Today being Labour Day or International Worker’s Day, is there a more suiting moment to review free-of-work income? To me there certainly isn’t. That’s why I’d once again like to share my passive dividend income with you guys. I do this every month for the sake of transparency, but also to keep myself motivated.

Even though the markets have been all over the place in April – it truly was a rollercoaster ride for my portfolio – one certainty remained: dividends. They form the bedrock of my investing strategy and hopefully also my financially independent lifestyle once I’ve accumulated enough assets.

I know that building a portfolio that throws off enough passive income to cover your living expenses takes a long time, but that doesn’t botter me at all. What’s more, it drives me to push harder and save as much as possible. I want to make time my own again, so that’s why I’m happy that progress has been stellar so far.

Think about it. I started buying individial stocks back in August of last year and already I crossed the €100 dividend income mark for any given month in March. And it doesn’t stop there, of course. Profit distributions from the companies I’m a shareholder of continue to roll in on a weekly basis.

While I was on a city trip to enjoy Dublin’s literature museum, art history gallery, and its beautiful surrounding countryside the past few days, my broker notified me of two cash payments hitting my account. I could be on a holiday, I could be asleep – it doesn’t matter. Unlike myself, money that works for me doesn’t need to rest, so these dividends will keep coming for as long as I want them to.

That’s why I hope that these dividend income reports motivate you to put your own money to work as fast as possible. If I can do it, you can too!

Dividends received

After last month’s massive income, I could reasonably expect April to come in a little lower, and that’s perfectly fine. Even though it would be fun to receive over twelve separate dividend payments each month, over time twelve will start to sound like an insignificant number if you continue to save and invest.

Besides, I’m happy with any amount of dividend income that inches me closer towards my €500 goal by the end of the year. Would you say no to a free meal? I wouldn’t.

All dividends below are listed in Euros, and are after foreign withholding taxes and a 25% income tax levied by the Belgian federal government.

| Date | Ticker | Company | Dividend |

|---|---|---|---|

| 01/04 | KO | The Coca Cola Company | 3.25 |

| 07/04 | DGE | Diageo plc | 8.85 |

| 09/04 | GSK | GlaxoSmithKline | 7.66 |

| 24/04 | MUV2 | Munich RE | 29.34 |

| 27/04 | GE | General Electric | 2.89 |

| Total | 51.99 |

That’s five businesses I’m a fan of that rewarded me with a piece of their profits, simply because I remain invested in them. As you can see, dividend income diversification remains relatively low, but that’s to be expected with a relatively new portfolio like mine.

Coca Cola (NYSE:KO) jumped ship again in its quarterly payment, while British distiller and spirits distributor Diageo (LON:DGE) and German reinsurance giant Munich RE (ETR:MUV2) appear on my dividend income list for the first time. Together with GlaxoSmithKline (LON:GSK) and General Electric (NYSE:GE), already two regulars at this point, these five companies made me almost 52 Euros.

Compared to my paycheck such an amount might not seem like much, but this month’s dividends actually covered my two-way plane ticket to Dublin. Simply amazing!

Growth

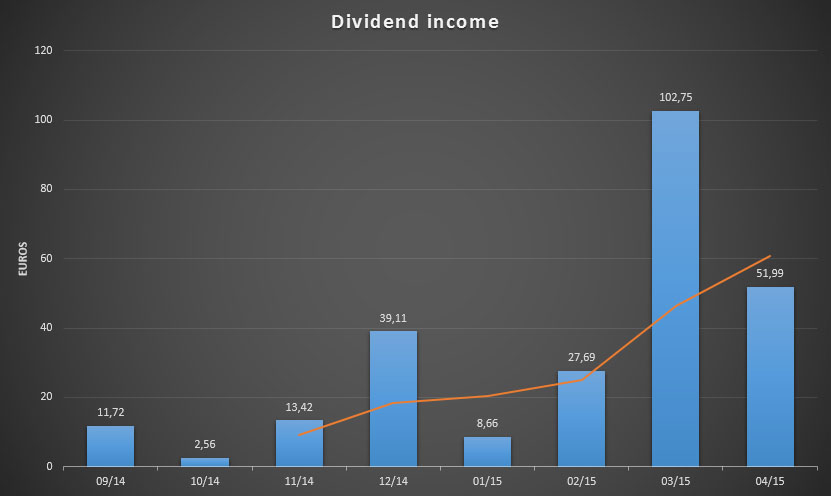

As my portfolio continues to grow, its passive income stream is likely to reach new heights on a regular basis. The trend line trailing three months in the graph below makes that tremendously clear. Although March’s dividends heavily skew the line upward, the fact that the graph’s tail keeps the same direction in April makes me a happy camper.

The strong growth component of my dividend income is no surprise since many European dividend growth stocks stick to an annual or semi-annual payment. Still, when taking a quick look at the quarter-over-quarter growth there’s tangible and lasting progress: from just €2.56 in October of last year, to €8.66 in January and €51.99 this month.

That’s a 600% QoQ jump for April when compared to January! If only we could keep this type of momentum going.

Going forward

The dividend income for 2015 is currently sitting at €191.09 or 38% of my annual goal. With four months in the books for 2015 that means I’m slightly ahead to reach €500 in dividends. And the best part? That money will be put to work too, thus increasing my future income at a faster pace.

May should provide the last major boost to my passive income stream since my remaining European holdings will forward their annual payout. Real-Estate Investment Trust Home Invest Belgium (EBR:HOMI) should deliver a dividend payment close to €50 all on its own, for example.

Because I used my April paycheck to acquire 10 shares of American-Belgian-Brazilian Anheuser-Busch InBev (EBR:ABI or NYSE:BUD), I’ll also receive a piece of the world’s largest brewer’s profits next month. I furthermore deployed my holiday bonus to initiate a stake in Belgian movie theatre chain Kinepolis (EBR:KIN), which also pays a dividend in May.

Even though these two companies trade for a fairly high price, which is no surprise in today’s market, I’m sure they’ll continue to do great in the future and thus reward me as a shareholder. Because of their great dividend history my annual dividend income jumped by another €50, quite possibly for many years to come.

Thank you for reading and for your continued support. And be sure to let everyone know how your dividend income turned out this month in the comments. Do you feel like you’re on the right track?

I love these updates. It is a really joyful and pleasing thing to receive FREE money in your account every month! Compared to my April, yours was astronomical, to the point of being on the other side of the universe, as April is our worst month, with only £2.07 coming in!!!

May is also a bad month, but June is our best, with over half of our annual dividends arriving then.

Keep up the great work!

Cheers

M,

Dividend income reports are by far my favourite posts to read too! Seeing other people do well makes for a good motivator.

Don’t feel too bad about your income this month. Since we both just started out the income is likely to fluctuate heavily. Besides, I have a lot more stocks paying an annual dividend than you do, so the first months of the year are always going to be strong performers. 😉

Looking forward to your June income! Half your yearly income – big boost to morale, right?

Hope you guys are well over there,

NMW

HI NMW,

Excellent month one more time, you are moving forward to FI every day.

I am like you, I love to receive a nice pay check from our companies, when in vacation, or sleeping.

In April, only one company (SREN.VX) delivered her pay check to us, but it was big one 7442.0 EUR.

Enjoy your work free Friday and have a good weekend.

Steve

Steve,

Progress has been great indeed. Every month feels like a major push forward towards financial independence. Can’t wait to get to your level of deployed capital and income though!

Because I recently looked in Munich RE, I also took a closer look at Swiss RE. It’s a great company too, so I’m sure you’ll continue to receive that massive extra paycheck for the rest of your life.

All the best,

NMW

Nice progress, NMW. Like you I am about 40% towards my dividend income goal for the year. Though this month we only shared two dividend payers. I will be writing this up shortly.

It is great when you start to work out what that dividend income paid for that month. The flights for the Dublin trip? Excellent! A free trip (of sorts!).

How badly do you think your income will be hit when/if the Euro strengthens a bit relative to other currencies? Have you taken a look to see the likely impact?

Keep up the good work. Achievement of this year’s goal looks easily in sight!

DD,

It seems like we’re in the same place with regards to our portfolio allocation and income progress – makes it fun to compare our efforts!

Your April was pretty impressive too with over £170 already. With just four months under your belt, you’re already at 42% for the year. That’s quite impressive and I’m sure you’ll crush your goal for this year.

What’s not to love about a ‘free’ flight to Dublin? Gotta love dividend income and cheap European airlines.

The Euro has strengthened a little bit the past few days, so both my portfolio size and income level have gone down a little bit. Overall I believe about 10% of my forward income could be ‘at risk’, which isn’t too bad. Besides, over the long-run currencies average out, so I don’t worry too much about it. The upside is that I can buy more foreign equities when the Euro regains its strength.

Thank you for dropping by once more!

Cheers,

NMW

It certainly does seem we are mirroring one another!

Yes, April was my best by far up to this point. May will also be strong as well but I think it will then be followed by some slower months. I should be able to easily pass my goal for the year, however. We will see! Then have to work out how best to revise it!

All told, April covered about 1/4 of my entire expenses. However, this was helped by a very economical month and well above average dividend income. Still, shows what can happen!

Yes, if I had felt more comfortable in how best to do it. I would have thrown some money into Euro denominated dividend aristocrats. In the meantime, I think I will focus on UK companies with large Eurozone exposure who are being beaten down by the FOREX rate.

Keep up the good work!

I like the uptrend NMW. You’re on a awesome path my friend. Like i’ve said before, you’re so young still and with compounding on your side, you’ll have a large cushion in the future no doubt. I’m sure of it. Keep up the good work and we’re all proud of your progress. Take care and keep it up. Cheers to us!

Tyler,

Your comments always lift my spirits! You’re a true believer of saving, investing and financial independence – and it shows. Thank you for motivating all of us and showing how it’s done.

Hope you’re well,

NMW

That was a bargain flight you got to Dublin and secondly, even more of a bargain as it ended up ‘free’! Great stuff!

It’s incredible that you only started buying stocks in August, yet already you can see your investments clearly reaping the benefits. Of course, this has been aided by your incredibly high savings rate.

Looks like you’re on for a bumper May payout – you will easily hit your target of €500.

I’m at 33% of my dividend goal and I think May will be a good one for me too as I have quite a few paying out then.

Keep up the great effort and hope you have a great weekend.

Weenie,

You have to love Ryanair, don’t you? Most flights from Brussels to Dublin (or basically anywhere) start at €20 for a one-way ticket, so I could have gotten an even cheaper flight if I booked earlier.

Sometimes I’m amazed at the speed with which things are moving, like you mention. August isn’t even one year ago and I’m already seeing tangible results materialise. Talk about a good motivator.

33% is right on track to hit 100% by the end of the year, so I’m sure you’ll make your goal, especially with May being a staple month for your portfolio. I’ll be rooting from this side of the channel.

Best wishes,

NMW

NMW,

Excellent stuff there, love the graphic, and the averaging line. 52€ is a great sum of money for doing nothing, excepting holding onto what you have. Its pretty awesome also to get a raise in that period too. I think you will definitely eclipse your annual goal. Nice strong month over there, keep it up!

-Gremlin

Gremlin,

Thanks, man! I’m really happy with my income so far, especially since it’s completely free of work. And as you said, my annual goal of €500 won’t be too much of a problem unless something really drastic happens.

Cheers,

NMW

Great progress NMW! You have plenty of motivation and I’m sure you’ll achieve your annual goal. Thanks for sharing.

– HMB

HMB,

Thank you! Motivation in spades, so if I fail it won’t be because of a lack of trying.

Cheers,

NMW

Great looking month with several names in common. I was considering adding more DEO but opted against it for now. I just can’t get passed that valuation. I added some a few months back but that was it. Thanks for sharing… these are the single best posts to read online.

Keith,

DEO/DGE sports a relatively high valuation at the moment, but I believe it’s justified. Even though there are potentially better buys out there, I can’t argue against a defensive stock like Diageo even if the price is high. I hope the price comes down a bit so we can both add to our positions!

Best wishes,

NMW

Very solid progress NMW! I would love to visit Dublin one of these days.

Keep up the solid work NMW.

Tawcan,

Thanks, pal. Will do!

Dublin is a great city to visit. It’s got its quirks, but also a rich history and fun outdoor activities if you’re up for that sort of stuff. And of course, Irish pubs like you’ve never experienced them before.

Cheers,

NMW

Sick progress bro! You’ve already come a long way from that €2.56 in October!

If only I lived in Belgium; we could celebrate by eating some waffles over a game of Rayman 2 😉

Cheers!

Alex,

Incredible what consistent saving and investing can do in a relative short time, right? Sometimes I’m still amazed at the progress so far.

Ha, if that doesn’t make you consider moving here I don’t know what will! If you’re ever in the neighbourhood let me know and I’ll fire up the Nintendo 64. 🙂

Best wishes,

NMW

It’s always a wonderful feeling receiving these dividend checks eh NMW. I’m happy for you and excited for your progress. It’s only gonna get better bud. Keep it up and hustle hard. Your future self will thank you. Cheers my friend.

Thanks again, Tyler! Will do! 🙂

Very glad to hear that not only are you building a war chest for your financial independence fund and starting to receive some dividends but also you are going out and having fun at the same time (traveling to ireland). You should check out eastern europe if you get a chance.

Sooner or later you’ll be receiving $100 per month and you’ll be excited to inch closer to $200 per month. You are on the right track. This is a marathon.

25000,

What’s the point of generating passive income if you can’t enjoy life? I don’t plan on retiring early just to sit on my butt al day. I’d rather reach financial independence a few years later, but with tons of life experience under my belt and ample room to further enjoy life.

A friend of mine and I are actually planning a trip to Eastern Europe in the near future. We’re still not sure on the how or what exactly, but I think it will be a lot of fun (and cheap, ha).

Thank you for your continued support, it really helps me stay motivated.

Best wishes,

NMW

Another good month and your upwards trend is continuing 🙂 you’ve made so much progress since August! Looking forward to your May update.

Nicola,

You were one of the first people to visit my blog – thank you, so you know how fast progress has been over the past few months. Incredible, isn’t it? Let’s hope I can keep the momentum going.

Hope you’re well over there,

NMW

NMW

We all the dividend earners should unit like the workers 🙂

good dividend income keep the snowball rolling.

Divorcedff,

Having a special holiday for dividend growth investors would be a pretty sweet deal, ha!

Thank you for dropping by and taking the time to leave a comment, I appreciate it.

Best wishes,

NMW

Great month. I wish I had started down this path. By the time you are my age, 42, your portfolio will be massive. Keep up the good work.

DD,

Everyone wishes they had started earlier! Even though I’m only 25, I sometimes think of where I could be if I had started earlier. Thinking like that doesn’t help us get ahead though, so we can only make the best of the here and now.

Besides, you’re making big strides forward yourself. You’ll definitely get to where you want to be in a couple of years.

Keep it up!

NMW

Oh man, I missed the ex-dividend date for GE. I bought some GE at the dip, I guess, that factor in people selling it after they captured the payout date. Great April month!!

Vivianne,

Sorry to hear you missed the GE ex-dividend date. Don’t worry about it too much though; it’s just one dividend payment. There are tons more on their way if you continue to hold on to GE.

Cheers,

NMW

It’s very interesting to view your dividend income reports every month. I don’t believe I’ve ever see someone’s portfolio start from the very beginning like I have yours. There are times when I feel like it would be fun to share my whole portfolio with everyone but I still like to keep certain parts of my life private from the world, especially since I do have a few real life friends/family that know about my writing (not that I think they really read it but that’s a different story).

I don’t even think I really tracked my own personal portfolio until many years after I started it, and even a few years after I got serious with it. Keep up the great work though, it’s very interesting to see visually how your dividends keep growing.

Zee,

I understand why you’d like to keep some aspects of your life hidden from your blog’s readers, especially when you personally know them. That’s one of the reasons why I blog anonymously – no one knows I operate this blog. By doing so I don’t see any harm in providing full transparency where financial information is concerned.

Thank you for your support, much appreciated.

Best wishes,

NMW

NMW,

Slow and steady, my friend. You’re doing a great job!

Another excellent month. Just think of where all of this is going. It’s incredibly exciting.

Keep it up!

Best regards.

Jason,

Thank you for checking in again and for your continued support! Your blog helped me tremendously over the past few months, so a lot of what you see here is thanks to you.

Hope you had a great time in Omaha!

Best wishes,

NMW

Hi NMW,

It seems you had a solid month, keep pushing that snowball. I do own Kinepolis ( bought them 2 years ago) but I wouldn’t add them to my portfolio at the current price. If you want a Belgian stock i think there are better( cheaper) stocks at the moment, the biggest problem is that most Belgian stocks don’t have a history of growing their dividend each year. But I’m going to attend their annual meeting next week.

Cheers,

G

Geblin,

Sure will! May should be another great month with most of my Belgian holdings paying a dividend. Another €100 month should be possible!

I added Kinepolis a couple of days ago during its dip. Even though I believe the price is relatively high, I don’t mind it all too much. The company still offers great value and it’s one of the few Belgian stocks that continues to increase its dividend payments every single year.

Have fun at the annual meeting and let me know how it was if you have some free time on your hands.

Best wishes,

NMW

Great month. I will have mine up soon. Slow and steady wins the long race!

DFG

Looking forward to your income report, DFG!

Since I only own Vanguard ETF’s I only get dividends each quarter. Too bad they are not too predictable yet so I can not afford to rely on them 🙂

but free money is always welcome so I won’t complain

JJ,

There are worse things in life than owning Vanguard ETFs! 😉 Besides, any free-of-work income is welcome like you said.

I hope you can rely on your passive income soon.

Best wishes,

NMW