awesome work once again. You’re doing great with the “Big 3” – housing, transportation, and food. That’s really the strength of your savings. You can have fun and still save 70%+. Once you can get those three main expenses under control, the rest is pretty easy and just a matter of maintaining good habits.

Keep it up!

Best regards.

Jason,

You’re absolutely right! Housing makes up 50% of my expenses, but that’s because my other costs are so low. Having a room mate really helps in this department as my housing cost would otherwise be at my current total expenses. And as you know, not having a car pushes down transportation costs hard.

Thank you for dropping by!

Cheers,

NMW

That is an awesome savings rate NMW! Unfortunately, I don’t keep track of my expenses and I think I am going to start doing so. I doubt that I can save 70% also!

Jeff,

You should definitely try to keep track of your expenses. It’s not just great to keep your expenses down at this very moment, but also awesome to look back upon in a couple of years.

And I’m sure you’ll be amazed at how much you save each month when you put your back into it.

Cheers,

NMW

Keep it up as always NMW. Savings is key and early on too. Also I think having the courage to be different and telling your friends/family that you would rather do something free or just not go out and save the money. If only I had saved when I got my first job instead of going out every night and buying an expensive car. I am on the right track now but lost 17 years in doing so.

DFG

DFG,

You make a great point. Having a different mindset isn’t enough, you should stick to it even when everyone else tells you differently. Many of the people I know believe it can’t be done to save as much as I do and still have a great life, but I prove them wrong month after month.

Even though you may have “lost” 17 years, it makes me happy to hear that you’ve now found a nice balance between saving, enjoying life, and your family.

Best wishes,

NMW