In the bi-weekly Stuff Our Parents Never Taught Us series I will introduce and clarify basic financial concepts in an attempt to increase the level of financial literacy among my Millennial peers. For some bizar reason, the majority of our parents didn’t think it necessary to teach us the 101 course of personal finance. If you’re over 18 and have no idea what stocks and bonds are, or how interest rates and dividends work, this is for you!

Imagine you live a train ride away from your loved one. Imagine going into a bank to withdraw money to buy a 50 euros two-way ticket at the train station later to visit her. Imagine arriving at the train station only to find out your ticket now costs €75 instead of last week’s €50. Imagine this 50% price increase happens every week for over a year. Now that you know all about compounding, you intuitively feel you won’t be seeing your loved one for a very long time.

Although this sounds like an unlikely situation, it is but one of the many horror stories of excessive inflation, or hyperinflation. The German note from 1924 pictured above, for example, is worth one trillion Mark. Ever heard a waiter say “that’s five trillion dollars for your beer please, sir”? Between April 1924 and December 1924 the cost-of-living index in Germany exploded from 41 to 685, which is so fast it will destroy almost anyone’s savings.

These are the kind of horrible experiences people think about when they hear talk about inflation. As a result, inflation is one of the very few economic indicators that people actually care about since it has a direct impact on their standard of living and personal inflation-adjusted net worth. However, inflation is not bad per se. A healthy economy always fosters a low rate of inflation to further grow and expand. Consequently, consumers can also take advantage of inflation.

How does inflation work?

Inflation is the increase in the price level of goods and services in an economy over a longer period of time. When prices go up each unit of your currency will buy you less and less goods or services. However, the effect of inflation is not evenly distributed between goods and services. As a result, some goods become proportionally more expensive to others.

Inflation is the increase in the price level of goods and services in an economy over a longer period of time. When prices go up each unit of your currency will buy you less and less goods or services. However, the effect of inflation is not evenly distributed between goods and services. As a result, some goods become proportionally more expensive to others.

People owning physical assets furthermore see the value of those assets go up, whereas cash-based and fixed-income portfolios experience a decrease in value. In other words, increases in the general sustained price level erode the real value of money over time. Because prices of goods and services are based on the principle of supply and demand inflation is not a constant. Consequently, future inflation levels are mostly uncertain.

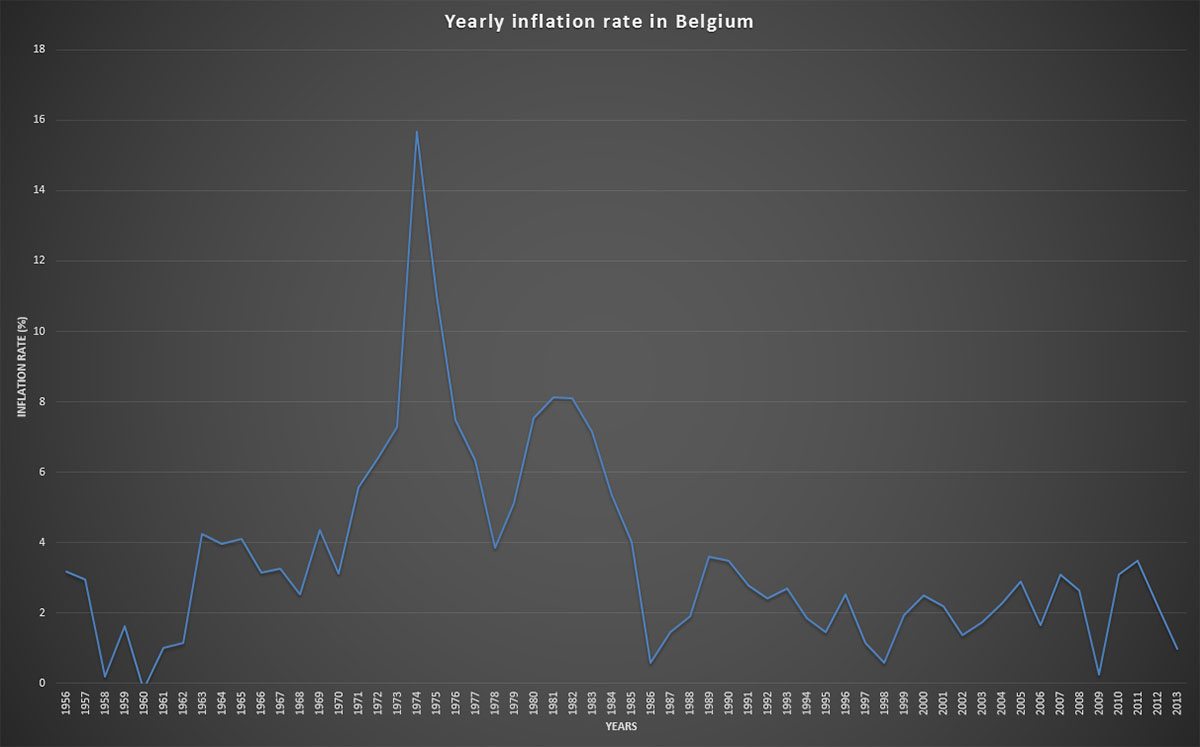

Consider for example the inflation rate for Belgium between 1956 and 2013 in the graph below (click to enlarge):

We clearly see that the level of inflation varies from year to year with a big spike of almost 16% during the height of the 1970’s oil crisis. As can be seen from this graph, inflation can also become negative, as is clear from the -0.17% inflation rate in 1960. Negative inflation is called deflation and has the exact opposite effects from inflation. A good example of a country in a long deflationary state is Japan.

Without going into too much detail and economic hocus pocus, most economists consider a low and steady rate of inflation to be healthy. Inflation boosts our economy because of effective labour-market adjustments and because it incentivizes financial markets to invest. Too much inflation risks overheating our economy, ultimately resulting in a recession. That’s why the European Central Bank has a 2% inflation target, even though the current rate is only 0.5% for the Euro area.

Why does it matter to you?

Even though we can’t predict future inflation levels with certainty, it’s important that you take into consideration both current and future inflation. You have to make sure that you reduce the risks associated with an increase of price levels and that you take advantage of the positive effects of inflation.

First, if you rely on fixed-income or on a paycheck that is not adjusted regularly to inflation, your purchasing power will go down over time. Of course, you will hardly feel the effect at first, but over time it will be noticeable. If you have a monthly budget of €1,000 now, you’ll need over €1,200 ten years later to sustain your current lifestyle at a 2% yearly inflation rate. So make sure to ask your company for a regular pay bump. Belgians, rejoice! Our paychecks are automatically adjusted to inflation!

Second, and following the same logic from the previous paragraph, if you are saving up for (early) retirement make sure to put your savings in investments that return more than the average inflation rate. Good hedges against inflation are the stock market and inflation-adjusted bonds. Another option are assets, although it’s not always easy to estimate an asset’s future value.

Third, if you are in debt – which I’m not advocating except when buying a house – the real interest rate will decrease as inflation increases, even though the nominal interest rate remains the same. As a result, you’ll have to pay back less money in real currency. That’s why it currently is such a great time to take out a mortgage in Belgium. When interest rates are at an all time low and once inflation picks up again, your outstanding debt will basically go down to the point where your mortgage was free.

Final thoughts

Sharp-minded readers will have noticed that inflation works almost exactly the same as compounding interest, but in a negative way. That’s why I wanted to emphasize the dangers, but also the opportunities of inflation. A clever investor always makes sure that the return on his assets, be they stocks, bonds, rental properties or businesses, is higher than the inflation rate.

Since I’m well prepared I don’t mind inflation all that much: my job pay is automatically adjusted and my investments are almost guaranteed to beat the average inflation rate over the long run. How do you feel about inflation and which measures have you taken to maintain your purchasing power?

What drives me nuts about inflation is how costs go up but wages do not! In our company, they have not increased the per km mileage rate for over 10 years (if you have to drive your car to go to the airport for a business trip or to a meeting elsewhere in the city) and yet the cost of gas and insurance has increased! I hate when Corporations take advantage of people like that. They are trying to minimize costs because we are losing money, but putting it on the backs of employees is really distasteful.

That’s an extremely lame move indeed! Ten years is just way too long for the same mileage rate. You’re probably losing over 20% compared to ten years ago, which is a big no. Isn’t there something the HR department can do? Renegotiate the rate for all employees perhaps?

In Belgium salaries and the like are almost always automatically adjusted when inflation pushes the consumer health index over its threshold. The upside is that our purchasing power remains the same year-in, year-out. The big downside is that our corporations become less and less competitive vis-à-vis their foreign counterparts, especially during periods of high inflation.

I hope your company returns to profit soon, Debs!

Cheers,

NMW

Inflation is one of my great fears and reasons for planning and building a sizeable portfolio of capital producing assets.

I even feel bad about the small amount of cash we have in our house for emergency quick access, as it depreciates in value every day. I guess the trade off is that it is available instantly. Still… haha.

Ha, tell that to everyone in Belgium keeping their stash in a 0.3% savings account! 🙂 Fun fact: because the inflation is only at 0.6% in Belgium right now and most of the products and services in our consumer health indices don’t apply to me, I’m actually enjoying some personal deflation. Awesome or what?!

I wouldn’t worry to much about the emergency fund… The benefits in case of a real emergency far outweigh the drawbacks of inflation eating away at it.

An hour after I posted this post I bumped into your article on inflation. Hopefully we won’t have to deal with Zimbabwean style inflation any time soon!

Inflation is the hidden tax that keeps on taking. There was a 2% raise this month at my work and everyone is excited, but I don’t think it even keeps up with inflation. Pretty sad, oh wells…

Henry,

I don’t really see how inflation is a hidden tax, could you elaborate?

And it sucks when your paycheck increases don’t even match inflation. Hopefully you earn enough promotions throughout your carreer to come ahead of inflation in the long run!

Cheers,

NMW

Here’s an article which explains it pretty well…

http://drlwilson.com/Articles/INFLATON.htm

I see what you mean now, but I don’t agree entirely.

While it is true that central banks can create money out of thin air, they do so to stimulate the economy. The only thing worse than inflation is deflation. Consequently, when inflation is spiraling out of control they can also act and try to cool down economic growth, thus reducing inflation.

I have no idea how it works in the US, but in Belgium at least there are automatic adjustments to our consumer index to preserve our purchasing power (think salaries, pensions, subsidies, etc). This is also to offset the regressive effect of inflation on the less fortunate.

Furthermore, the Belgian central bank has no decision-making power over the Euro’s interest rate. It’s the European Central Bank that is responsible for our monetary policy. Because there are 18 euro area members, there’s no single policy that will solve the problems in all countries. Look, for example, at how different Belgium is to Spain or Germany to Greece!

Ultimately, I understand where you are coming from, but calling inflation a tax is misguided in my opinion. There are lots of policy tools available to offset the effects of inflation. They should make inflation less of a pain in the butt, especially if you hedge your savings by buying stocks for example.

Thanks for the insightful article!

NMW

Hi NMW,

Nice write up. Many people don’t grasp the effect of inflation.

Cheers,

G

Thanks, Geblin!

I’ve been preaching to my friends to the point where they were getting annoyed, so I thought it would be a good to spread the message about inflation here! 🙂

Best wishes,

NMW

I know the problem. I was preaching to my friends that dividend stocks are the way to go and that watching the stockprices daily doesn’t help.You need to keep the eyes on the playing field and not on the scoreboard.

Cheers

Thanks for this, made me understand the effects of inflation better. It is just frustrating how inflations go up and our salaries do not! *Sigh

I’m glad you found this post insightful!

Make sure to ask your employer for a regular salary adjustment, I’m sure he will understand. If your company is large enough, maybe team up with some of your colleagues.

Thanks for visiting,

NMW