The past couple of weeks I’ve been missing in action in our community. The consistent flow of articles and active engagement on other blogs has dropped to historically low levels because I have been overly busy at work and because of the great weather outside. While that bothers me, I’m glad to report that one thing remains unchanged: dividends.

That’s right, dividend payments keep hitting my account on a weekly basis, thus pushing my passive income ever higher. Although the amounts remain relatively small, one day these dividends will be able to sustain my current lifestyle and as a result cover all my living expenses. At that point, I’ve basically won the Win for Life lottery.

Below you can find a detailed report of the companies that regularly forward a piece of their profits to me. I provide you guys with this information not only for the sake of transparency, but also to keep myself motivated. Indeed, looking back on what you’ve achieved over an extended period of time is a great way to stay the course when you’ve got a long ways to go.

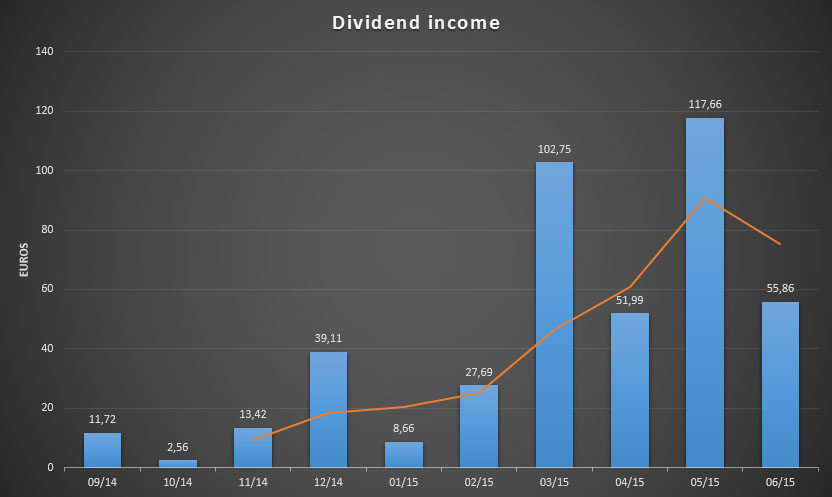

Three months ago I jumped over the €100 dividend income threshold for the first time. It might not seem like much, but to me it felt like a major – and honestly rather unexpected – achievement. Of course, March’s massive jump was the result of annual or bi-annual payment schemes of European stocks, but it still showed me how fast you can get your dividend snowball rolling when you put your back into it.

Let’s see what’s what in June, shall we?

Dividends received

Over the previous five months I have already accumulated a little over €300 in dividends, which is more than half of my 2015 goal of €500 in passive and completely free-of-work income. That’s a rather large sum of money when you take into account that I only bought my first dividend stocks in August of last year. Since receiving my first payment from McDonald’s (NYSE:MCD) back in September, the dividends have shot up nicely as the months have passed by.

Current porfolio yield should come out at about €700 of future dividend income annually already, which is about one third of my monthly salary. As such, I’m rather certain that I’ll crack this year’s goal, not in the least because I’ll continue to save and invest as much as I possibly can to push my financial independence date forward.

All dividends below are listed in Euros, and are after foreign withholding taxes and a 25% income tax levied by the Belgian federal government.

| Date | Ticker | Company | Dividend |

|---|---|---|---|

| 01/06 | AFL | Aflac Inc. | 1.98 |

| 03/06 | ULVR | Unilever plc | 13.17 |

| 09/06 | JNJ | Johnson & Johnson | 2.47 |

| 10/06 | IBM | IBM Corp | 4.30 |

| 15/06 | MCD | McDonald's Corp | 6.56 |

| 19/06 | BP | BP plc | 6.17 |

| 22/06 | RDSB | Royal Dutch Shell | 18.81 |

| 24/06 | QCOM | Qualcomm Inc. | 2.40 |

| Total | 55.86 |

The table above shows us eight payments from eight profitable companies that want to reward their shareholders for believing in their business models. Some of those companies have been at it for over fifty years, while others have only recently adopted a dividend growth policy.

What’s interesting about June’s numbers is the fact that all dividend stocks stick to a quarterly payment scheme. As a result, I’m relatively sure to receive this kind of income every three months for the rest of my life – how great is that!?

In total I made about €55.86 in dividends in June. I expected that number to be higher because I added to my Shell (LON:RDSA and LON:RDSB) position not too long ago, but the French oil giant Total SA (EPA:FP) decided to jump months and pay its dividend in July. Nevertheless, I’m as happy as can be about this month’s result.

Growth

The main reason why I’m glad to see almost 56 Euros on the table, especially with Total’s payment date wizardry, is because I managed to grow June’s income compared to March’s quarterly paying stocks. Although the increase is rather small, it shows me that I still have a large impact on the growth component of my portfolio.

Of course, the dividend growth rate of the payments I receive are nice, but at the moment it’s still up to me to provide the main force behind my future dividend income. That’s why I’ll continue to save and invest as much cash as possible over the coming months and years, even with the European stock markets being under strong pressure from the financial crisis in Greece.

As you can see, the trend line broke off its relentless march upward for the first time ever this month. That’s no surprise when you consider the big annual or semi-annual payments of many Belgian holdings in my portfolio. Anheuser-Busch InBev (EBR:ABI or NYSE:BUD) and Home Invest Belgium (EBR:HOMI), for example, are a big reason why things shot up so much in May.

Another side effect of these annual payment schemes can be seen in the quarter-over-quarter growth that June displayed, which obviously is negative. However, when you compare June’s numbers to those of December last year, a nice increase is clearly visible – I’m still on the right track!

Going forward

My dividend piggy bank continues to grow with this month’s income pushing the total up to €364.61 or 72.9% of my annual goal – spectacular numbers! Six more months to go and I’m set to crush any and all expecations I had when I first started this journey.

These excellent results strengthen me in my believe that buying high quality companies that stick to a sustainable dividend that grows over time is a good way to become financially independent. After all, it’s not the dividends I’m after, but the freedom they provide me with later on in life.

Thank you for reading and for your continued support, even in my absence the past few weeks.

HI NMW,

You are absolutely right to continue investing in strong companies, you will be rewarded in the future. You are doing great in your quest.

Cheers from tropical Switzerland,

RA50

RA50,

Ha, glad to hear you enjoyed the same tropical weather we’ve been having over the past few weeks. At the moment it’s cooled down a bit, so lots of cycling time! 🙂

Thank you for your continued support. Hope you guys are great over there,

NMW

Already 72.9% on your annual dividend income goal and it’s only July? You’re way ahead of the game NMW! I’m sure you’ll exceed your goal by a mile. Keep up the great work. 🙂

Tawcan,

Even though my percentage is way high because of annual payouts of European companies, it seems that I underestimated the growth effect of dividend stocks! It looks like my goal will be met in August or September already.

Cheers,

NMW

Hi NMW,

That’s another strong month. It’s great to see the money work for you and paying these nice dividends! The snowball is really starting to roll for you 🙂

Cheers from France,

IndependentBunny

Independentbunny,

You hit the nail on the head: the best thing about dividend growth investing is to see your money hard at work on a daily basis. Every time a dividend payment hits my account I can’t help but smile like an idiot. 🙂

Best wishes,

NMW

Great progress through the year, NMW. Looks like you need to up your goal 🙂

Congrats on the div income and best wishes

R2R

Thanks, R2R! Hope everything is well for you too over there!

Great job on the upward trajectory! Might be time to set a new goal since you’re going to be surpassing your original one. With added funds throughout the year, you will definitely be increasing you forward dividends. Nicely done, congrats!

– HMB

HMB,

You’re absolutely right – I underestimated the growth component and the effect of added capital throughout 2015! I expect to hit my goal in August or September already, which would be terrific.

For next year I’m going to try and set a more realistic goal! 🙂

Cheers,

NMW

Nice progress, I’m also loading up on RDSB.

DAC,

Great to hear you also see a lot of value in RDSB, especially at these compressed prices. Let’s hope they remain low for a little while longer so we can continue to build our positions!

Cheers,

NMW

NMW

Great progress, keep on going with your investments, and the snowball will grow.

Divorcedff,

Will do, you won’t see me slowing down any time soon! Can’t wait to find my snowball has turned into an avalanche of dividends.

Best wishes,

NMW

Hi NMW,

It seems you had a great month, nothing beats passive income. It just keeps coming and growing while we do fun stuff or sleep:).

Cheers,

G

Geblin,

Exactly! It’s awesome to find you’ve received even more dividends when you wake up in the morning. And for me the best part of the strategy lies in the fact that the growth component is much faster than I first anticipated.

You better watch out or I’ll catch up with you! 😉

Cheers,

NMW

NMW,

Great result. The wonderful decisions you continue to make over and over again continue to reward the you of today and, surely, the you of tomorrow.

Keep it up. You’re crushing your goal this year!

Best regards.

Jason,

Thank you – again, means a lot to me coming from you! Let’s hope future growth and income remains strong.

Hope you’re good over there in the US,

Cheers,

NMW

Glad to hear you’ve been out enjoying life, and even better seeing you post again. Congrats on another excellent month, keep building that forward income piece by piece and you’re set. Best wishes!

Ryan,

Nothing better than earning free-of-work income while you’re out and about enjoying life. I guess it’s a small glimpse of what’s to come when we reach financial independence in a couple of years! 😉

Best regards,

NMW

Great job NMW! Even now with a semi sizable portfolio, my contributions still do the heavy lifting with raising my forward dividend income. But with enough time the lifting that you do becomes less and less, or at least less necessary for the same amount of increase thanks to your dividends continuing to rise. Luckily I own very few companies that don’t have regular quarterly payouts so I don’t have as many swings in my dividends on a quarter to quarter basis. That’s really just an issue for accounting purposes though because after years of living below your means it’s not going to really matter when you receive those payments as you will be well versed in budgeting. Keep up the good work and have an excellent second half of 2015!

JC,

You’re right that we’ll be doing the heavy lifting for some time through new contributions, but after a while the dividends and their growth will take over – in a big way. Can’t wait to see dividend growth at the level of a brand-new monthly contribution.

The non-quarterly payouts make the graph spike her and there, but I don’t mind it too much: dividends are dividends. In the long-run I’ll know how much I can expect every month, so I can adjust my budget to it if need be.

Best of luck for the rest of 2015 to you too!

Cheers,

NMW

Hey NMW,

Glad to hear you’re enjoying some great weather! Much better use of your time than sitting in front of a laptop!

You’ve made tremendous progress on the dividend front in a very short space of time – keep the great momentum going!

Cheers,

Jason

Jason,

Even better would be to sit outside with a laptop, but I sadly can’t drag my desktop with me on the go! 😉

Progress has been stellar indeed. I really underestimated how fast I could get things moving, but you won’t hear me complain about that.

Hope all is well over there,

NMW

Congrats on another great month of earnings dude! I hope that in spite of your busy life as of late, you’ve still managed to squeeze in some video gaming here and there. Wouldn’t want you to get withdrawal symptoms ;P

Keep up the good work as always.

Cheers

Alex,

Not a lot of video gaming these days! I’d much rather go cycling when the weather is still nice. Besides, at 35°C it’s a little bit too hot to be sitting behind my computer all day – those GTX 970s in SLI put out a bit too much heat on their own to keep the room cool. 😉

Best wishes,

NMW

Kudos on the dividens 😉 I just cashed my check of €1300 for the quarter ^^

Just keep buying and you’ll get there

Johan,

That’s a massive quarterly cheque, congrats! Can’t wait to get to your level of dividend income.

Cheers,

NMW

NMW,

Still a march forward. Keep crushing it and enjoying that nice weather. There is plenty of time to sit inside and write come winter time.

– Gremlin

Gremlin,

My thoughts exactly! I do miss writing and reading other people’s blogs, but I’ll catch up when the weather turns cold and rainy in a couple of weeks. Now at least I know I’ll have to plan a couple of posts in advance to fill the void next year.

Best wishes,

NMW

Excellent progress, NMW.

Like you after a strong couple of months which saw £150+ in income I have a few well below the £100 mark again.

What is great though is that it look as though I may be threatening the £100+ per month average by the end of the year. I don’t think I will quite cross it. But nice to be near it!

You’re a little ahead of me with regards the income goal. I am at 69% rather than 72%. But it looks like we are both securely on track to reach our goals for the year!

Keep up the good work!

DD,

Wow, it would be awesome for you to hit the £100 on average mark by the end of the year – truly impressive milestone. I hope to get to your levels of income soon, but I’m guessing it won’t be long now.

It would be nice to have a smooth income curve, but I don’t mind the non-quarterly payments too much. Money is money, after all.

Let’s see who reaches 100% first! 😉

Good luck,

NMW

Awesome to see your dividend growth! The snowball is starting to form–you’ll be amazed how quickly it amasses. I look forward to your updates in a few months when you can start making year-over-year comparisons.

Good luck and keep it up!

Eric

Eric,

Absolutely! I’m already amazed at the speed with wich the dividends are rolling in. I underestimated how fast you can put together a well-diversified income portfolio.

The year-over-year comparisons are going to be a lot of fun. I’m really looking forward to dissecting my numbers in detail.

Thank you for stopping by,

Best wishes,

NMW

Having 73pct of your goal after 6 months… Who can complain about that?

Do you have some long term plans to smooth out the spikes?

AT,

Hard to complain about those kind of numbers, right?

I’m not going to try and smooth out the spikes as they’re inherent to European stocks. In the end they don’t matter all that much because dividends are dividends, after all. Over time I’ll learn to account for them and they won’t be an issue anymore.

Also, as a side note: I don’t purchase shares based on their payout date or to smooth out my income. Only their business strategy, fundamentals and dividend outlook counts.

Cheers,

NMW

Wow six months in and almost 3/4 of the way there? Sounds like you need to update your goal already, fantastic job!

Duncan,

That’s what you get when you invest in a lot of European companies that only pay dividends once a year. Nevertheless, I’m going to crush my goal over the course of the next two months I believe, so I clearly underestimated my goal.

Cheers,

NMW

Wow, most people can barely meet the goal and you’re already crushing it! Nice!

Thanks, Vivianne!

Not seem like much? That’s incredible!

Lots of us are killing ourselves to hit $100/mo (or ~$110/mo to make a direct comparison) in passive income.

And that growth graph you posted shows ups and downs, but that’s why I love adding trend lines. Smoothes things out for better projections.

Great work in June. Hope July is even better!

FM

FI Monkey,

Thanks for your enthusiasm – it’s exactly how I felt when I first noticed I passed €100 per month! 🙂 All beginning is difficult, but once you’ve hit a certain critical mass things start moving on their own. People often say that the first €100,000 is the hardest – I think that €100 in dividend income is a similar threshold.

Keep it up over there,

Best wishes,

NMW

Keep on rolling the snowball. It is always motivational to see other Europeans working on their goal of FI. Greats from Germany — the biggest country of non-stock-investors I have ever seen 🙂

BM (love the name!),

Exactly! Awesome to meet another European trying their hand at financial independence and investing. I’ll be sure to check out your blog in great detail.

Also, Germans are big on government bonds and insurance products, right? Don’t worry, I guess that goes for many other European countries, Belgium included.

Best wishes,

NMW

I am in the same boat as you NMW. Lucky for us the divs keep a coming.

Later,

DFG

DFG,

What a luxurious position to be in! 😉

Have fun,

NMW

Nice progress, guess you should aim a bit higher with your targets for 2016 😉

Mr. FSF,

Ha, I’ve already been thinking of my 2016 goals and I guess I should be a lot more optimistic about my future dividend income. I really underestimated the growth component and the effect of new contributions on my overall dividends.

Cheers,

NMW

Hey NMW!

Another great month of dividend income – it looks like single-digit and low double-digit payments are a thing of the past for you! Looking forward to the next update mate.

And like ZtZ said above, I hope you’re getting enough gaming out of that GTX 970! 😉

Take care,

DL

DL,

Thanks, buddy! Small payments or large payments, I love them equally as long as my dividend income continues to grow at the current speed. I couldn’t be more happier!

Ha, my GTX 970s are currently enjoying a small holiday – although I’ve played some Far Cry 4 recently. I’d rather enjoy the nice weather while it lasts. 🙂

Cheers,

NMW

Well done NMW. Looks like you have a great set of companies paying out there on a quarterly basis! I have a few like that, I should invest in a few more and I see some on your list that I don’t have yet!

I too have been doing pretty ok on the dividend front and will pass my own goal next month.

All the best and hope you have a great weekend!

Weenie,

We do share a couple of companies, glad to see that. Great minds, right? 😉 I strongly believe in all the stocks I currently own, so feel free to check them out and see if you feel the same way.

I haven’t had much time to keep track of your progress, but I look forward to read about crushing your next goal. Good luck! 🙂

Cheers,

NMW